Will We See A Natural Gas Rally This Winter?

Summary & Key Takeaways:

Bloated inventories and strong US production are weighing down natural gas prices.

Although LNG export demand remains strong, unseasonably warm weather in the US is leading to subpar domestic consumption.

However, the current El Nino responsible for the warmer weather may prove weaker and shorter than first thought, which could help support prices as we progress through the North American winter.

We will need to see a sustained period of colder than normal weather to see a meaningful move higher in prices given the current state of US inventories.

Looking into 2024, we should see US production roll over to some degree, while the continued build-out of LNG export capacity should also help support natural gas prices over the medium-term.

An abundance of natural gas

In assessing the supply side of the equation for the natural gas market through the lens of storage and production, we are getting a fairly obvious message at present. It’s not bullish (at least not yet).

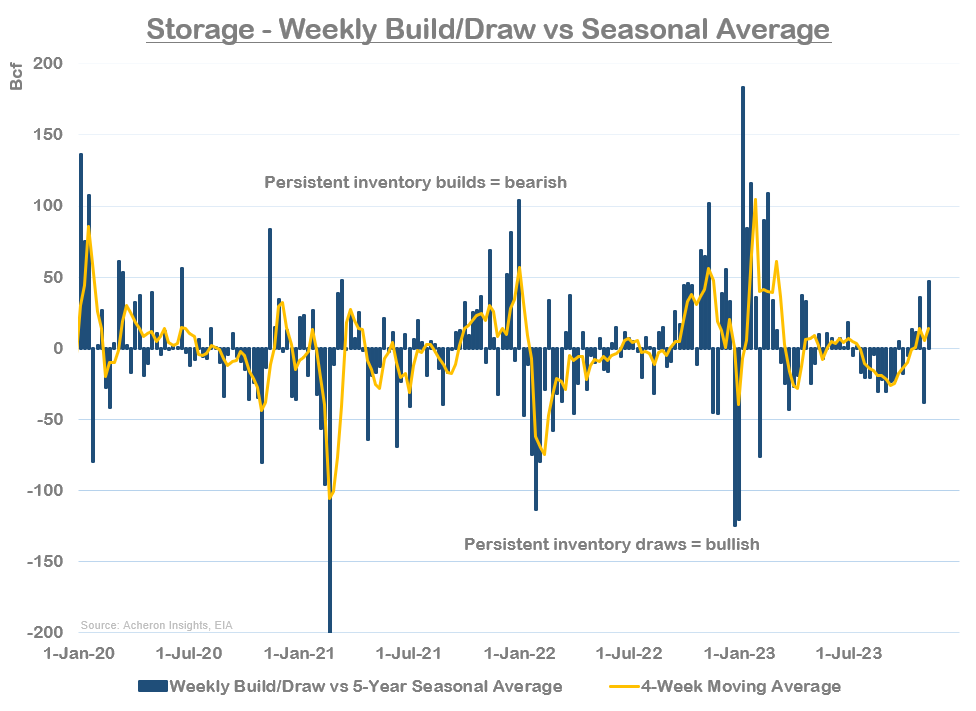

According to the EIA’s storage data, despite briefly dipping into bullish territory through Q3 on the back of strong seasonal draws helping to support prices, natural gas futures are getting hit hard now that we are once again seeing inventory builds above seasonal norms.

The same can be said of outright inventory levels, which are well above seasonal averages for this time of year. This is a commodity in oversupply.

Not only are inventories firmly on the bearish side of the equation, but US natural gas production is also materially above seasonal averages. Although production tends to peak just prior to the winter months, already bloated inventories coupled with a significant rise in production seen throughout October and November has put significant pressure on prices of late.

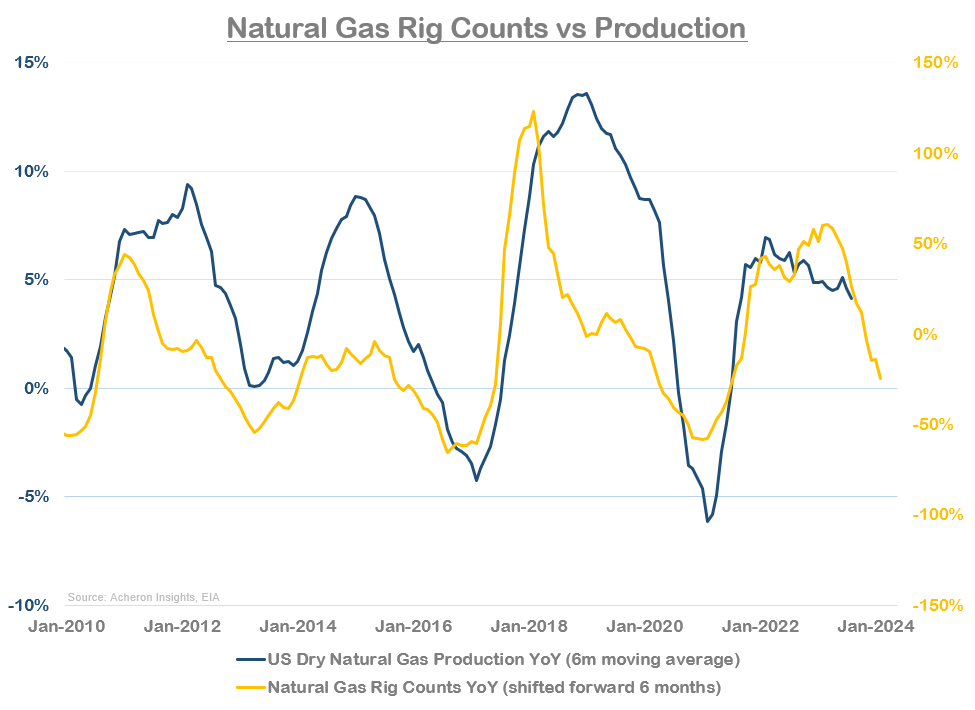

While this bodes poorly for the short-term, the outlook for production come 2024 appears a little more positive for bulls. Indeed, the continued fall in natural gas rigs throughout the US suggests we should see production levels start to roll over as we enter 2024. The natural gas rig count peaked back in April at 159 and has since fallen to 121 as of October, which equates to roughly average levels for the past five years. Given the general lead time the change in gas rigs has on production since the shale revolution, this paints a more bullish outlook for 2024 relative to the present.

Outlook for demand

In terms of the current state of natural gas demand, on the bullish side of the equation has been very strong demand for LNG exports. Demand for North American LNG continues to trend higher, both on a nominal and seasonally adjusted basis.

Looking forward, continued LNG export capacity growth is another sign of a potentially more favourable outlook for natural gas prices as we progress through 2024. As it stands, the EIA projects North American LNG export capacity to increase from the current ~11.4 bcf/d to ~24.3 bcf/d over the next two to three years. In the US alone, the five LNG export plants currently under construction are expected to bring on ~9.7 bcf/d in LNG export capacity during this period, with as much as 4 bcf/d expected to come online throughout the winter of 2023/24. Should this increased export capacity be met with similarly strong export demand (likely), this dynamic assist in bringing down bloated storages as we progress through 2024.

However, the current state of US natural gas demand is subpar. Total US consumption (industrial, household, commercial & power) is on the rise but in a relatively benign fashion compared to seasonal norms. Though we did see a pop in consumption in early November, favourable weather has resulted in demand coming in below seasonal averages. As with all commodities, the intersection between marginal supply and marginal demand determines price, and as we have seen, both factors have been bearish for natural gas over the past few weeks.

Of course, what’s causing below average demand for this time of year has been the weather. One way to assess this dynamic is through the lens of degree days, and more specifically for the northern hemisphere winter: heating degree days. Degree days is effectively a measure of how cold the temperature is relative to a standard norm (65 degree fahrenheit in the US), and helps to quantify the required energy demand to heat or cool a building. A higher number of heating degree days implies higher heating demand (and increased energy consumption), and vice versa. As we can see below, as Autumn comes to a close in the US and temperatures cool, for the most part demand for heating has thus far been benign, indicating hotter than usual temperatures, and thus less natural gas demand.

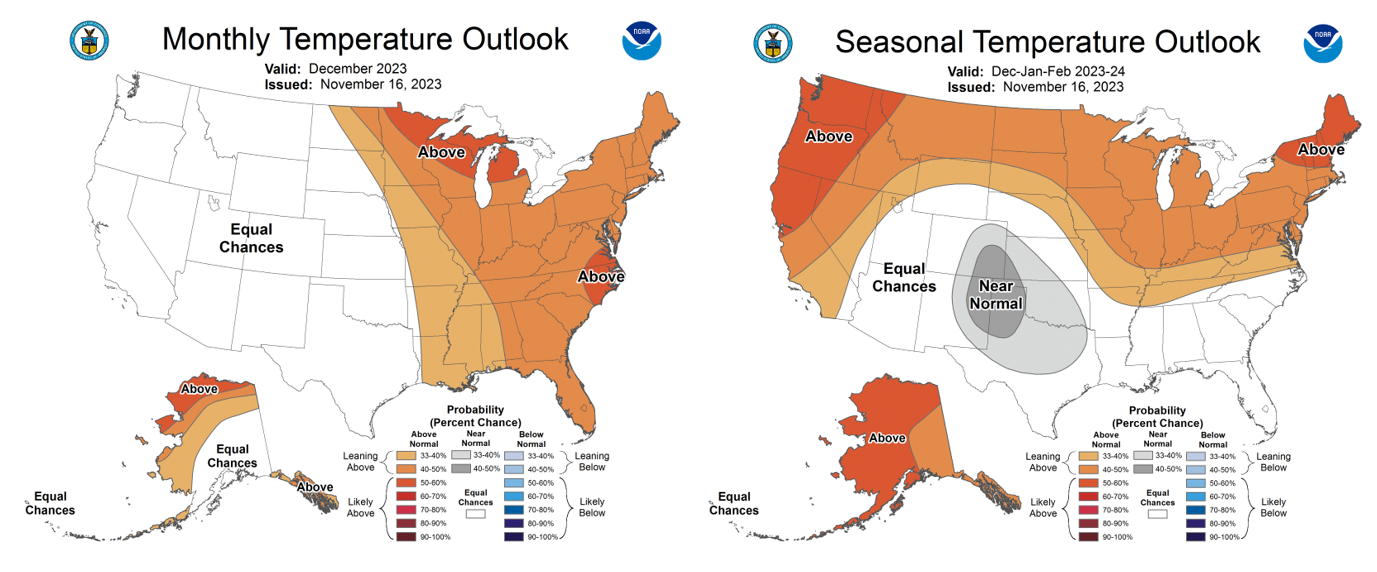

When it comes to natural gas, weather is the biggest unknown and is ultimately the short-term driver of demand. And although weather predictions and forecasts will only get you so far, they are worth analysing when assessing the outlook for prices. Fortunately, according to the National Weather Service, the temperature outlook over the coming couple of weeks looks to be shifting back toward the colder end of the spectrum, which if true, should provide a short-term pop in heating demand.

Source: NOAA

Looking out over the next couple of months, the NOAA’s weather forecast remains on the warmer side, though such long-dated forecasts are only so accurate. But, should we indeed see a warmer than usual US winter, this bodes poorly for natural gas prices given their bloated inventories and strong production.

Source: NOAA

Behind this unseasonably warm North American weather has been El Nino. Generally, when El Nino is present, one of its implications is warmer weather in the US, an outcome that is generally unfavourable for natural gas prices during the winter months. As we can see below, the NOAA’s Multivariate ENSO Index (MEI) is one of a number of different models that is confirming that El Nino conditions are present. However, while this has been the case for the past few months, the current El Nino looks to be far weaker than those we have seen historically.

Source: NOAA

Another way to assess the presence of El Nino (or La Nina) is by assessing the Southern Oscillation Index (SOI) and Oceanic Nino Index (ONI). Without going too much into the weeds, the presence of El Nino is confirmed when we see persistent negative readings in the SOI and persistent readings above 0.5 in the ONI. While the ONI is confirming El Nino is present, the SOI is doing so to a far lesser degree, with the latest reading in October coming in noticeably stronger than in recent months.

Not only does this seem to confirm a relatively weak El Nino, but it also suggests the current El Nino may be in the process of weaking further. One reason for this is the significantly negative readings we are seeing in the Pacific Decadal Oscillation Index (PDO). The PDO measures the trends and fluctuations in the Pacific Ocean’s sea surface temperatures, which itself has a significant impact on the La Nino/El Nino cycle. Generally, when the PDO is negative, any El Nino that occurs is what’s known as an El Nino Modoki, a weaker and shorter El Nino. Additionally, La Nina’s which occur during periods of a negative PDO tend to be longer and more frequent, hence why the ENSO cycle has been dominated by La Nina in recent years.

Confirming this notion is the El Nino Modoki Index (EMI), which is projected to breach the 0.5 threshold in the coming months.

As such, while the current El Nino has created warmer than usually weather in the US as the country approaches winter, the negative bearish effects for natural gas prices associated with this dynamic look to be lessening, and there seems to be a decent chance we see a cold US winter as we progress into 2024. Unfortunately, given the state of US natural gas production and storage, to see a sustained rally in natural gas, we need to see consistent cold weather such that persistent drawdowns in inventories can occur.

A positive signal from the futures market

In terms of the term structure, another key signal, the front month spread has recently diverged positively from price. While the prompt spread remains in contango (January contract trading at a premium to the December contract) and is a dynamic which generally suggests a bearish tilt in the balance of supply versus demand, such divergences in spreads often lead spot prices themselves. Perhaps this proves true once more and we see a short-term move higher on the back of a cooler couple of weeks.

Source: Refinitiv

Speculators are short

From a positioning perspective, though I put less weight on these dynamics within the natural gas market compared to the oil market, it is still a data point worth considering. Here I am assessing positioning via small speculators within the futures market, whose readings often provide a fairly reliable medium-term contrarian buy or sell signal. And, as we can see below, small specs are as bearish natural gas as they have been at any point over the past decade. This suggests there may be a short-squeeze ready to play out at some point in the near future.

Market technicals

Meanwhile, from a technical perspective the picture isn’t great. The UNG ETF (which effectively tracks the front month futures contract and captures the negative roll yield associated with a persistently backwardated futures curve) is having a tough go of things. We are now trading back at the bottom of the 2023 range at around $6, and, should this support level fail to hold, it won’t be an enjoyable period for bulls. Conversely, should we see a pop in consumption over the coming weeks on the back of cooler weather and finally eat into inventories, this seems like a good place for natural gas to stage another rally.

Unfortunately, seasonality is not a bulls friend at present, with December generally being one of the worst performing months for natural gas.

Summary

Putting it all together, the current state of the US natural gas market remains generally bearish. Bloated inventories, strong US production and a warmer than usual Autumn are to thank for this. Although LNG exports remain strong, for a decent rally in natural gas to occur, we need to see persistent drawdowns in inventories, which is unlikely to occur unless we see a sustained period of cold weather. The thesis that this El Niño may not be as strong as previously thought could result in the latter occurring to a certain degree over the coming months, but, the current state of US (and European) inventories will ultimately cap upside gains, at least for now. Bulls may need to wait until 2024 to see a material move to the upside ensue.

. . .

Thanks for reading!

If you would like to support my work and continue to allow me to do what I love, feel free to buy me a coffee, which you can do here. It would be truly appreciated.

Regardless, feel free to share this with friends and around your network. Any and all exposure goes a long way and is very much appreciated. Thanks again.