Preservation of Capital

The basis behind this blog is articulate my thesis behind my investment decisions, and track my portfolio and its performance.

Any positions I enter from here on will then be reflected within my portfolio, along with the basis behind each investment to be outlined within a new post.

To begin, it is worth noting that I have a very bearish outlook on equities over the medium to long term. For me, this position is not a difficult one to bear. If you look at U.S. equities on a number of long term valuation metrics, it is easy to see how overvalued this market remains.

The CAPE ratio of 29 we see during the current market bubble remains at a level only seen previously during the height of the roaring 20’s and the tech bubble. Whether fair value as determined by the CAPE is 16 or 20, there is no doubt that subsequent returns from such high valuations have historically not been attractive.

It is not just the U.S. market that is expensive, this theme pertains to most of the world’s developed economies:

The outlook for developed market equities across the board is bleak:

Whilst there are no doubt opportunities to be found over the coming years for the astute active investor, and certainly certain sections are attractive at present (energy and emerging market equities, of which I am both bullish but awaiting a better entry point to add to my positions), it is for those who have adopted the passive buy and hold approach who will likely bear the brunt of what is coming.

What is needed going forward through what will likely be the worst economic conditions seen since the Great Depression is a store of value.

This brings me to gold

For me, the ideal asset to hold going forward is the classic storehold of wealth that is gold (and silver for that matter). We are in the midst of a precious metals bull market that began in 2016 and will no doubt end in gold and silver eclipsing their all time highs.

The fundamentals case for gold is easy. Negative real yields on bonds are making the “defensive” aspect of the classic 60/40 portfolio pertain to what has been dubbed “reward free risk”. Whether this means a end to treasuries as a productive asset class going forward remains to be seen, but why lend out money to the government at a negative rate over the long term? Whilst yields are likely to fall further over the medium term, holding bonds long term has never been a good investment at any point in history when yields were this low. Whilst gold has no yield, an asset that yields zero is greater than an asset whose yield are negative.

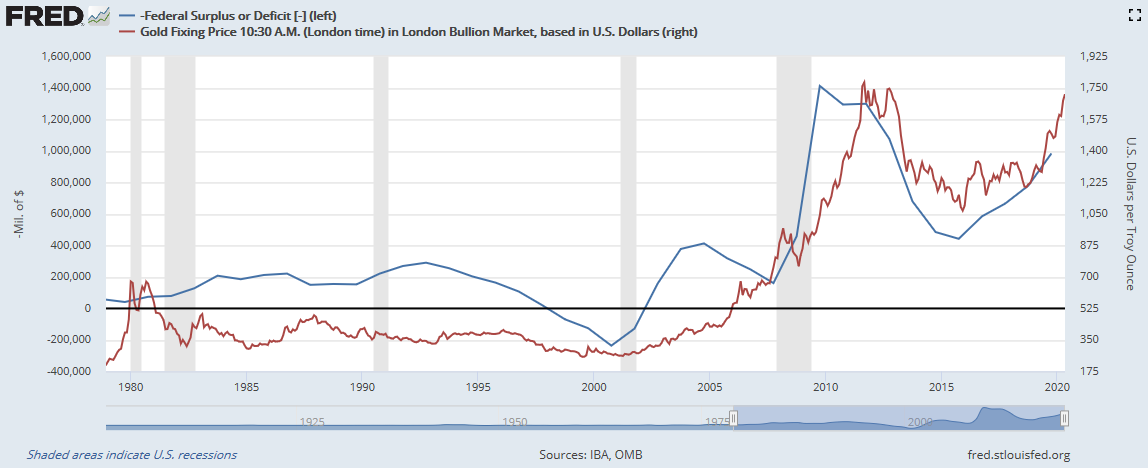

One of the better long term indicators for the gold price is the U.S. fiscal deficit:

Given we have entered the age of fiscal dominance, exacerbated by the Coronavirus shutdowns, there is only one direction in which the federal deficit will trend over the coming years.

Furthermore, the abuse of fiat money creation we have seen over the past 50 years will eventually lead to distrust in the U.S. dollar as the worlds reserve currency in some capacity. This has been the case throughout all of history. Paper money eventually fails and those with the foresight of history will be the ones who flee to tangible stores of value before the masses.

Whilst I am long-term bullish on gold, I am not so over the short-run. To keep things brief, I will further touch on my fundamental long-term drivers for gold in a post when I add to my position, over the coming months.

In the recent months, we have seen the gold price rocket higher as investors fled equities and bought into gold following March downturn as a safe haven. This has lead gold becoming overbought, a trend which may be beginning to wane.

However, there are a number of short-term headwinds that will likely push the gold price lower over the coming months.

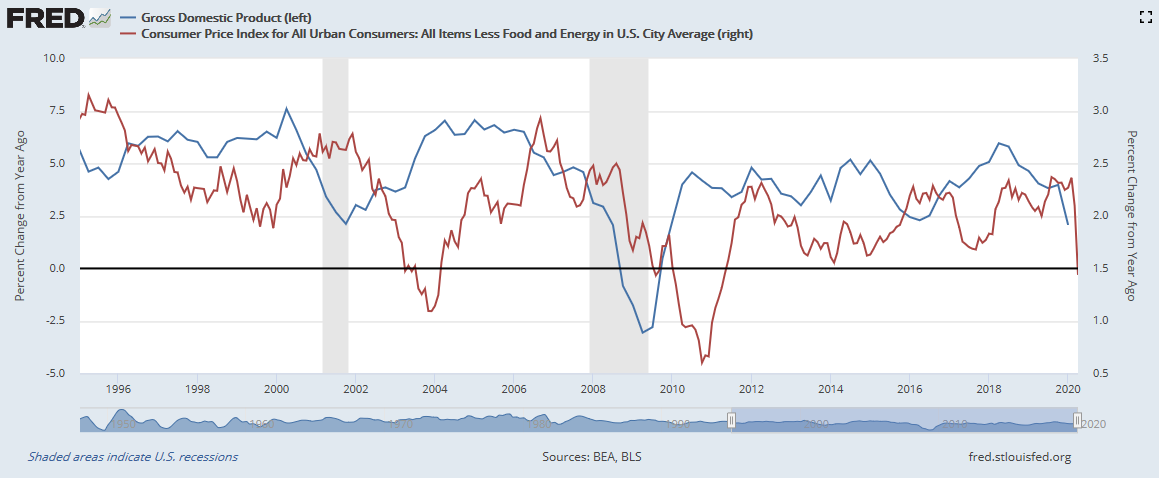

Firstly, CPI has dropped significantly over the past few months. This is no surprise as market crashes are generally deflationary. The lockdown has led to excess supply and a rapid drop in the velocity of money. GDP has been a good leading indicator of the direction of CPI over the subsequent year or so:

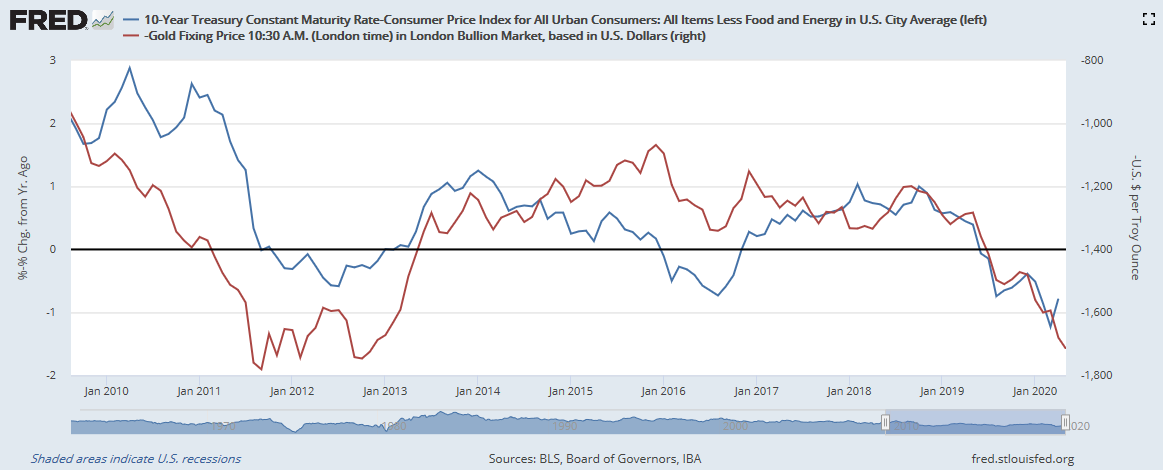

When CPI is falling faster than yields, this pushes up real yields, a bearish outcome for gold:

Real yields are now rising and have diverged from the gold price. I expect gold to follow suit until rates begin to fall or the trend in CPI to reverse. Either way this will likely cause short-term weakness in the gold price a provide a good buying opportunity amidst what is a gold bull market.

From a technical perspective, long-term momentum and money flow have diverged bearishly from the upward trend in the gold price:

This indicates that momentum has likely peaked for the time being. On a shorter term perspective, gold recently broke out of its uptrend and fell below its 50 day moving average. If gold falls below this support, there is a chance some (more most) of its recent gains could be given back. Should this occur, I will reassess my outlook and look to add to my position.

It is likely my next post will be when this occurs, at which point in time I will delve further into my bullish thesis behind gold, and look to touch on silver and the miners, should they following the gold price over the short-term.