The Gold Bull Market Is Just Getting Started

Beginning of the next bull?

Gold and precious metals have continued their stellar start to the year. On the back of banking crisis induced liquidity injections and the near unanimous view that policy makers are done hiking, gold has priced this in with aplomb and is now testing its all-time highs.

While there has been a clear shift toward favourable fundamentals for the precious metals space, whether this is the beginning of a new bull market remains to be seen. But, the signs are there. Let’s dig in.

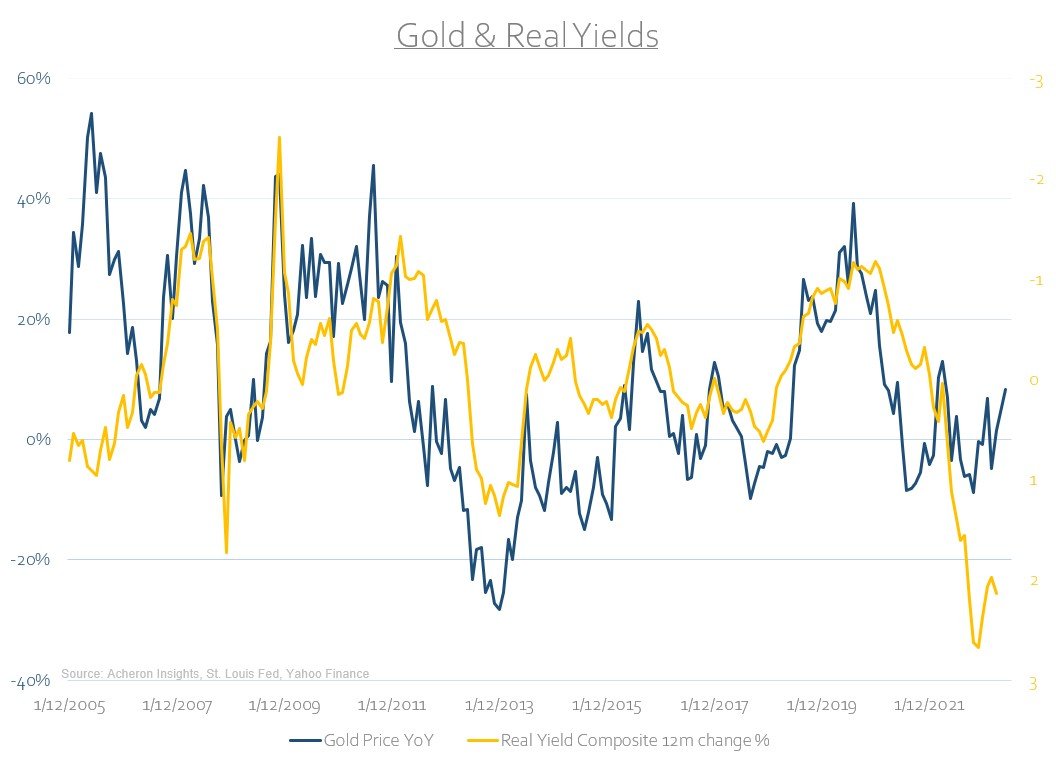

Real yields are peaking, bullish for gold

Despite the fact that real yields have been pushed into positive territory (bearish for gold) for much of the past year as a result of this hiking cycle, gold has avoided selling off to any material degree. In fact, it has held up remarkably well in the face of such a material headwind. Given the consistent negative relation been the two over time (gold is a negative yielding asset, so when real yields are negative on fixed income securities it reduces the opportunity of cost of owning gold, and vice versa, hence their negative correlation), gold’s resilience in the face of the highest level of real yields in over a decade has been remarkable. With real yields having moved lower over the past couple of months and a banking crisis to boot, it is unlikely we will see materially higher real yields anytime soon.

Clearly, real yields look to be in the process of peaking for this cycle, meaning we are likely in the early innings of a renewed bull market in precious metals. But, it may be a little too early to suggest they will roll over just yet, particularly if the Fed has one or two surprise hikes left in them as economic and inflation resilience remains for now. However, as growth is likely to slow materially in the second half of the year, there will be a time where nominal yields fall faster than inflation expectations, and thus, real yields roll over hard and fast. One would expect such an environment to be accompanied by a more accommodative Federal Reserve, thus ultimately setting the stage for a fundamental backed move higher in precious metals.

Given the poor economic outlook (particularly in relation to the credit cycle), the Fed can only hold out for so long. This is certainly a dynamic the yield curve has been pointing to for some time now. So, it should be unsurprising an inverted yield curve - as we continue to have at present - is generally a favourable environment for gold prices. The fundamental picture for precious metals continues to bold well on a cyclical basis.

Source: SentimenTrader

Another key ingredient to a sustained bull market for the yellow rock is a bear market in the greenback. Though there have been periods whereby both the dollar and gold appreciated or depreciated in tandem, generally, the latter’s performance is superior during periods of a weak US dollar. While I remain a dollar bear on a cyclical basis, shorter-term, this latest move higher in gold has not necessarily been confirmed by the same magnitude of weakness in the dollar, suggesting gold may have gotten a little ahead of itself for now.

We are far from level of extreme optimism

As the fundamentals appear generally favourable on a cyclical (>3 month) perspective but perhaps a little less so on a tactical perspective (<3 month), measures of investor sentiment and positioning toward the asset class are sending a similar message.

Speculative positioning (here measured by the managed money category within the futures market, consisting of hedge funds and CTA’s) has seen a significant pick-up in long positions during this recent move higher. Just as leveraged market participants were light on positioning at the Q4 2022 bottom, hedge funds and CTA’s have now re-entered the market with aplomb, suggesting much of this move higher can be attributed to short-squeezes and trend following. However, we are not yet at levels of extreme bullishness by these market participants that have marked notable tops in price. There is still plenty of room for prices to be driven higher by leveraged speculators.

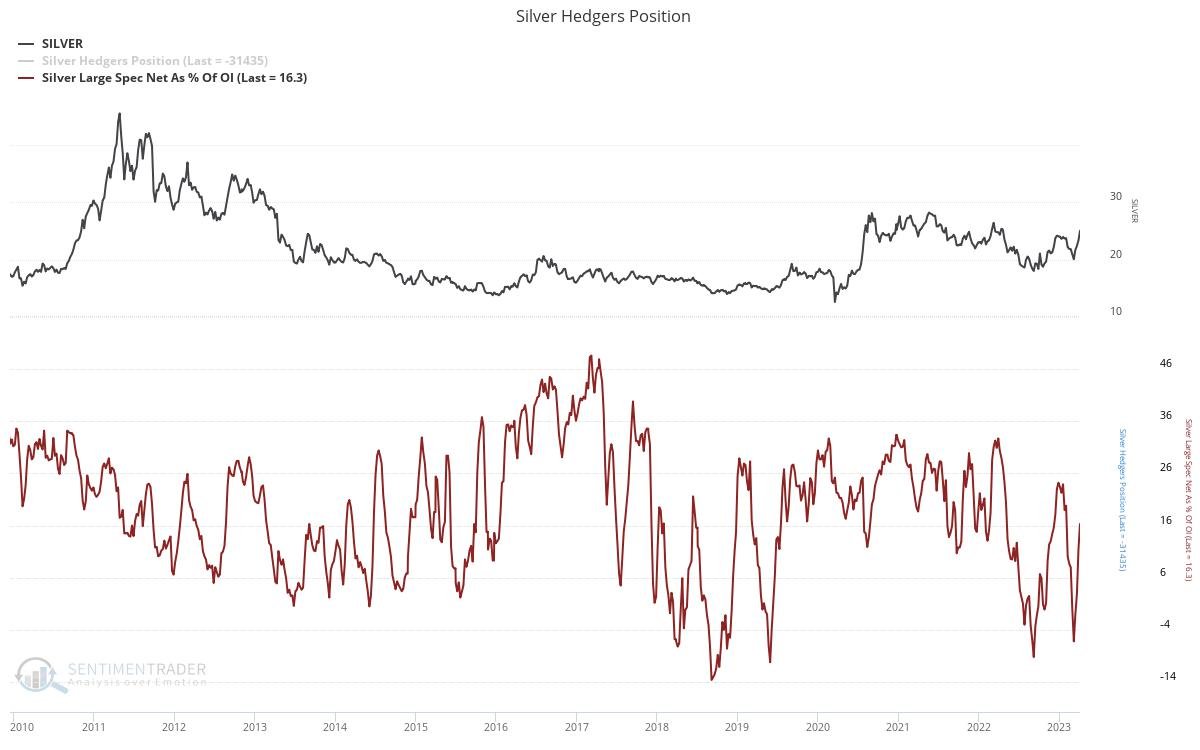

For silver, things are even more constructive. Given silver’s relative underperformance compared to its yellow brother in recent weeks, such relative positioning dynamics suggest silver likely has plenty of scope to play catch-up and thus outperform going forward. As it stands, silver probably offers more upside opportunity on a cyclical basis should the precious metals bull market indeed be renewed.

While we have seen a clear level of speculative interest come back to the precious metals space, considering gold is testing its all-time highs, the fact that overall sentiment is still relatively neutral shows just how much further prices could head higher over the next year or two. If we measure sentiment via SentimenTrader’s Gold Optix index, as we can see below, comparing the overall level of sentiment at present versus the levels of excessive optimism that accompanied the 2012 and 2020 highs, the contrast is striking. Prices are nearing an all-time high and yet not one is paying attention.

Another way to measure this lack of excessive optimism is by looking at the flows into the GLD ETF. While we have seen a pick-up in in-flows during this move higher, they have been relatively muted compared to what occurred at recent tops. Clearly, there is plenty of scope for retail speculation to flood back into the market.

The physical market remains tight

Of course, one major contributor to the higher prices in recent times has been the action of central banks, which have in turn kept the physical market tight

For most commodities, a useful tool to assess the dynamics within the physical market is by examining the shape (i.e. term structure) of the futures curve. Put simply, a backwardated term structure is when short-dated contracts trade at a premium to longer-dated contracts and may be suggesting buyers are willing to pay a premium for immediate delivery of the physical commodity, despite the additional storage and transportation costs associated with said delivery. This is generally consistent with a dynamic of when demand exceeds supply, and of course ought to be considered bullish, particularly of supply sensitive commodities.

As we can see below, there remains a small level of backwardation at the front end of the curve. This is not a common occurrence within the gold or silver markets. So long as this remains, one would suspect there is likely a solid price floor for precious metals.

Market technicals

The technical picture for gold is an interesting one. We are now butting heads with a clear level of overhead resistance around the $2,000-$2,050 level - representing the all-time highs - and have seen a slight bearish divergence in the RSI. As such, we should probably see some kind of minor correction or consolidation ensue from here. I think it may be a little too early before a clear break above this level does eventuate (perhaps one last hawkish hurrah from J-Powell and Co. could trigger a final pullback), and as such any correction should likely be bought hand over fist.

However, should we break to new all-time highs imminently, then the sky is the limit. When it comes to precious metals, history suggests a close within 1.5% of a two-year high for the first time in two years generally precedes further gains over the next year or so. I suspect this will prove true once again.

Source: SentimenTrader

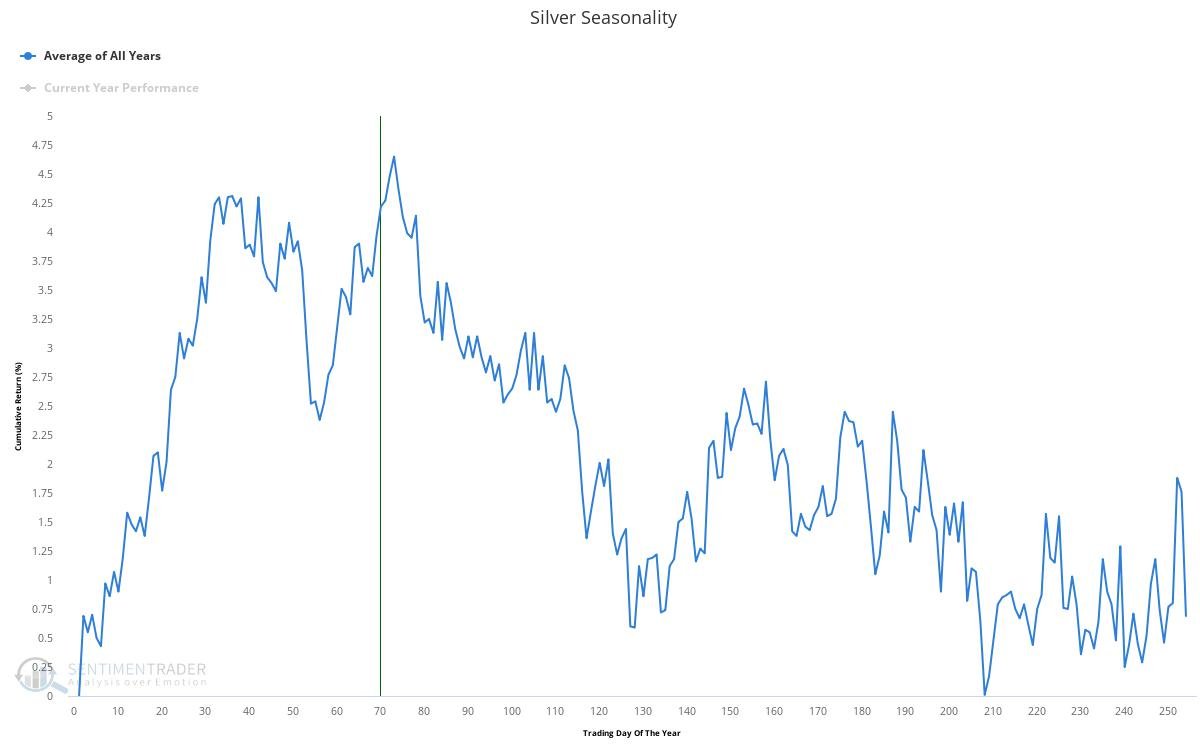

But, we may just have to wait until the second half of 2023 before the fireworks truly begin. A message being confirmed by seasonality for both gold and silver.

Either way, I’ve more interest in precious metals as an asset class than the broad stock market at this point in time. Relative to the S&P 500, gold looks to be breaking out of its long-term descending wedge pattern on the back of material bullish divergences in momentum and RSI. If we are entering a secular period whereby real assets outperform financial assets, then gold and precious metals will be at the forefront. The relative price action looks to be on the way to confirming this thesis.

Summary & Key Takeaways

In summary, the fundamentals for precious metals look to be in the process of shifting from headwinds to tailwinds, highlighted by the seeming peak of real yields. Although speculative positioning has increased during this recent rally, we are not yet at levels indicative of long-term tops. Meanwhile, sentiment toward the sector remains relatively neutral, suggesting there is plenty of room for retail speculative to boost this market higher.

Short-term however, we are right at an important overhead resistance level, one that is likely to be difficult to break. Additionally, seasonality, the dollar and the potential for one last hawkish move from policy makers could see prices correct in the coming weeks.

Investors bullish precious metals should thus use any market weakness as an opportunity to add into what is seemingly an asset class on the verge of cyclical outperformance.

. . .

Thanks for reading!

If you would like to support my work and continue to allow me to do what I love, feel free to buy me a coffee, which you can do here. It would be truly appreciated.

Regardless, feel free to share this with friends and around your network. Any and all exposure goes a long way and is very much appreciated. Thanks again.