Has The Reflation Trade Run Its Course?

Since November, the reflation trade has dominated markets. Copper is up over 30%, energy (XLE) over 65%, lumber nearly 10x and basic materials (IYM) almost 20%.. Conversely, we have since seen the dollar index fall a further 3% and long term bonds (TLT) nearly 11%. For those long the reflation trade, I am sure you are all waving your hands with joy. But, when I see such gains come so fast and so sweet, it tends to make me nervous. Investing is never this easy. The question then becomes, does this tend continue or are we in need of a rest? Call it the contrarian in me but I can’t help but lean towards the latter. Let me tell you why.

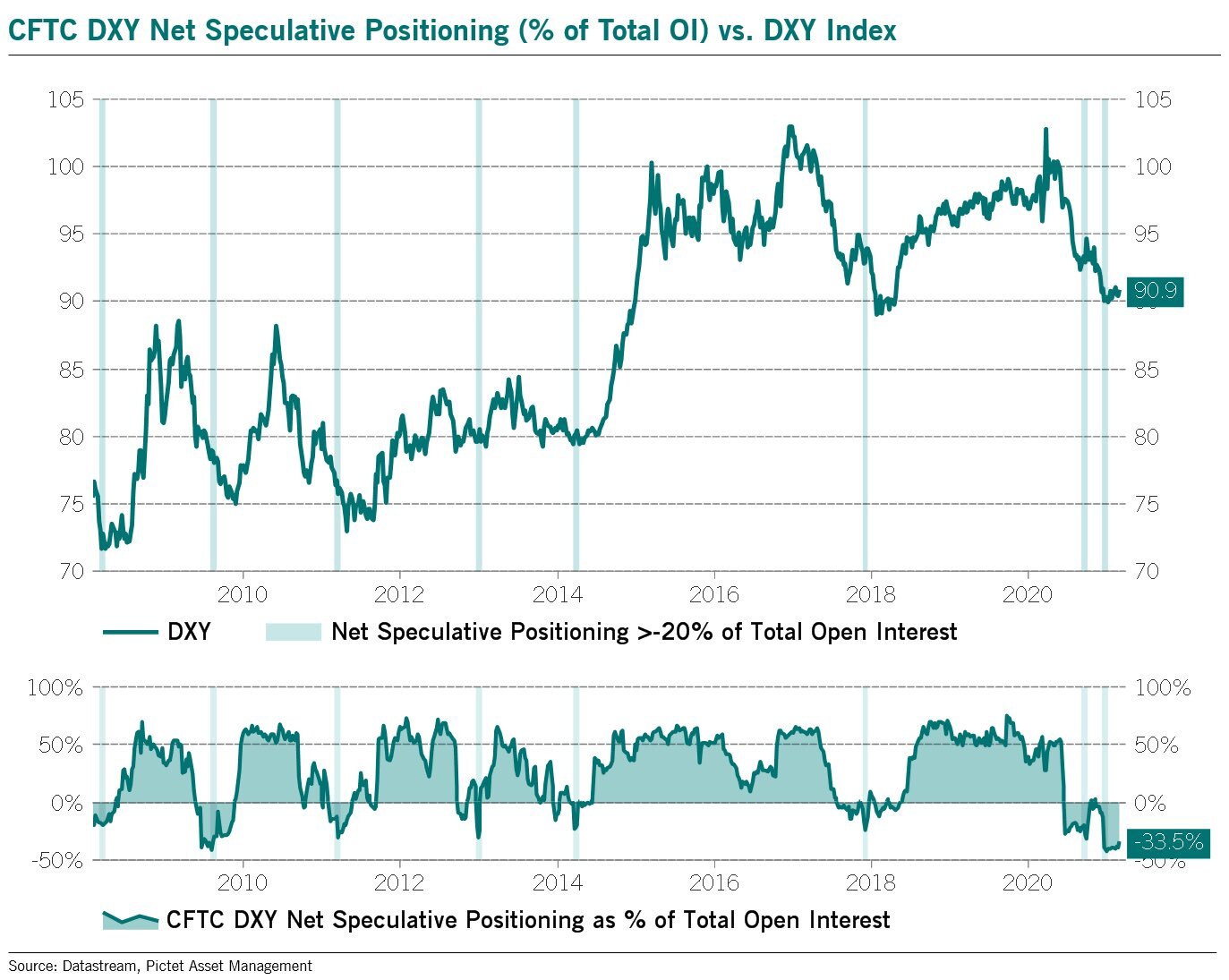

I wrote back in January why my bias is for a stronger dollar over the coming months. My stance on this has not changed. Speculators remain historically short dollars, and these positions will eventually need to be unwound to some degree which would in all likelihood result some form of dollar squeeze. Brief though it may be, such an outcome would not bode well for the reflation trade beneficiaries.

Source: Julien Bittel, CFA

It is not just the dollar where speculators are near record short, but bonds too.

Source: BarChart.com

As sentiment towards the dollar and bonds is near historical lows, as we can see below, copper speculators remain near historically net long. The same can be said of lumber and most other commodities.

Source: FreeCOTData.com

Indeed, sentiment towards those short dollar trades is historically high. Inflation friendly ETF inflows have seen their strongest demand on record.

Source: Arbor Research & Trading, LLC

Turning to rates, whilst the recent rally should come as no real surprise, there are reasons to believe this could be put on hold for the time being. There is strong technical resistance for the 10-year at its current levels dating back nearly 10 years. The daily sentiment index (DSI), is also showing its most bullish reading in years. This fits nicely into the idea bonds and the dollar could be due for a counter trend rally/short squeeze.

Source: StockCharts.com

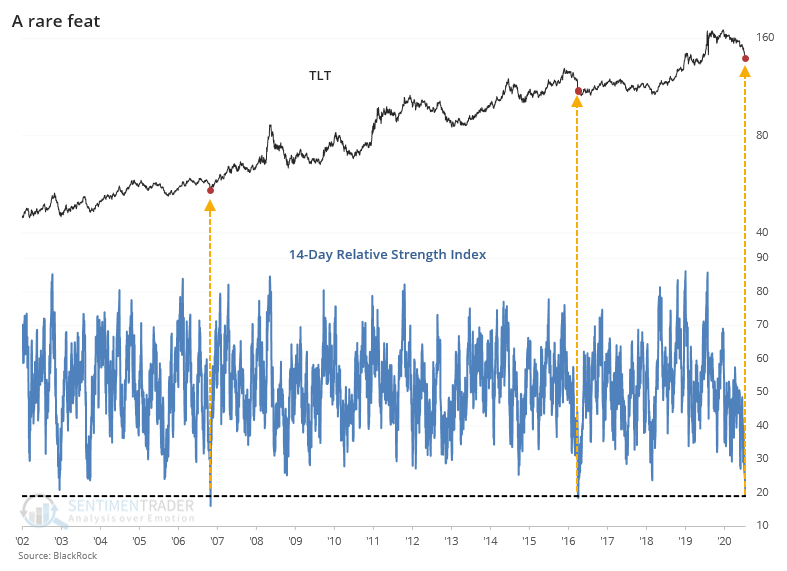

Also confirming this thesis is the near record low in relative strength index for the TLT ETF. A rate feat to be sure.

Source: SentimenTrader

Additionally, as noted recently by Grassland Capital, a DeMark weekly 9 setup buy signal is set to trigger this week for TLT. Illustrated in the chart below, the implications of this are generally indicative of trend exhaustion and is also suggestive of a counter trend rally.

Source: Grassland Capital

If we drill down further into the technicals for the best and worst performers I mentioned earlier, a similar theme emerges. Copper futures (below left), long-term bonds (below middle) and energy (below right) have put in classic reversal candles on their respective weekly charts, as noted by Travis Kimmel on twitter. Another typical sign of a potential reversal in trend.

Source: Travis Kimmel

Sticking with energy for the moment, crude oil has just reached a very important technical point. The huge descending wedge pattern below is yet to be broken to the upside on several attempts over the years. One would think this implies crude is due for another rejection before a retest or any potential breakout to the upside could occur.

Source: TradingView.com

In summary, my aim of this article is to point out that several technical and sentiment indicators may be telling us the reflation and rotation trade of late is perhaps due for a correction, or at least a period of consolidation. Don’t let this musing fool you however, I recently laid out my bullish case for energy here and emerging markets here. I would love to see a pullback allowing me to add to my positions. Likewise, I am of the opinion that yields have much further upside ahead.

But, I would suggest caution is warranted over the coming months. For those in agreeance, perhaps some form of counter-trend protection is warranted, be it in the form of a long dollar or long bonds trade. Hedging via long-term bonds in some form would be my preference.