What Are Markets Pricing In?

Summary & Key Takeaways

Given the forecastable nature of the business cycle, understanding what markets are pricing in from a business cycle perspective is an integral tool to one’s asset allocation decisions.

As it stands, stocks as a whole have done a solid job pricing in the growth slowdown. However, the high-beta and high-risk areas of the stock market look particularly vulnerable to the downside.

Likewise, downside risk remains present for industrial commodities and potentially energy commodities.

Fixed interest markets look mispriced, particularly within the credit space.

The business cycle matters for markets

In my opinion, the importance of the business cycle within an investment framework cannot be overstated. The business cycle represents the cyclical growth of the economy. From spending, consumption, corporate earnings, inflation, employment, to the performance of assets markets such as commodities, stocks and fixed interest, so much of finance and investing is determined by where we are in the business cycle and where it is heading.

In finance there is an overwhelming propensity to overcomplicate things. At times this is justified. But, for the most part it pays to keep things simple. This is true of all parts of investing, from technical analysis to economic growth. Given how many financial markets track the business cycle, an excellent example of keeping things simple is to assess which stage of the business cycle financial markets are pricing in, and, if you have a view on the outlook for the business cycle itself (my most recent analysis of which can be found here), identify profitable investing opportunities and make informed asset allocation decisions.

Stocks

Beginning with everyone’s favourite asset class in the stock market, the major US equity indices as a whole have done a solid job pricing in the current cyclical slowdown. The S&P 500, Nasdaq and Russell 2000 respectively are pricing in a US ISM Manufacturing PMI (my preferred proxy for the business cycle) of around the mid 40’s. Given the various leading indicators of the business cycle are suggesting the PMI is likely to bottom anywhere from 40-45 at some point this year, it is fair to say stocks as a whole have priced much of this in.

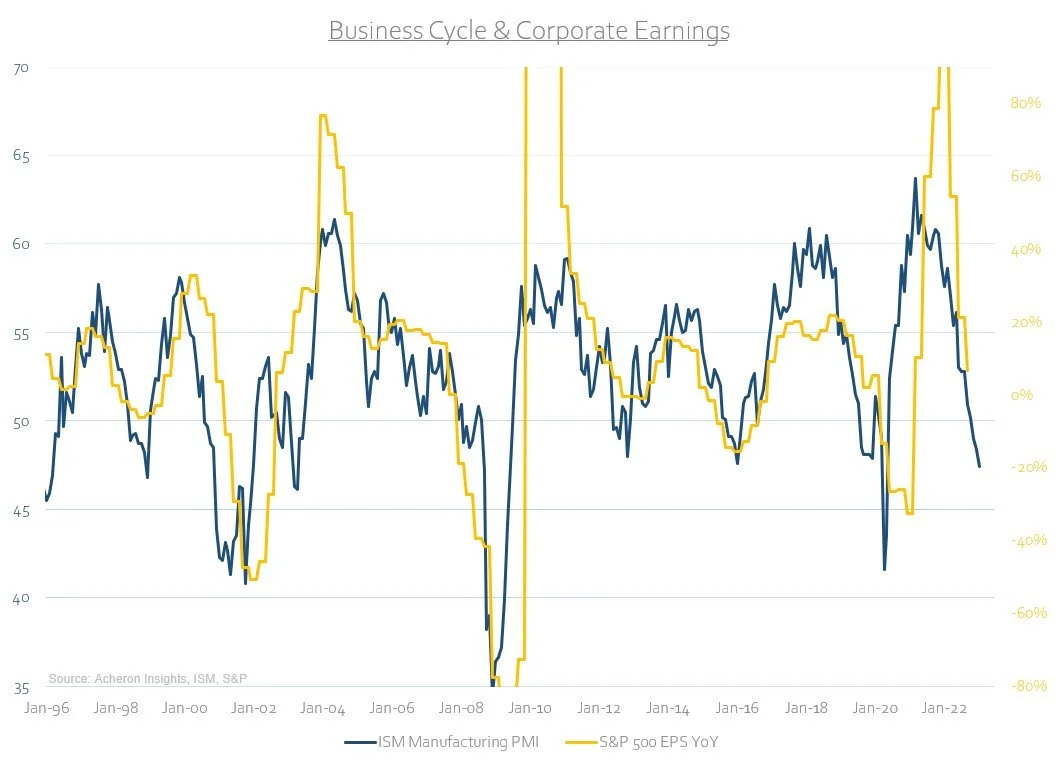

From a corporate earnings perspective, as we can see below, there remains clear downside. Even if the PMI bottom’s out around the 45-50 level, corporate earnings are still likely to fall another 15-20% on a year-over-year growth basis from current levels.

Stocks have priced much of this in however. The S&P 500 itself looks to be pricing in EPS growth of around -25%.

Does this mean we should be buying the dip in stocks? Unlikely. Until the leading indicators of both the growth and liquidity cycles start to pick up (which is yet to occur to any meaningful degree), investors ought to be selective with their equity allocation at present. While this does not imply stocks will go down from here, it does suggest there is further downside risk in stocks over the medium-term.

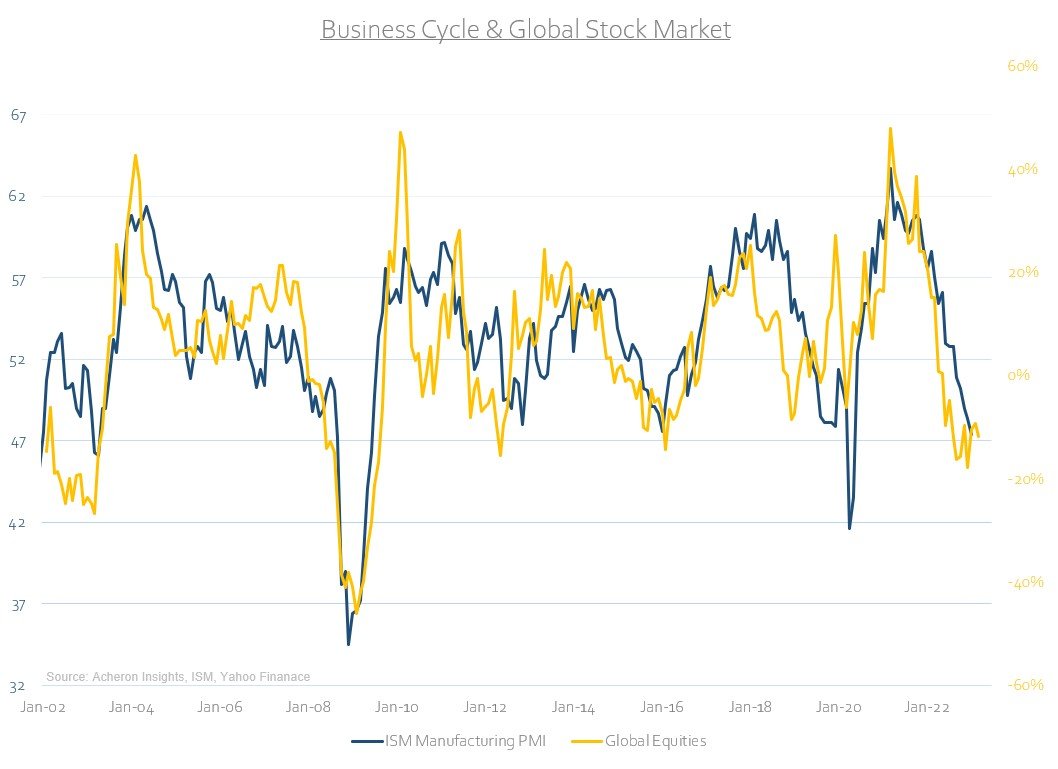

The same can be said of global stocks as whole.

As well as emerging markets.

If we turn our attention to the cyclical areas of the stock market via an assessment of the cyclical versus defensive stocks ratio, the recent repricing to the downside has been significant and constructive. This illustrates how hard some of the cyclical sectors such as retail, consumer discretionary and industrials have been hit over the past year or so, and that their underperformance relative to their defensive counterparts may not be material from here on.

Again, just because areas of the stock market have repriced in a constructive manner doesn’t mean you have to buy stocks. Nowhere is this more evident than the high-beta and speculative areas of the market. If the leading indicators prove correct and suggest the PMI does bottom out around the 40-45 area, this would indicate the high-beta/low-beta ratio could correct a further 15-20% from here.

What assets trade akin to the high-beta/low-beta ratio? Those that are highly speculative and reliant on abundant liquidity, with crypto being one such example. Stocks simply do not bottom in a recession within the high-beta/low-beta ratio still near its cyclical highs. Respect the business cycle and be patient with your allocation to such high-risk assets.

Commodities

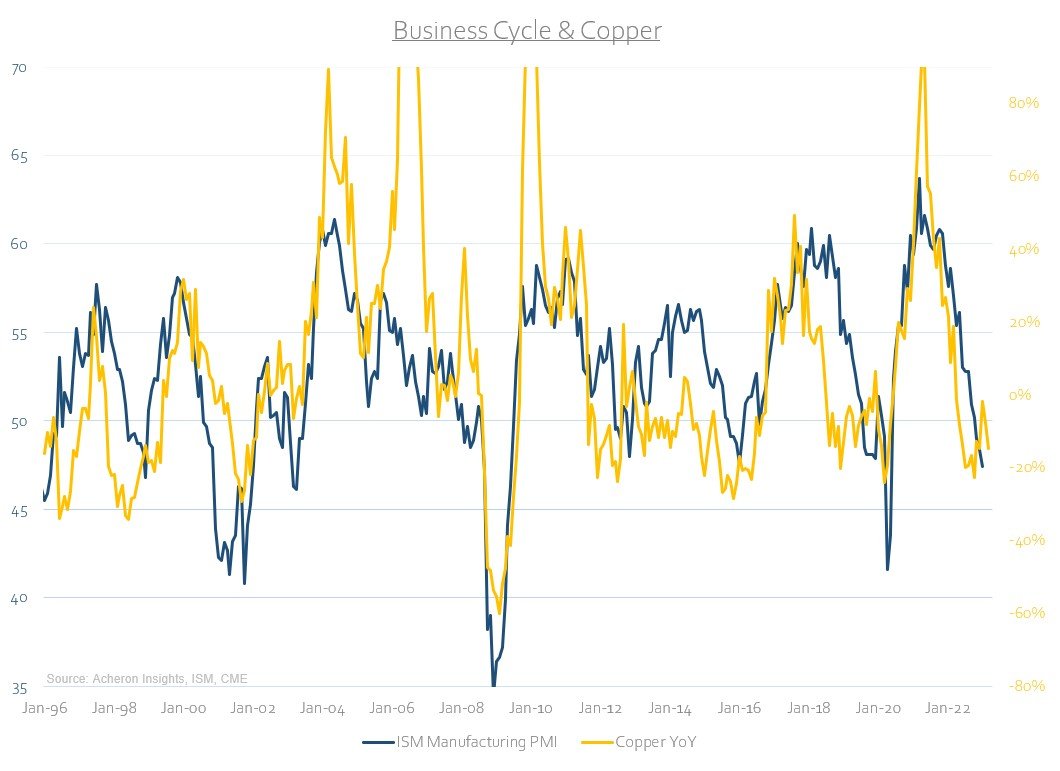

From a commodity perspective, it should be no surprise to anyone the performance of industrial commodities and base metals are heavily tied to the business cycle. Industrial commodities such as copper and aluminium are highly demand sensitive, with their supply dynamics having a far lesser impact on their cyclical performance relative to agricultural commodities and some energy commodities.

Indeed, the demand for industrial commodities is largely a function of economic growth and thus the business cycle. As the business cycle moves higher, demand for goods rises and so does industrial production and manufacturing, which in turn increases the need for industrial commodities and thus pushes up their prices. The opposite is true during business cycle downturns. While there are periods whereby supply constraints and geopolitical events overwhelm these cyclical factors, the business cycle is still in the driver’s seat from a cyclical perspective.

As we can see below, both industrial commodities as a broad basket as well as copper itself are roughly pricing a PMI of around 45-50, suggesting further downside may lie ahead for this area of the commodity complex.

The same can be said of oil, with WTI crude pricing the PMI around the 45-50 level as well. Unlike industrial commodities however, supply constrains have a greater cyclical influence on the pricing of energy commodities, particularly crude. Given the structural supply constraints within the oil markets at present, whether we see crude prices trade lower in-line with the business cycle remains to be seen, though energy bulls should nonetheless be cognisant of the potential downside for crude oil.

Bonds

This is where things get a little more interesting. I have highlighted a number of times recently the divergence between interest rates and the business cycle, a divergence which still remains in place.

This is true of both yields…

…and bonds.

There are of course a number of justifiable reasons as to why this divergence has emerged, from forty-year high inflation and a demand/supply imbalance of US Treasuries to name a few, but there continues to look to be a potentially profitable cyclical trade to be had within the bond market as this business cycle slowly forms its bottom. A H2 2023 recession would certainly bolster this view. Watch this space.

Credit

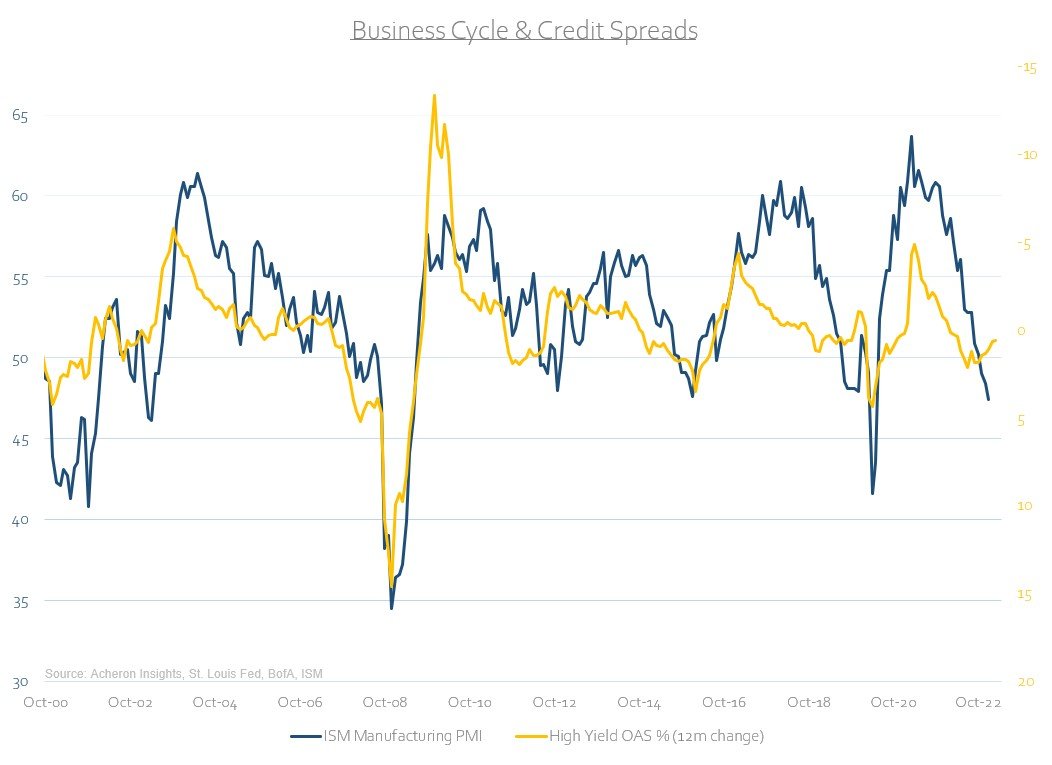

Perhaps even more enticing however are the divergences between the credit markets and the business cycle. High yield spreads are currently pricing in a PMI of anywhere from 50-55. If you believe we are heading into recession then it is clear high yield spreads could end up anywhere from 500 to 1000 basis points higher. In other words, there is significant upside risk for credit spreads at present. The outlook for the credit cycle itself certainly confirms this notion.

This wouldn’t bode well for high yield bonds, such as the HYG ETF, which is pricing the PMI at over 50.

Final Thoughts

Although the business cycle is not the be-all and end-all and should never be your sole input in assessing the outlook for a particular asset class, it is one of the most important variables. Divergences between the business cycle and performance of particular asset classes can create profitable investment opportunities.

While stocks have priced in much of the cyclical slowdown in the business cycle, the high-beta and high-risk areas of the stock market have not necessarily done so, and as such, it is perhaps not a good time to be allocating to such assets. Likewise, industrial commodities could also move lower should the business cycle itself continue to deteriorate over the coming months as suggested by the leading indicators. The same can be said of the credit markets, which look vulnerable and mispriced, while the business cycle suggest we will eventually see some kind of cyclical rally in bonds at some stage this year.

. . .

Thanks for reading!

If you would like to support my work and continue to allow me to do what I love, feel free to buy me a coffee, which you can do here. It would be truly appreciated.

Regardless, feel free to share this with friends and around your network. Any and all exposure goes a long way and is very much appreciated. Thanks again.