Industrials: A Buy The Dip Opportunity For Long-Term Investors

Whilst the industrials sector has only fallen about 7% from its highs set in May of this year, as proxied via the XLI ETF, the extreme washout of sentiment and breadth within the sector presents a potentially favourable buy-the-dip opportunity for long-term investors.

Beginning with sentiment, the SentimenTrader Optix measure of the pessimism and optimism of investors within the sector has fallen to extreme levels representative of decent buying opportunities over recent years. On the whole, investors are clearly pessimistic towards industrial stocks right now.

Whilst not at the same level of pessimism as the Optix measure above, the Bullish Percent Index (BPINDY) for the sector has fallen to a sub-50 reading. Such a level in the past has generally been indicative of attractive buying opportunities for those with a time frame of at least 12 months.

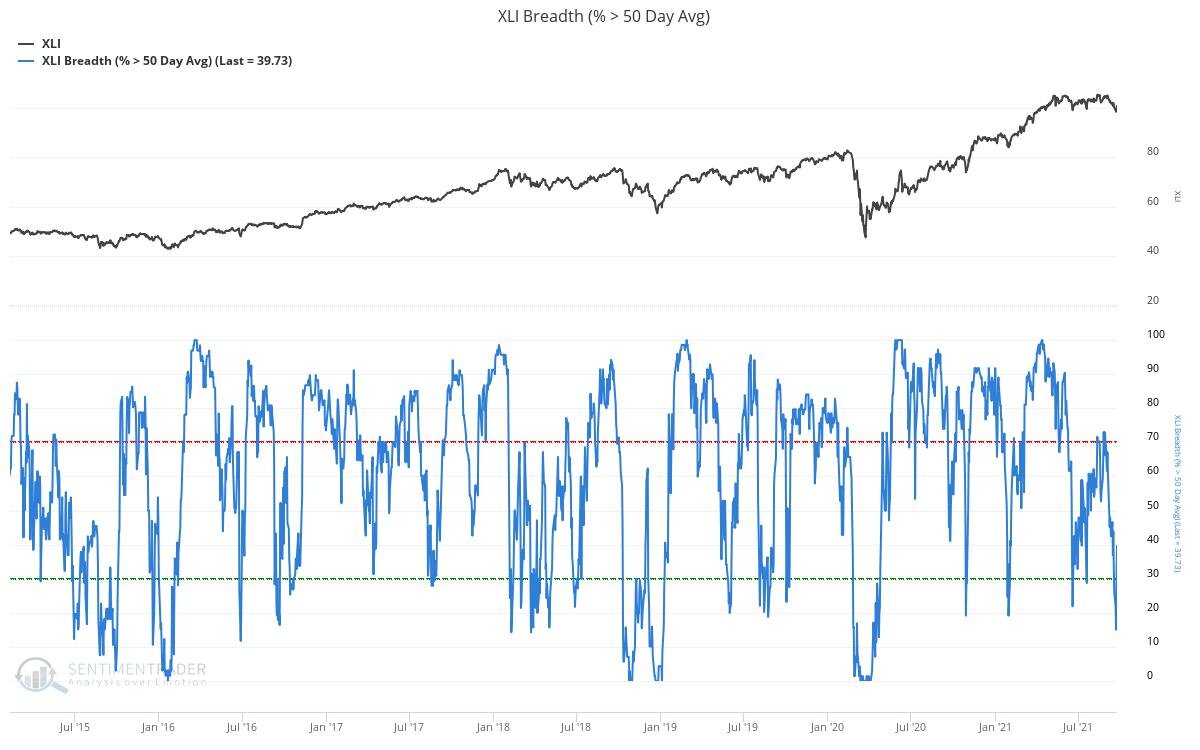

Meanwhile, the washout in breadth within the sector has too reached favourable levels for those looking to accumulate long-term holdings. The number of stocks within the XLI ETF trading above their 50-day moving fell to below 15%, if only briefly.

Using another measure of market breadth, the McClellan Oscillator (which calculates breadth based on various measures of the number of advancing versus declining stocks), has also plunged to a level indicative of an excellent long-term buying opportunity historically. According to SentimenTrader, when we see a reading in this breadth measure whilst XLI continues to trade above its 200-day moving average, investors who were willing to deploy capital at such a time were rewarded with excellent returns over the proceeding six to 12 months.

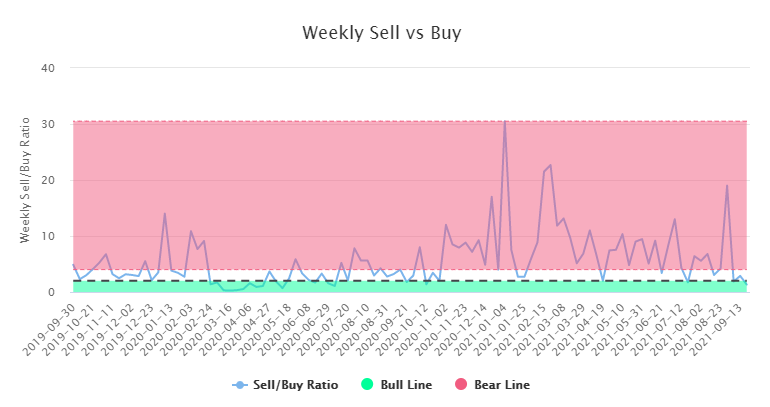

Corporate insiders are clearly taking note and are using this opportunity to add to their company holdings. The corporate insider sell-buy ratio for the industrials sector has fallen to its lowest level since March 2020.

Source: WhaleWisdom.com

From a technical perspective, the sector has been channel-bound for a number of months now, but has still managed to reach an oversold level in momentum (RSI) and money flow (MFI). Encouragingly, there appears to be a strong level of support around the $97-$98 area, which is the confluence of the lower trend-line of this channel and the 200-day moving average.

However, as you have probably noticed thus far, I am emphasizing my view that this buying opportunity potentially presenting itself is geared towards long-term investors looking to add or commence positions in the industrials sector. Whilst the breadth and sentiment levels in the sector are indicative of favourable buy-the-dip opportunities historically, this is more so the case for those buying with a long-term/multi-year timeframe.

As with most cyclical stocks and assets classes at present, the current state of the business cycle and the apparent deceleration in growth does not present a favourable risk-reward set-up for the next few months at the very least. This is a topic I covered comprehensively in a recent post. Indeed, as we can see in the back-test above, the one to three month returns in such times historically were subpar. This is the likely scenario for the next few months in my view. Until the leading indicators of growth in the economy begin accelerating, the industrials sector is likely to continue to underperform the market, as has been the case since May. However, as we have experienced this past week, unfavourable macro conditions create the potential for additional buying opportunities for the long-term investor.

Finally, confirming this message of potentially imminent further weakness is seasonality, which indicates that historically, September and October are generally not favourable months for the sector, but have provided solid buying opportunities.

In summary, whilst the macro headwinds are present for the industrials sector and are likely to remain present for the next few months, for long-term investors willing to look past the potential short-term volatility and underperformance, we may be experiencing a good buy-the-dip opportunity.