Stocks Sniffing A Bear Market Rally

Summary & Key Takeaways

A number of key technical, sentiment and flow based indicators are suggesting we could see a relief in selling pressure over the coming weeks, and perhaps a countertrend rally in risk assets.

Reducing market hedges and short positions at current levels looks to be a prudent strategy.

However, the outlook for the growth, liquidity and profit cycles remains bearish and suggests investors and traders use any forthcoming strength to reinitiate hedges and downside optionality.

Ready For a Market Rally?

Following what has been a relentless few weeks for markets there are an increasing number of signs suggesting not only is it looking like the selling pressure may be subsiding for the stock market, but a much needed rally may ensue.

From a technical perspective, the S&P 500 looks to be testing the lower bound of its downtrend after bouncing off the new low of around 3,620. This 3,620 level is of note as it represents the JP Morgan put spread strike, thus being an area of significant short gamma exposure held by options dealers (the tail wags the stock market dog, remember). Given this position expires on 30 June, one would expect such a level to act as a “put wall” support over the coming weeks. The “put wall” is an estimate of the level in which dealers are most short gamma as their short put positions approach strike. As these put positions approach their strikes, traders long those puts will begin to monetise and/or roll these positions forward, resulting in dealers buying back their short underlying positions that were used to delta hedge their short-put positions. As such, it is unlikely we see an accelerated move below 3,620 for the time being.

Indeed, should the S&P 500 manage to rally up to the 3,900-4,100 area, this looks to be a constructive area to reinitiate hedges, particularly as this will likely coincide with resistance from the 50-day moving average. Any move below 3,620 prior to the end of June would certainly nullify this thesis and likely usher in further selling as the put wall is breached, though I suspect we are in need of a catalyst to usher in further selling for now. With few significant data points set to be released over the next week two, such a catalyst may not arise for now.

In terms of the Nasdaq, it looks to have found similar support off the lower bound of its downtrend channel, and is looking like it wants to rally off this area. We saw similar rallies from such areas in late January, early March and in May. Confirming this idea is the fact that the latest lows were accompanied by a positive divergence in RSI and OBV, indicative of waning momentum and selling pressure. These divergences are more pronounced on the Nasdaq than the S&P 500, and given the Nasdaq has very much led the market lower this year, one would suspect it to be in need of a greater countertrend rally.

A test of the 50-day moving average or even the upper bound of the downtrend channel over the coming weeks is not out of the question. Bear market rallies can be swift and violent, especially when consensus is as short as it is presently.

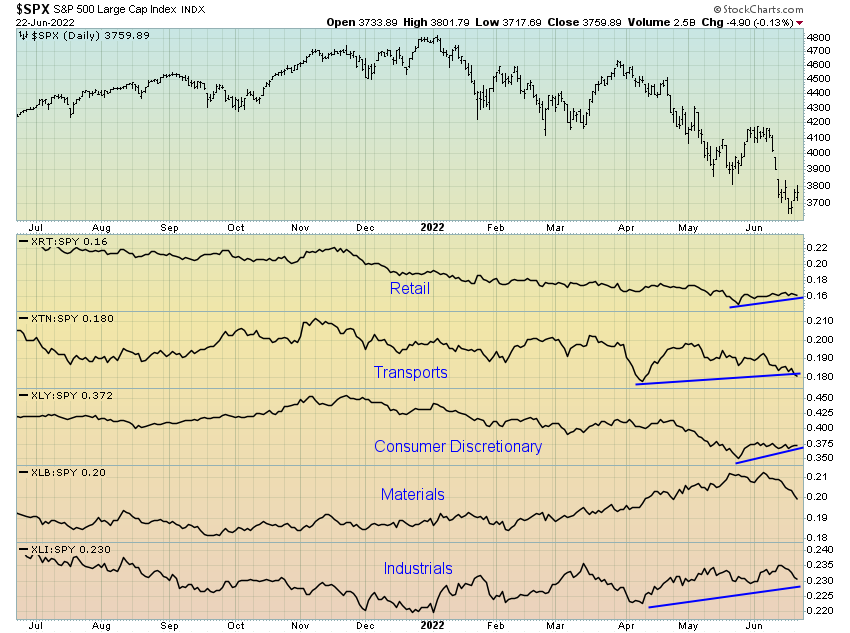

Indeed, it is not just from a technical and momentum perspective that leads me to believe a rally may ensure, but a number of market internals are pointing to a similar outcome. If we compare the price action of some of the most economically sensitive sectors of the stock market, in this case Retail, Transports, Consumer Discretionary, Materials and Industrials, we can see these sub-sectors bar Materials have outperformed the broad market during this latest move lower, with materials stocks selling off in-line with commodities over the past week.

Generally, when the pro-cyclical parts of the market do not confirm the lower lows, it becomes difficult to see the market itself move significantly lower.

Inversely, should the S&P 500 go on to rally and it not be confirmed by the outperformance from these pro-cyclical sectors, the probabilities suggest such a rally may be short lived.

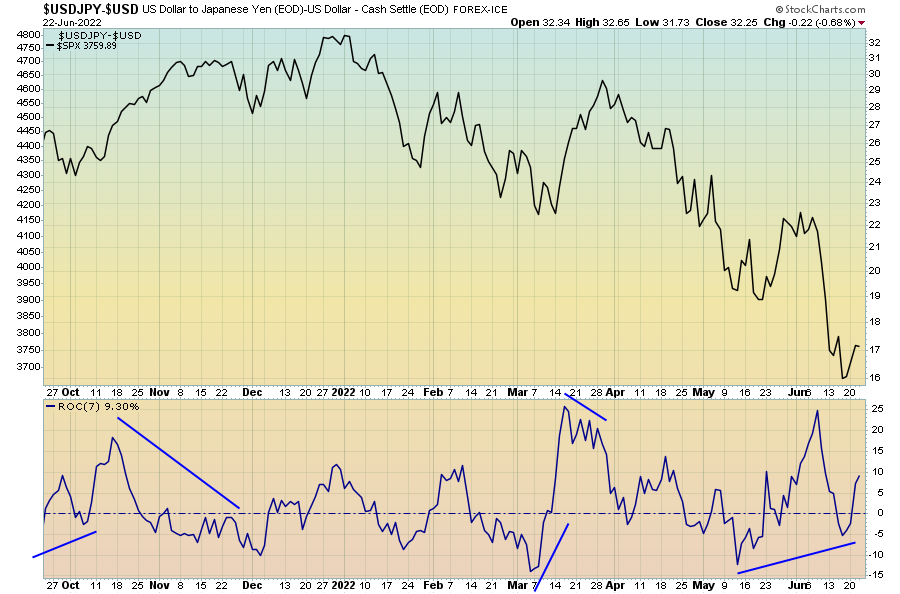

In addition the economically sensitive sectors of the market not confirming the recent lows, we can see that the currency markets are too suggesting the same. Here we can see the FX Weathervane (per the unique work of Chris Carolan) has too diverged positively following the recent lows. We saw a similar divergence prior to both the March and May rallies, moves which saw the S&P 500 move 25% and 15% higher in short order.

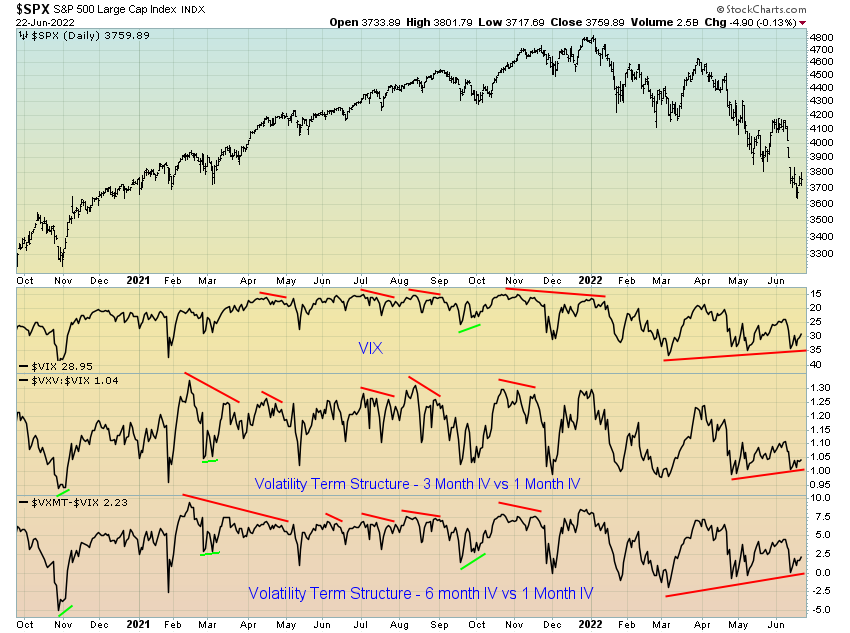

What’s more, both the VIX and the volatility term structure (presented below in a number of iterations) have also diverged bullishly following the recent lows. Bullish divergences in the VIX have historically been an excellent indicator of future price action, so too when comparing further dated implied volatility relative to one month out implied volatility. Volatility divergences are often signs of exhaustion and generally indicate some form of a relief rally may be due.

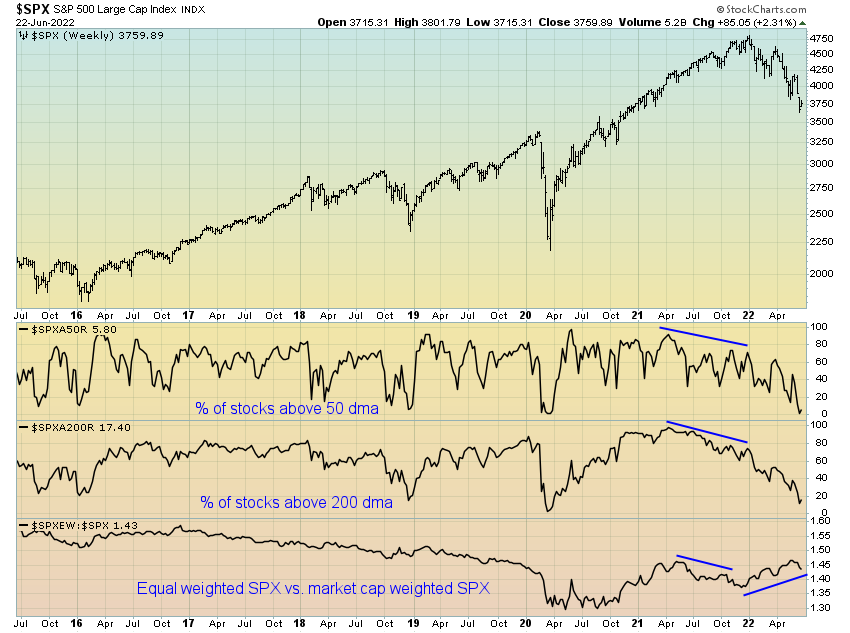

The recent lows have also seen market breadth display some of its lowest readings in years. The percentage of stocks trading above their 50 day-moving averages recently hit near zero whilst the percentage of stocks trading above their 200-day moving averages saw a sub-20 reading, both reaching their lowest levels since March 2020. Likewise, the equal weighted S&P 500 index continues to outperform the market cap weighted S&P 500 index, generally a positive outcome for stocks, at least in the short-term.

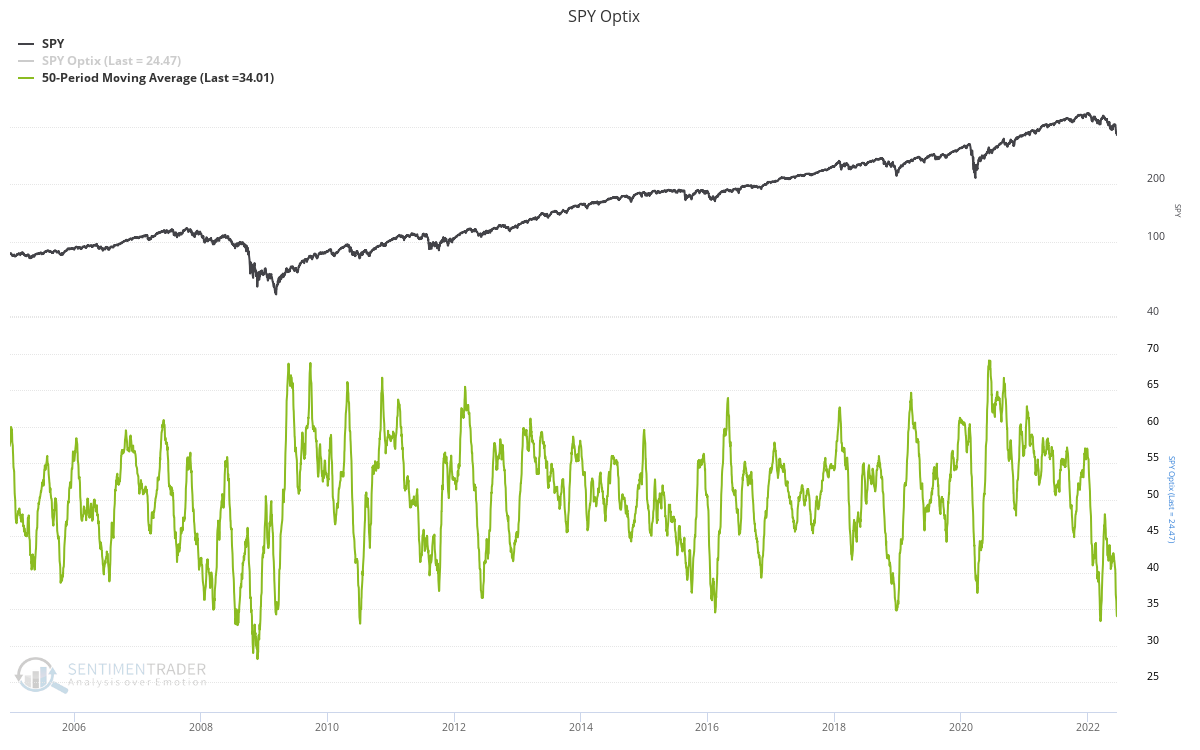

In terms of sentiment and positioning, both are at extremes and in need of a washout. Firstly, sentiment (here proxied by the SentimenTrader Optix index) has reached levels of extreme fear seen only sparingly over the past couple of decades. Whilst such extreme readings don’t imply a sustainable market bottom is present, we do generally see the market rally over the short-term from such levels with. Refer the price action relative to sentiment during the GFC for context.

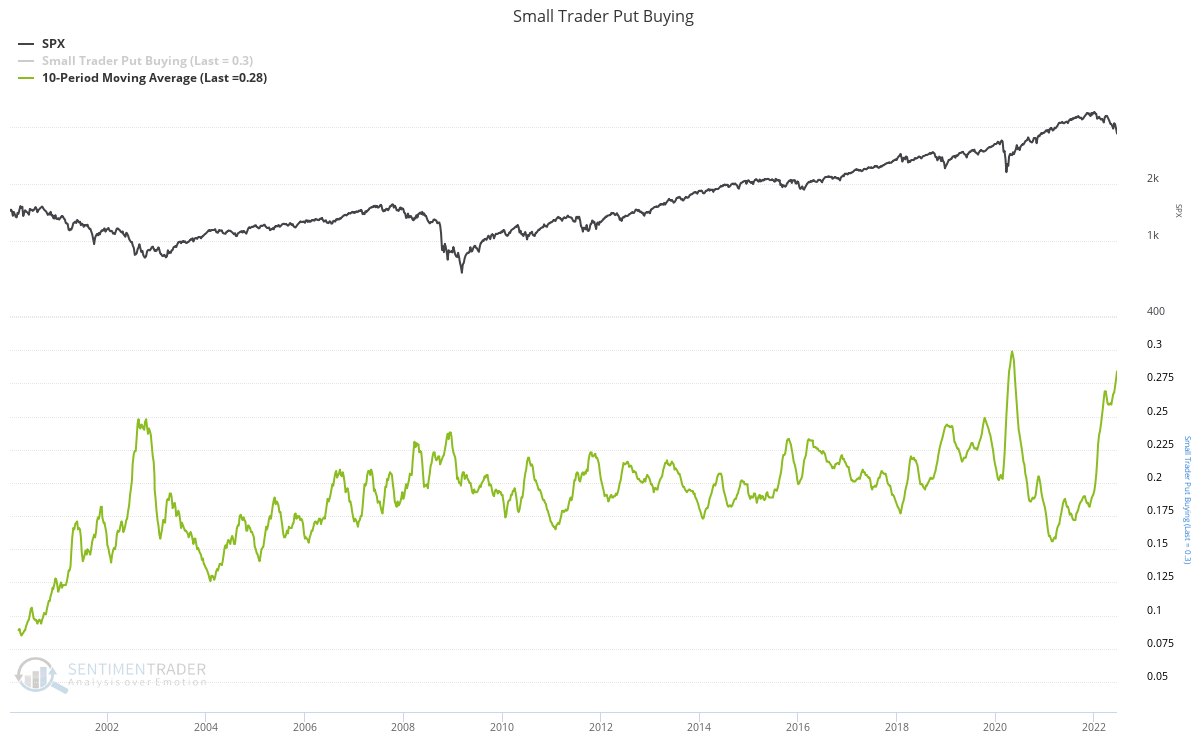

Clearly, everyone is bearish, and with bearish sentiment comes bearish positioning. Indeed, small trader put buying has reached near record highs.

Whilst small speculator positioning in the futures market for index equities (aggregating S&P 500, Nasdaq 100 and DIJA index futures) is extremely short. Remember, small traders (i.e. retail) tend to get their timing fairly wrong; buying at the highs and selling at the lows. It is increasingly looking like the markets need to rally to wash out this bearishness before the correction can continue.

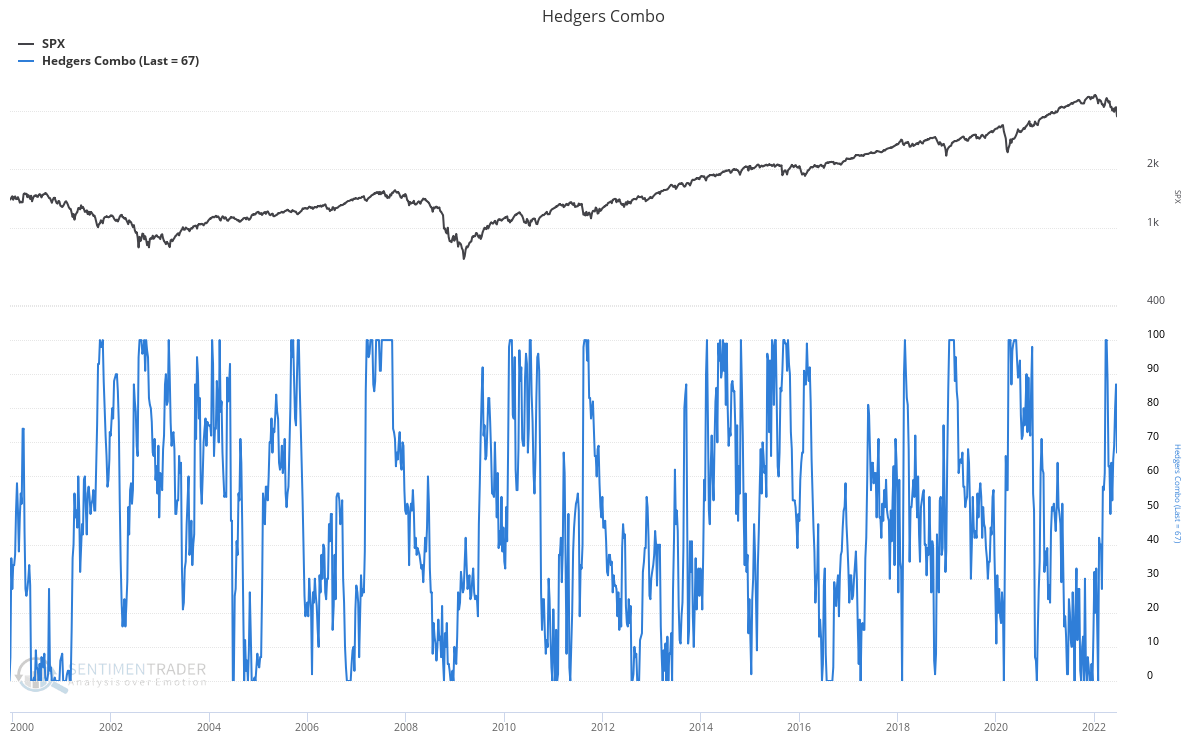

This is certainly an outcome the “smart money” is betting on, as commercial hedgers have on near max long positions. Similar positioning setups in recent years have again generally seen the market move higher in the short-term.

When we consider these dynamics in the context of what is a favourable period of seasonality through July (and yes, seasonality does matter), a relief rally over the coming weeks looks like a significant possibility.

Chart via MrBlonde

Another important consideration supporting this thesis are the quarter-end rebalancing flows set to hit markets as we close out the month. With broad equity indexes down roughly 6-8% versus bonds this quarter, expect rebalancing flows from target date funds, pension funds and traditional 60/40 portfolios to come into equities as these systematic strategies rebalance their books. This is a very real phenomenon and an important dynamic traders should consider, with the great Mike Green estimating such flows into stocks to be in the order of around $85b.

Owning downside protection from here remains a sound strategy, however, from a more tactical nature, the risk-to-reward for short-term hedges and outright shorts appear to be less appealing for now. Medium-term, given the forward outlook for the growth cycle, liquidity cycle and profit cycle, I continue to believe that strength should be sold. For now, it looks to be an optimal time to reduce broad short positions and equity market hedges, with a view of reapplying these should a rally eventuate. It has been a profitable couple of months for bears and now appears an opportune time to reduce bearish exposure. Bear market rallies can be swift, vicious and extreme.

In other markets, I continue to be ever intrigued by the bond market as the ultimate contrarian trade. Betting against both stocks and bonds has been a sound strategy of late, and, whilst I ultimately believe stocks could head much lower from here, I do see the bull case for a substantial move higher in bonds.

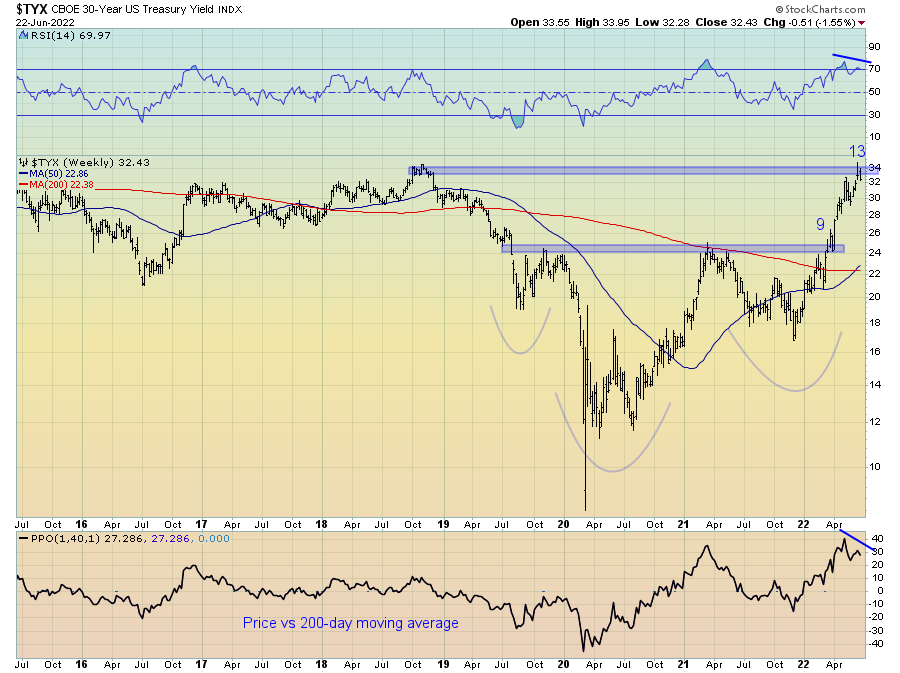

A number of signs are indeed suggesting bonds are looking ripe for reversal. Firstly, the latest move higher in yields on the back of recent higher than expected inflation prints is beginning to look like an exhausted trend. The 30-year Treasury yield has run into important overhead resistance at around 3.4% on waning momentum (as measured here via the RSI and price versus the 200-day moving average), all the while triggering a weekly 9-13 DeMark sell signal.

Given how far price has deviated from the long-term moving averages, a move back down to around the 2.4% level of support for the 30-year Treasury yield seems plausible at the very least, especially when considering the growth cycle outlook and ever increasing recession risk. Bonds will eventually price this in.

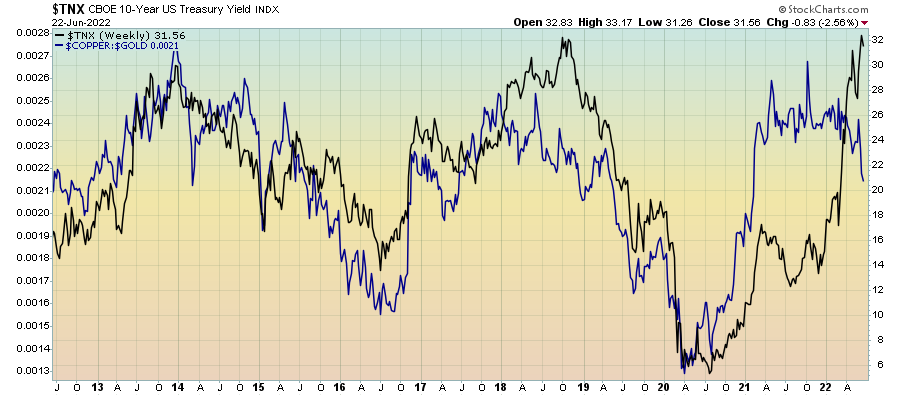

Market internals are now very much signalling rates lower and bonds higher, illustrated here via the trusty copper/gold ratio. The current divergence looks strikingly similar to what occurred in late 2018 as yields peaked around a similar level.

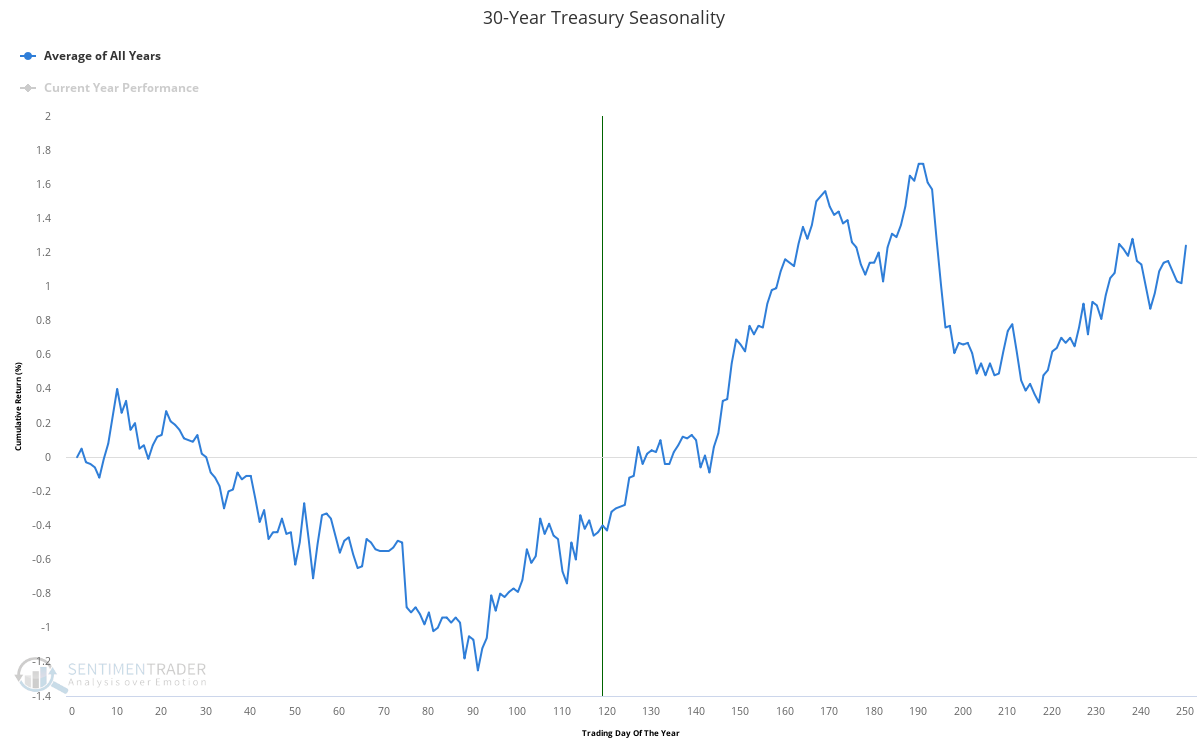

Seasonality too is very support of the long bond over the coming months.

Could it be that bonds are now undervalued? I suspect this is unlikely given how inflation is likely to not materially move lower until at least the early stages of 2023 on a rate-of-change basis. For bonds to rally, we likely need a continued sell-off in commodities, a Fed pivot, or a material deceleration in economic data (which we are begging to see). The bond trade is not be here yet, but it may be coming ever closer.