Gold Bulls, It’s Time to Buy

Following this recent sell-off in gold amid it’s healthy consolidation period over the past six months, sentiment has once again turned extremely bearish. For those bullish precious metals and the miners, you would do well to snap up this opportunity in earnest.

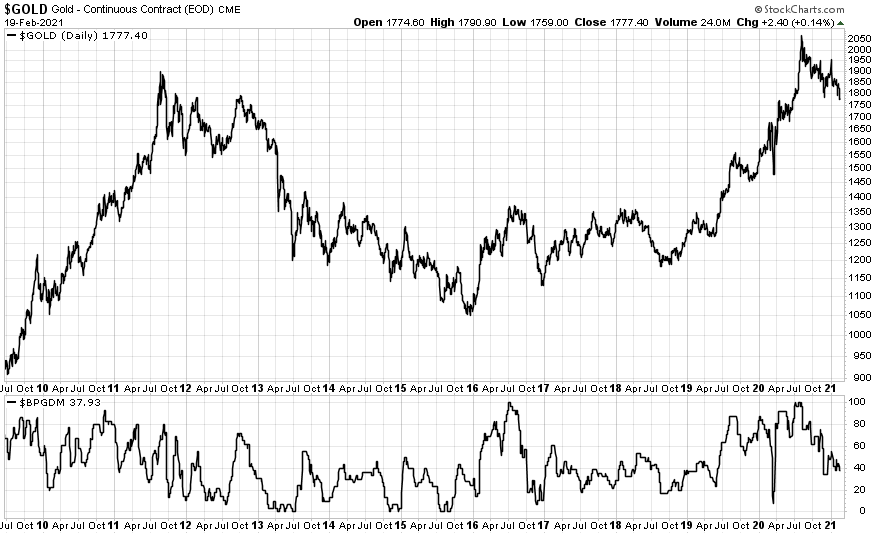

Firstly, if we look at the gold miners bullish percent index ($BPGDM), this has fallen to a level indicative of excellent buying opportunities over the past decade, particularly during the bull run of 2009-2012.

Source: StockCharts.com

Turning to money manager’s positioning (i.e. hedge funds and CTA’s) in the futures market (blue line below), this too has dropped to its lowest point since early 2019. Money manager’s have an uncanny ability to be long at the tops and not-so-long at the bottoms. Again, this is very constructive from a sentiment perspective.

Source: BarChart.com

As noted by Fred Hickey on twitter this week, other sentiment indicators for precious metals in the form of the Daily Sentiment Index (DSI) and Hulbert Gold Newsletter Sentiment Index (HGNSI) are all looking as bearish as we saw in the late November sell-off.

Indeed, gold is a hated asset class right now.

Turning to the technicals, there is plenty of long-term support at gold’s current $1,750-$1,800 levels.

Source: StockCharts.com

Shorter-term, we are still consolidating but there is decent support at $1,750. A breakdown to the lower trend line is of course a possibility, but in my eyes would be nothing more than another excellent opportunity to accumulate at even lower prices.

Source: StockCharts.com

The culprit of this continued correction in gold after a stellar first half of 2020 has been rising real rates. Particularly since November, we have seen nominal rates on the long end of the curve rocket upwards. As inflation is yet to sufficiently follow suit, when nominal yields rise faster than inflation, real yields will rise. Real yields and gold have the perfect inverse correlation (but of course you all knew that already).

Source: St. Louis Fed

Given the huge push to fiscal support going forward and the ever expanding federal deficit, we all know the bullish case for precious metals. The upside for yields relative to the upside in inflation is now clearly skewed towards inflation. The move to fiscal dominance likely means an eventual move toward outright yield curve control or some other form of financial repression in order to keep real yields negative to allow the government to fund said deficit. Negative real yields are golds best friend and likely do not pose as much of a threat going forward as in the past 12 months.

I have detailed my long-term fundamental bullish case for gold several times in the past. My outlook hasn’t changed. So, if you are like me and bullish precious metals, then this would be an excellent time to add to your core holdings, particularly so for the miners and for silver.

Both ratio’s when compared to gold suggest plenty of upside is ahead.

Source: StockCharts.com

Whilst traders of a more tactical nature may wish to wait until we see a sustained breakout above the downward channel we find ourselves in at present, long-term holders should see this as an excellent opportunity to add to their core precious metal holdings or favourite miners. For me, I will be adding to my core exposure before getting even tactically longer when we do see such a bullish breakout and confirmation of uptrend.