Crypto Market Outlook: Tough Times Ahead

It has been a tumultuous start to the year for crypto markets to say the least. With Bitcoin falling as much as 30% since and beginning and Ethereum nearly 40%, it is ever so important to once again assess the current landscape of the volatile markets that are digital assets.

Within my most recent crypto market update in early January I flagged $40k as a must hold and buyable area. Unfortunately, we saw the price action take as swiftly below this level in late January despite its importance; such was the power of the latest impulse move downward. Whilst we didn’t see a flush all the way down to the $30k area which I had marked as the next buyable level from a technical perspective, we did see a brief low of $33k followed by a rally back to the underside of the $40k-$42k level this past week.

It is difficult to view this recent rally as anything more than a relief rally or bear market bounce amid a downtrend. Given the importance of this $40k-$42k level, I suspect any attempted breakout to fail and be met with heavy selling. As such, now appears an opportune time to hedge ones exposure. Personally, I still view $30k as a likelihood, and selfishly, would love to see it reached purely as an excellent entry point to buy. Unless we break above $40k and retake the 50-day moving average, this remains my base case.

Indeed, by simply glancing at the weekly chart for BTC, a test of $30k looks like a reasonable if not likely proposition.

One technical concern that leads me to believe we have yet seen the lows of this correction is the lack of a capitulation-like spike in downside volume. Ideally, sustainable and long-term bottoms should be accompanied by a spike in volume in the manner of what occurred in the late 2018, March 2020 and May 2021 sell-offs, as we can see on the above chart. This fits in nicely to the thesis that we could yet see one more sell-off down to $30k on high volume.

The story for Ethereum meanwhile is that it has very much lead BTC to the upside amid this recent rally all the way up to $3k. Similar to my thesis for BTC, I expect any breakout above this key resistance level to fail initially. Should crypto markets continue their struggle in the coming months amid my bearish macro outlook, Ethereum could potentially go as low as $1,800. This would be a terrific buying opportunity to be sure.

Additionally of note is this recent rally in ETH has just triggered a daily DeMark 9 sell signal, further confirming the potential that we reject at $3,000 and revisit the $2,700 area. Should this indeed occur, $2,700 appears a reasonable area to add to long exposure.

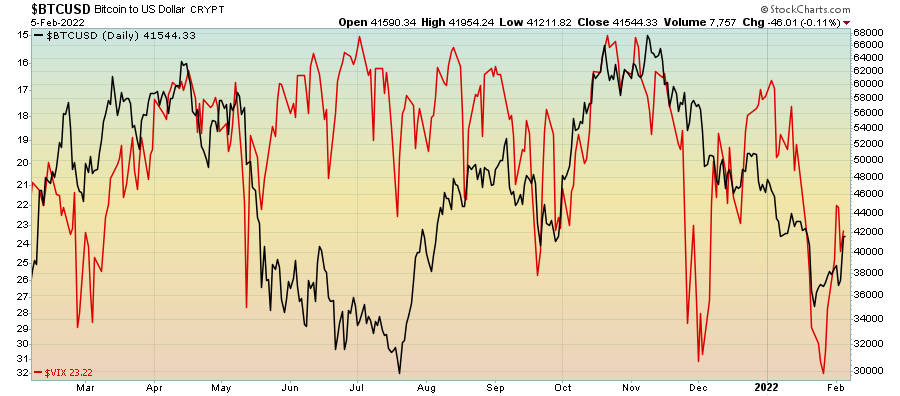

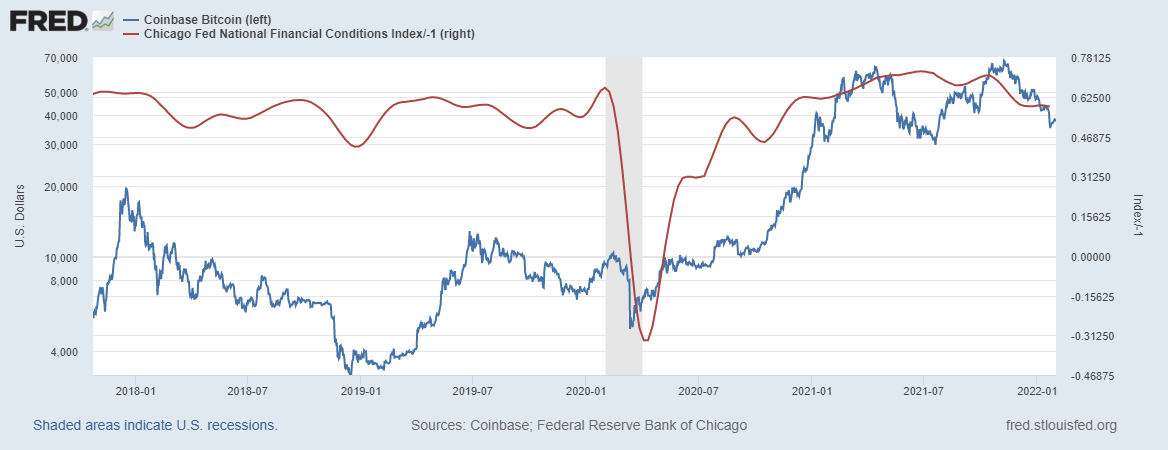

Clearly, the deteriorating macro environment is taking its toll on crypto assets in a similar manner to traditional risk assets. I have written much of late on the deceleration of growth and liquidity looking to trouble markets in 2022, a slowdown in which the Fed is looking to raise interest rates and tighten monetary conditions.

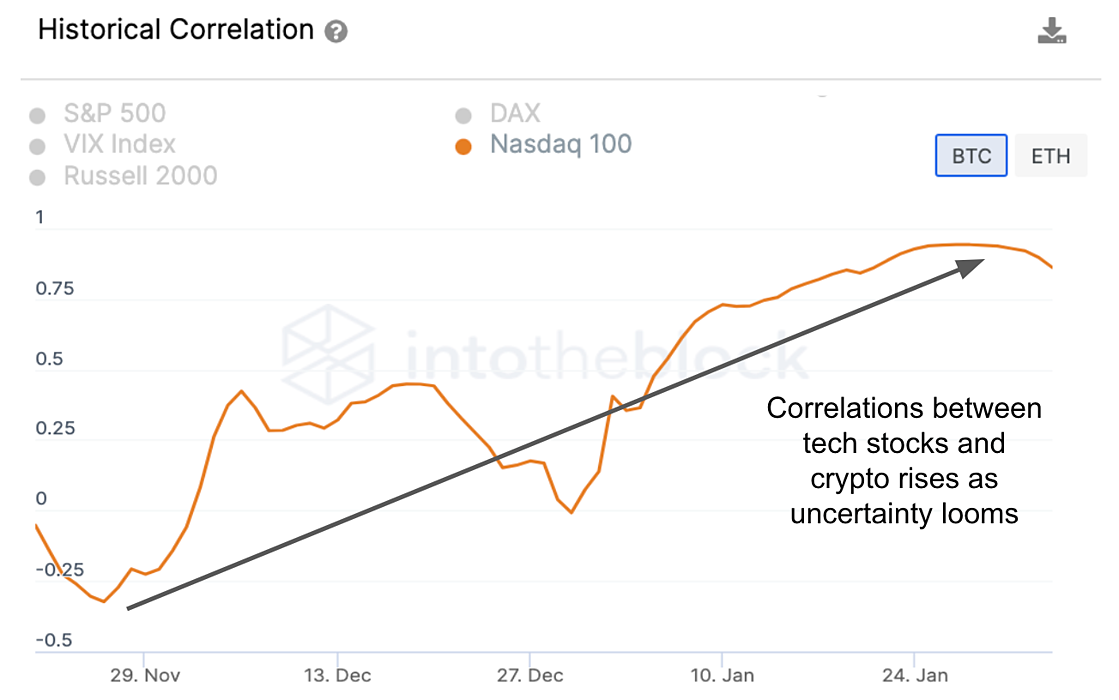

As such, it is unsurprising to see correlations between crypto and traditional equity markets continuing to increase of late to the extent that crypto is behaving very much like a high-beta equity like asset.

Source: IntoTheBlock

Indeed, unlike the correction we underwent in mid-2021, this recent sell-off has been one of equity markets spilling over into crypto assets.

So long as financial conditions continue to be unfavourable for the time being, this will likely provide a headwind for Bitcoin and digital assets. Unfortunately, this is my outlook for the foreseeable future.

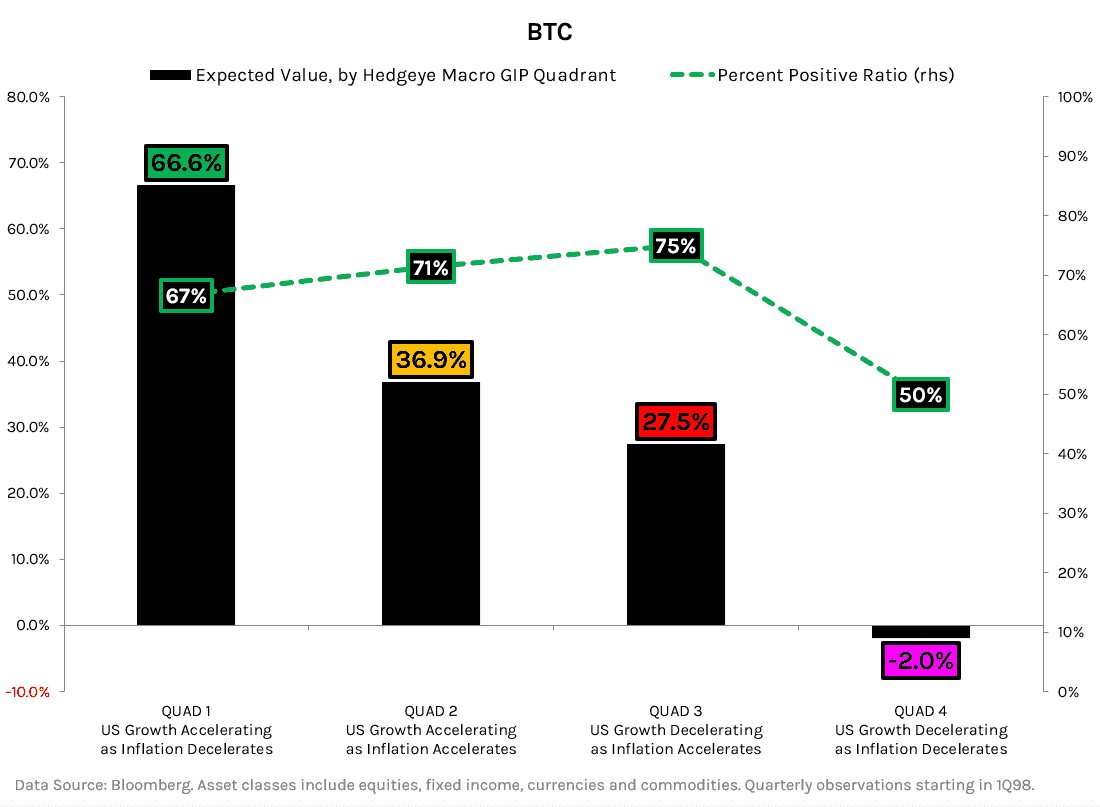

We can see below how Bitcoin and by extension crypto as a whole has historically struggled amid periods of decelerating growth and inflation. This is not an environment whereby the probabilities favour high-beta risk assets.

Source: Hedgeye

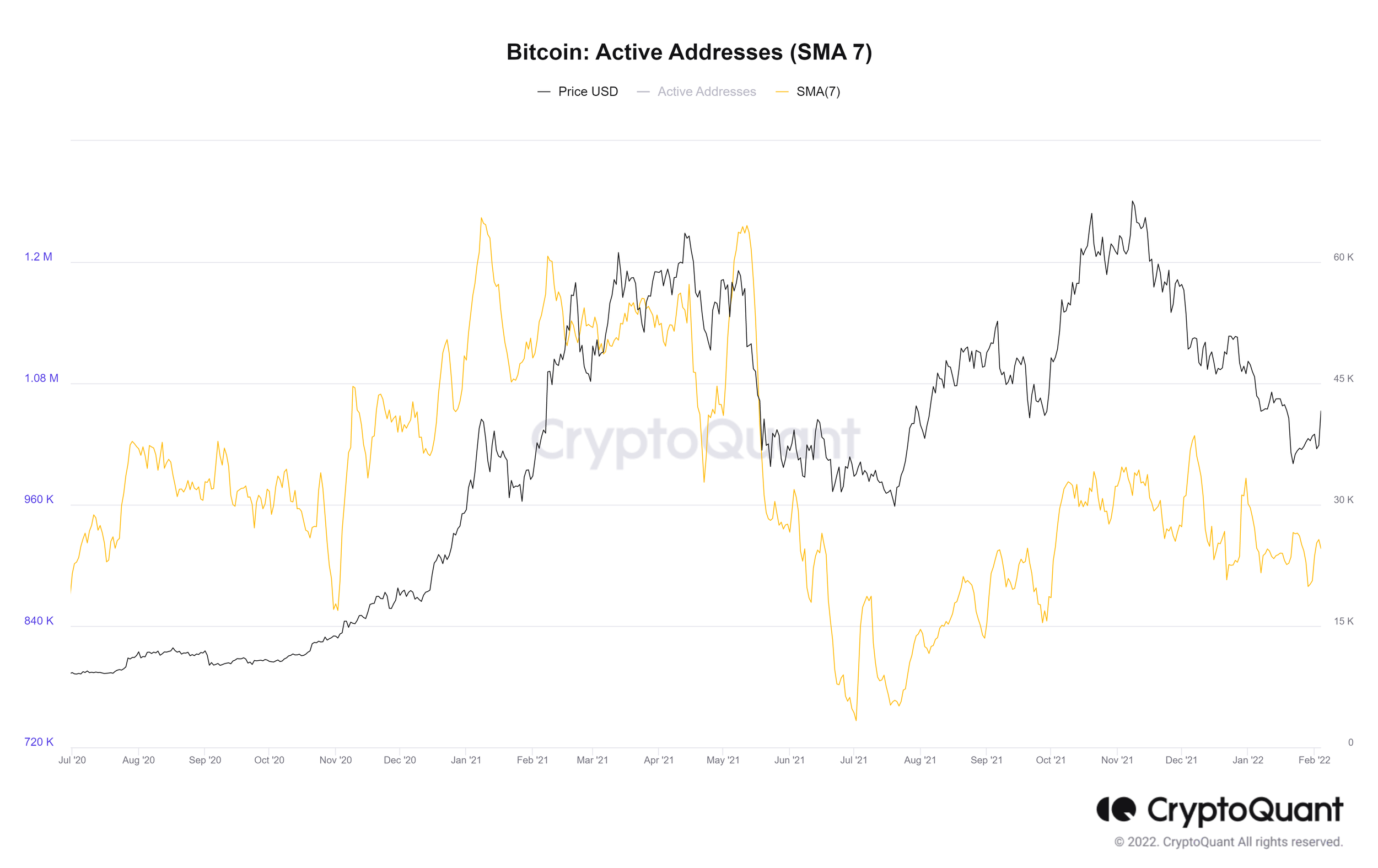

My barometer for how the growth cycle and macro implications are effecting crypto markets is to assess the movements in active addresses. This on-chain metric is by and large a proxy for retail speculation and participation. When liquidity and disposable income is abundant, similar to what we saw from mid-2020 to Q2-2022 as economic growth and liquidity accelerated in historical proportions, retail speculation and thus active addresses should rise in line with price. As growth by and large started to slowly decelerate in May 2021, active addresses have since lagged the price action significantly as the headwind that is the deteriorating macro environment continues to grow.

From a sentiment perspective however we are beginning to see some constructive developments of a sustainable bottom. The Crypto Fear & Greed Index is nearing levels indicative of recent market bottoms.

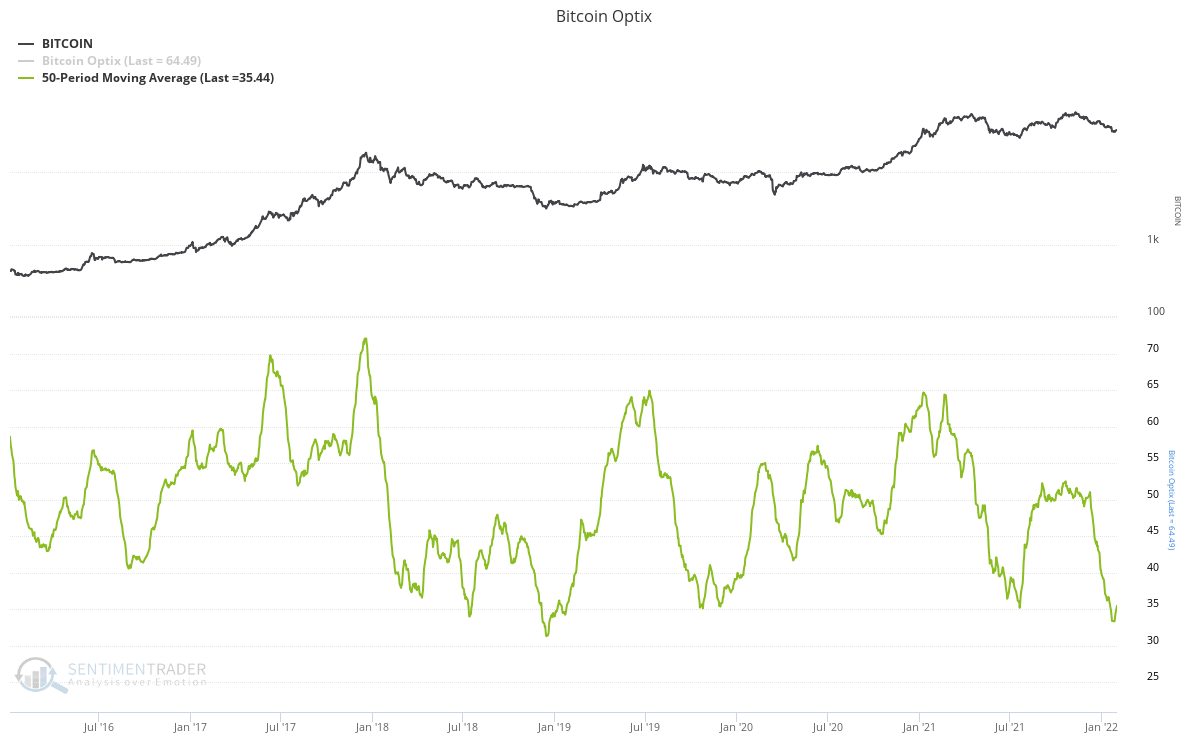

So too is the Bitcoin Optix index.

As constructive as this is, it is important to remember these measures of investor sentiment are better used as longer-term contrarian buy or sell signals rather than for short-term trading, as prices can easily continue lower or trend sideways for some time despite the low readings.

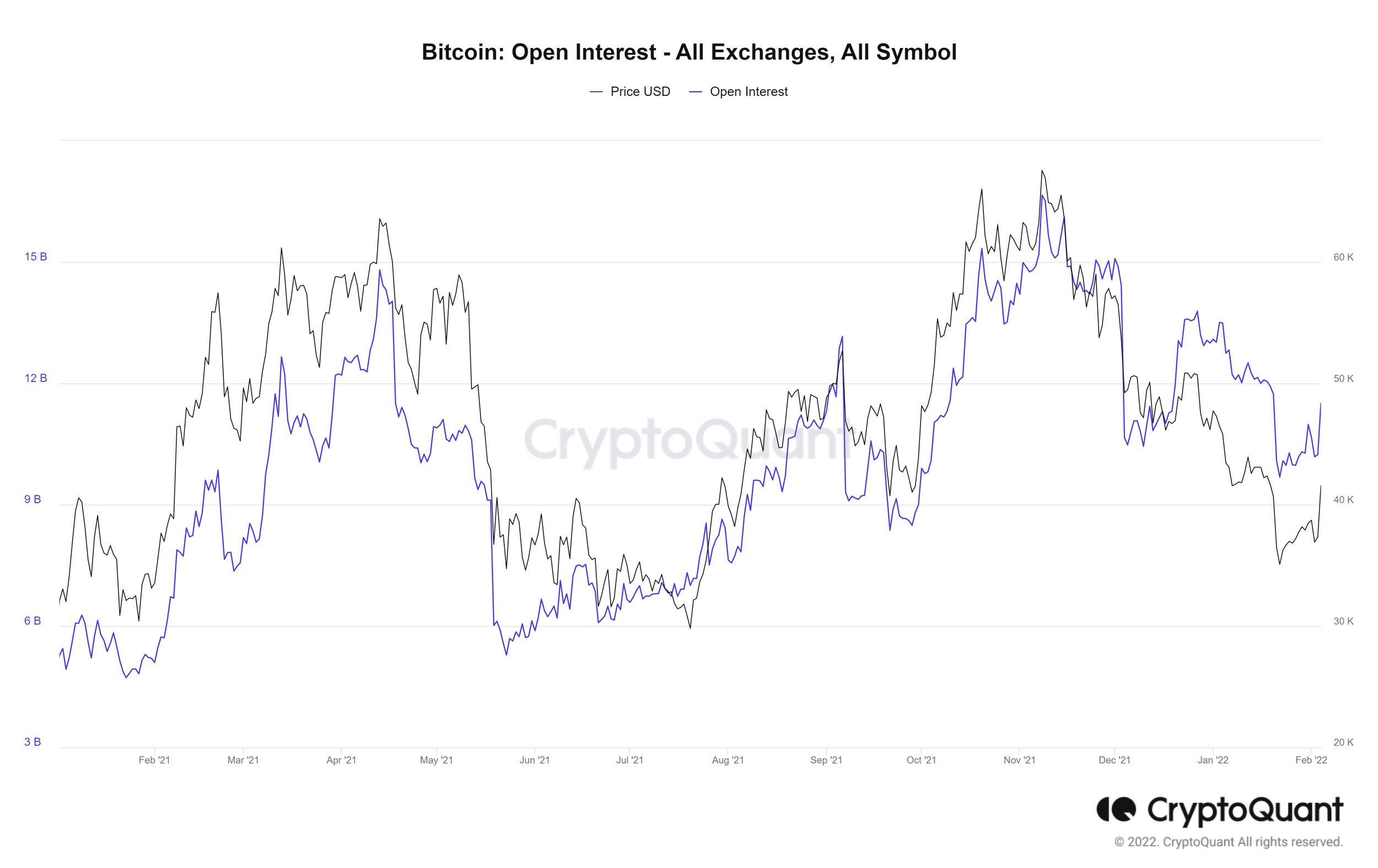

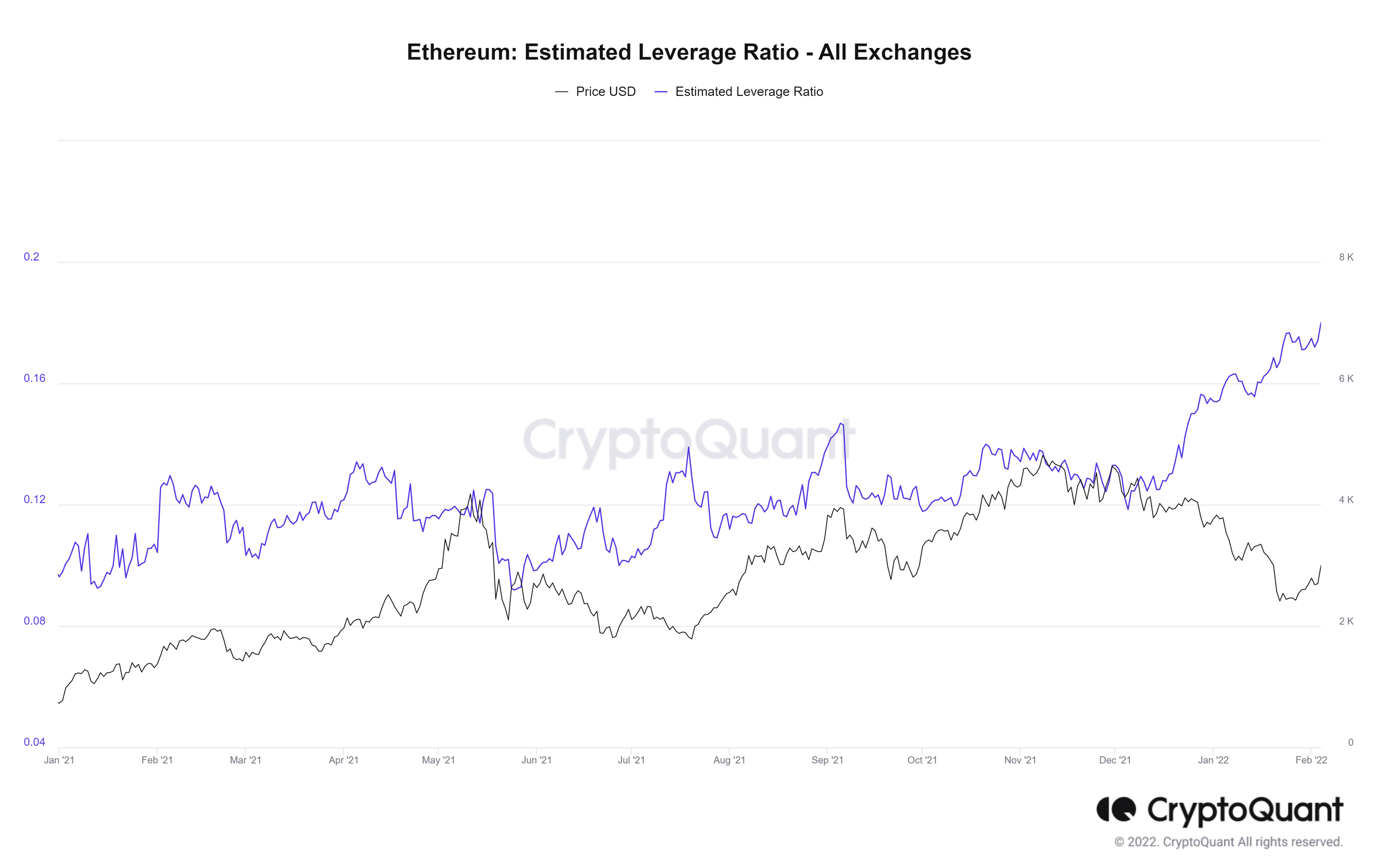

Turning now to the derivatives markets, as has been much the case of late is open interest remains elevated for both BTC and ETH despite the poor recent price action. However, as I have stated in the past, it is important to consider how this open interest data is being effected by the introduction of the Bitcoin futures ETFs in recent months. As the futures market is generally used for traders of a short-term time frame due to the excessive roll costs associated with holdings futures contracts for long time periods, buyers of the Bitcoin futures ETF who intend to hold for the long-term would cause the open interest data being skewed to the upside.

However, the fact that ETH open interest (not pictured) remains elevated seems to confirm the idea that there remains much leverage with the crypto derivatives ecosystem at present.

Such an elevated level of leverage relative to recent history creates a fragile dynamic whereby we could see continued volatility, with the potential of another sharp decline similar to what occurred in January as open interest diverged with price before the late January sell off.

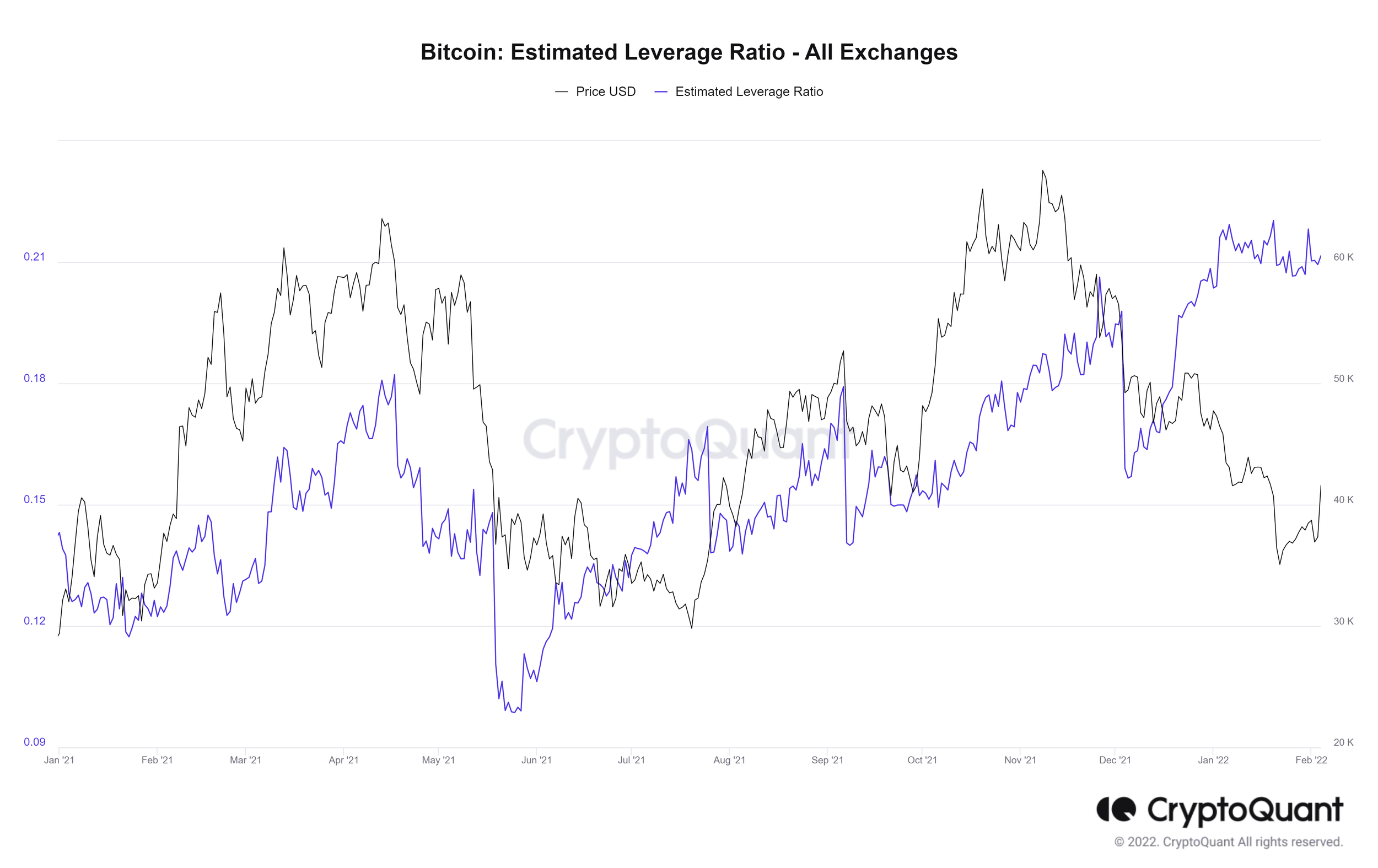

This possibility is particularly notable when assessing the fact that estimated leverage ratios for both Bitcoin and Ethereum have gone on to both make all time highs despite the respective underlying prices being roughly 40% below said highs.

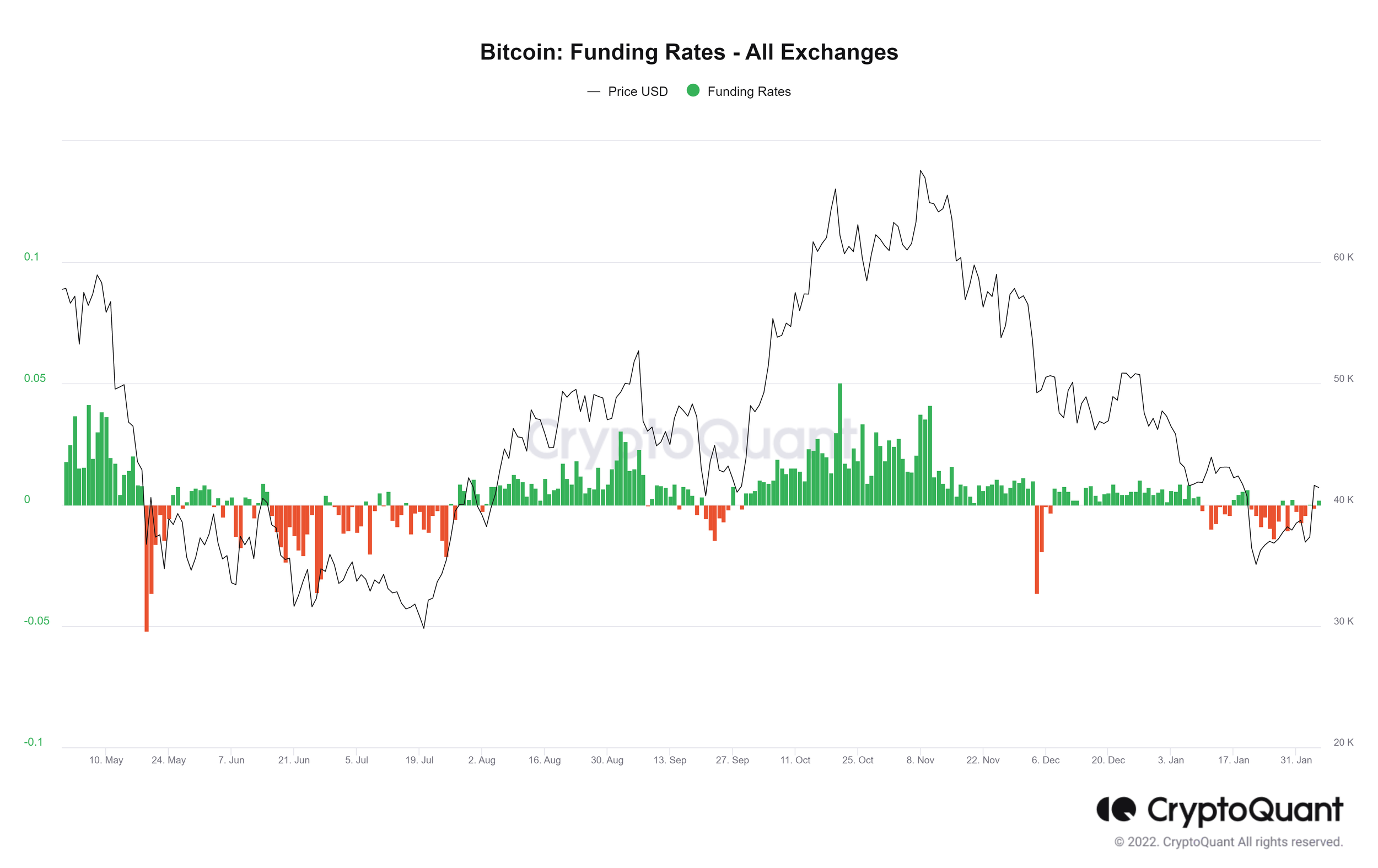

Perhaps a better measure of leverage within the system however are the futures funding rates. Funding rates are indicative of the directional bias of leveraged positioning. When positive, long traders pay premiums to shorts, and when negative, shorts pay premiums to longs. Positive spikes generally indicate extreme optimism whilst negative spikes often indicate extreme pessimism. Negative funding rates create the potential for a short-squeeze in a situation whereby price has fallen and yet open interest and leverage remain elevated, indicating speculators and traders are using leverage to bet on further downside.

For much of January, funding rates have been negative, particularly for BTC.

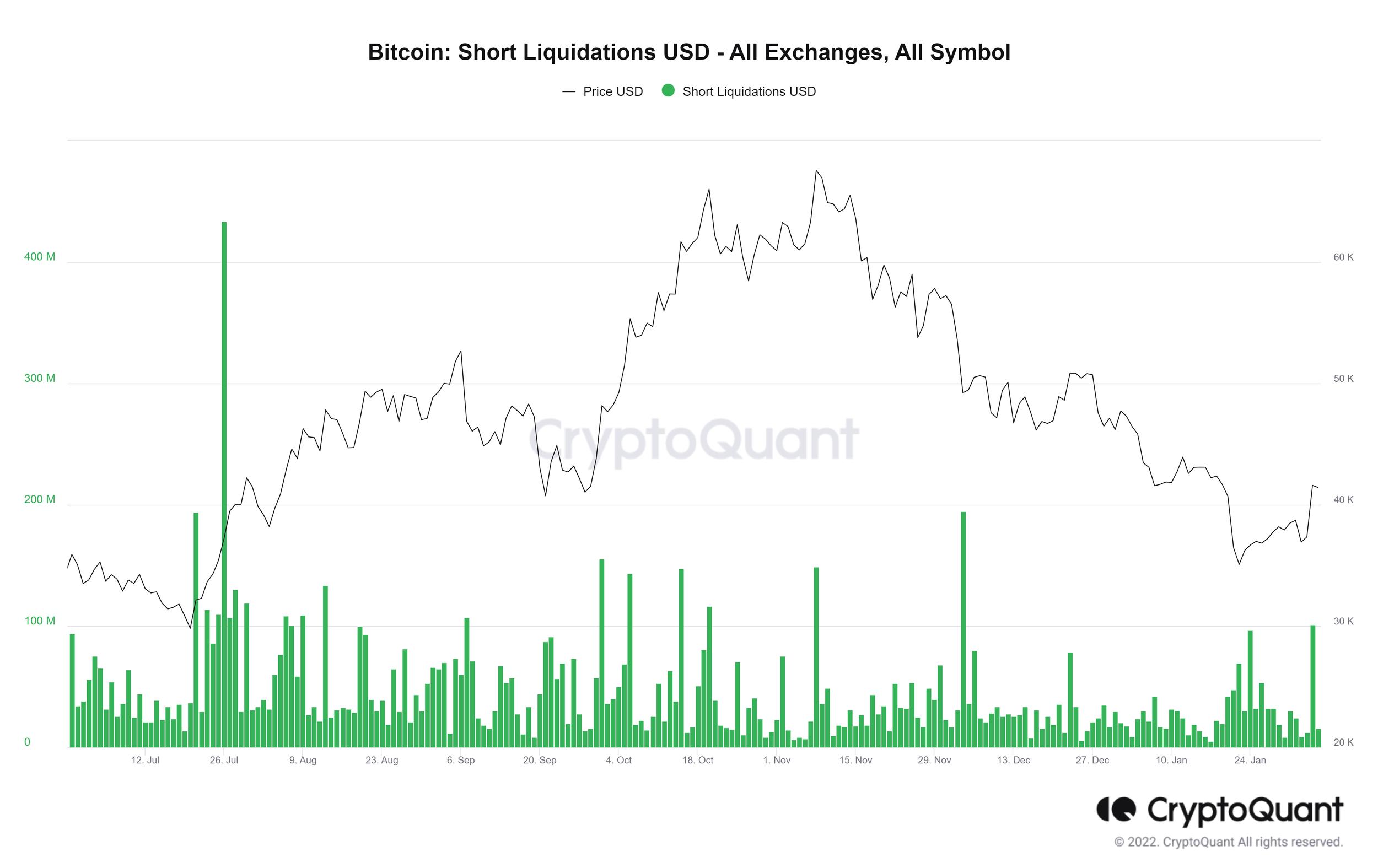

When coupling these negative funding rates with the elevated levels of open interest and leverage remaining within the crypto derivatives ecosystem, we can deduce that this recent rally back to $40k in BTC may have been somewhat driven by a short-squeeze. Given that a significant amount of levered long positions were liquidated in the January sell-off and yet leverage ratios remained elevated and funding rates were negative, we can see below how this dynamic could presage a short-squeeze whereby a large amount of levered short positions were required to be bought back, forcing prices higher.

Given the level of leverage still that has yet to be squeezed, the potential for further violent moves up or down remains a distinct possibility.

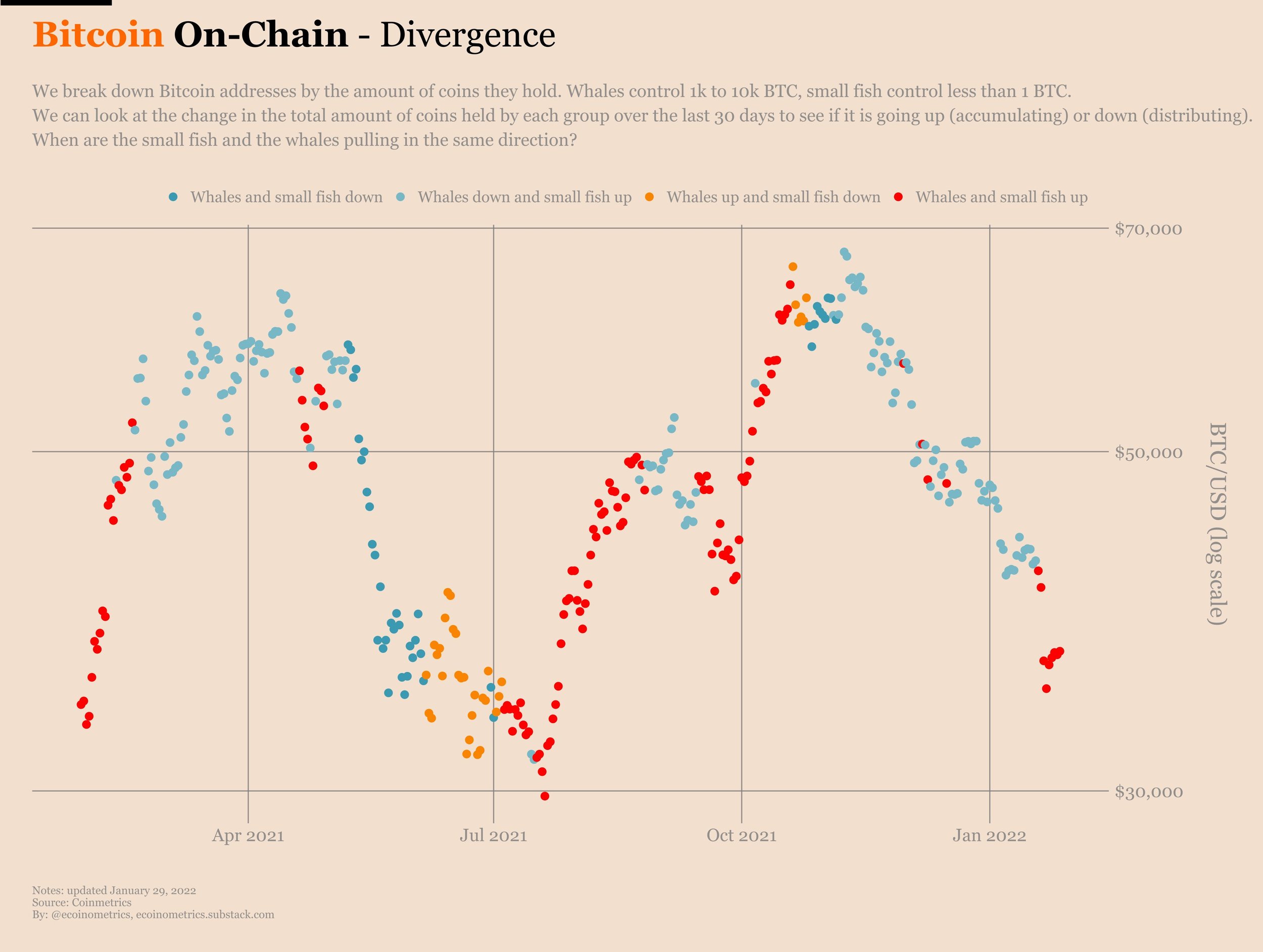

If we now turn to the on-chain activity through the lens of the buying movements of long-term holders and whales, we are slowly witnessing some constructive transaction behaviour taking place.

Firstly, as pointed out by Ecoinometrics, we are beginning to see whales accumulate and add to their positions. This is indicated by the red and orange dots on the chart below.

Source: Ecoinometrics

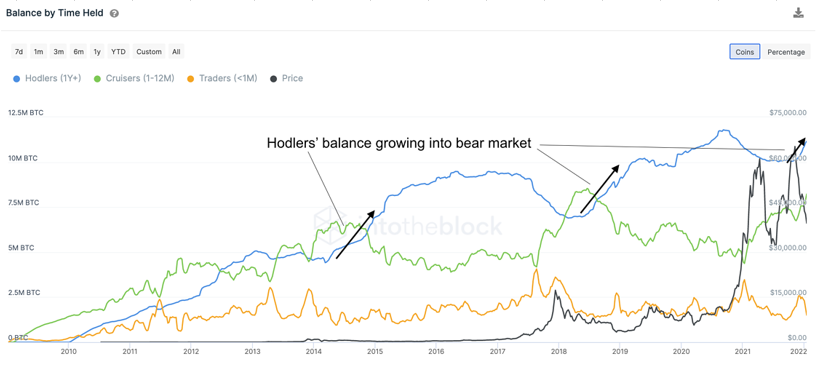

Additionally, we can see more evidence of long-term holdings accumulating and adding to their positions amid this pull-back per IntoTheBlock’s analysis below. Unlike the buying habits of short-term holders and traders who tend to tend to buy at the top and sell at the bottoms, we have seen a spike in long-term holders increasing their BTC balances similar to what we saw during the 2014 to 2015 and late 2018 to 2019 bear markets.

Source: IntoTheBlock

Further confirming this favourable long-term holder and smart-money behaviour is CryptoQuant’s transfer to derivative exchange flow metric, which shows how whales appear to accumulate and transfer BTC from regular exchanges to derivative exchanges during market bottoms and do the inverse during market tops. After the 30 day moving average of this metric was showing clear signs of distribution the latter months of 2021 as prices peaked and rolled over, we have since seen this metric tick up significantly of late.

Source: CryptoQuant, TradingView

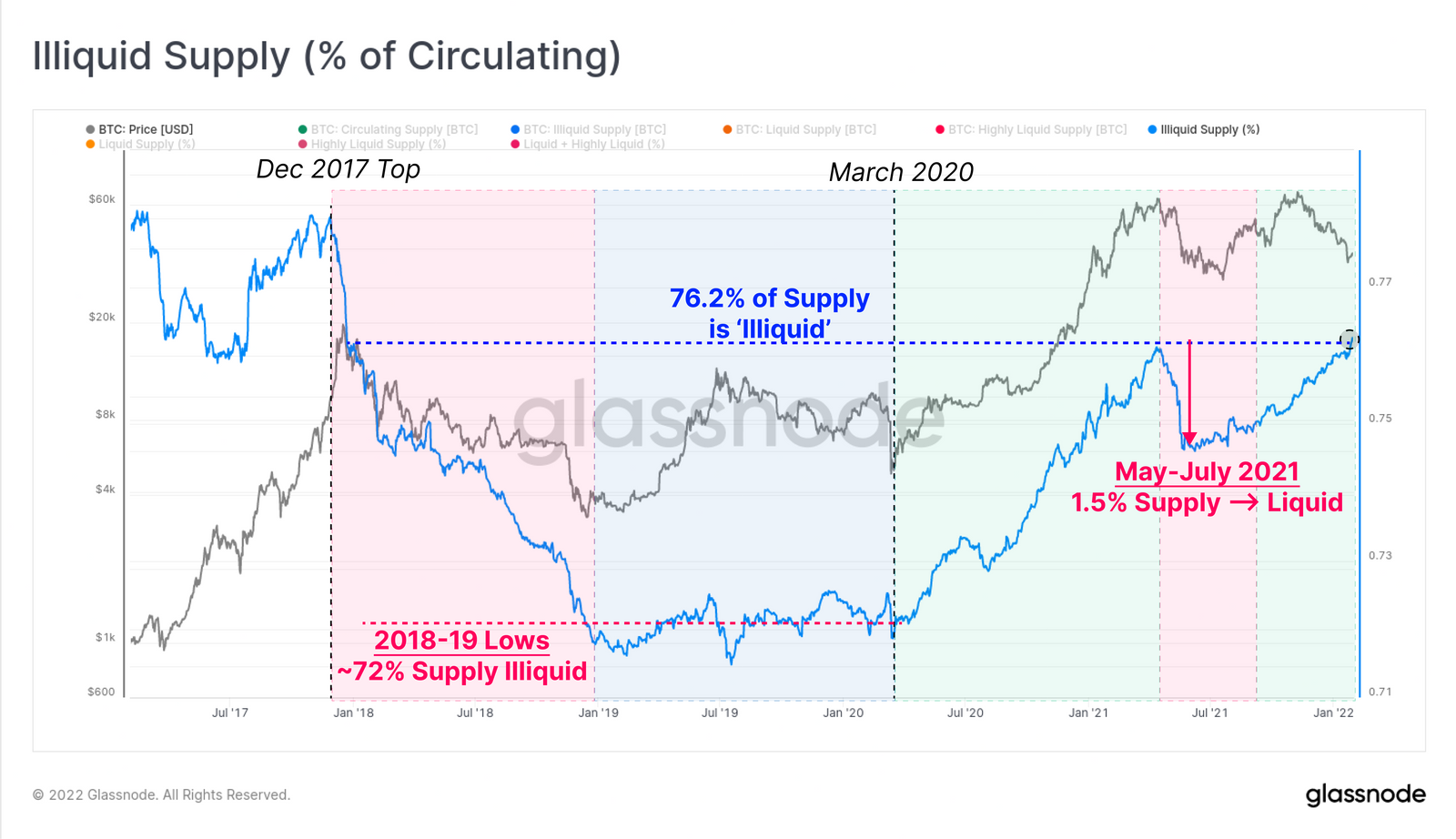

What is also encouraging is how this recent drawdown has seen the percentage of illiquid supply increase significantly, as noted by Glassnode. Such a dynamic may indicate short-term holders are selling to long-term holders who are thus removing said purchases from circulation and into cold storage.

Source: Glassnode

This ties in nicely with the buying behaviour of long-term holders presented above and creates the potential for the dynamic whereby should a catalyst emerge to push prices higher in the future, such as a pick-up in retail participation or increased institutional investment, we could see a significant move higher given the falling level of supply.

Speaking of institutions, I detailed within my most recent crypto market outlook the institutional money ready to enter the space, and it thus appears we are beginning to see said institutions deploy capital into this market weakness.

Institutional buying was never really going to occur until a favourable entry point presented itself. Alas, this recent pull-back appears to have indeed been such an attractive entry point for hedge funds and money managers to deploy capital into the digital asset space. This, coupled with the buying behaviour of long-term holders at present should help to support the formation of a market bottom.

However, it is important to remember these positioning and buying behaviour movements are not short-term trading indicators, but instead give us an idea of what the smart money are doing and how they are deploying capital. These investors are generally long-term in nature and are more willing to suffer through further downside volatility in the near-term.

Key takeaways

From a technical perspective, so long as we remain below the 50-day moving average and the $40-$42k resistance area for BTC and $3,000 resistance for ETH, I remain bearish in the short-term and suspect another move lower to be the highest probability outcome. A strong move above these levels would invalidate this bearish thesis.

The macro environment remains unfavourable for digital assets for the foreseeable future, particularly as crypto is largely behaving as high-beta risk asset at present.

We are seeing constructive signs in the buying behaviour of long-term holders and whales, aka the ‘smart money’, in addition to sentiment reaching levels of extreme pessimism, all of which are indicative of the formation of longer-term market bottoms. However, it is important to keep in mind such metrics are not necessarily useful to predict short-term market moves.

Institutional demand should continue to provide support to digital assets and crypto in the months ahead as hedge funds and other institutional money managers continue to deploy their capital into market weakness.