Short-Term Headwinds Abound For Gold

Summary & Key Takeaways

Through rising real yields, a slowing economy and poor seasonality, short-term headwinds remain for gold and precious metals.

However, this move higher in real yields is unlikely to last, and will soon turn from a headwind to tailwind for gold.

In an environment of ongoing geopolitical tensions, fiscal dominance, sanctions on foreign exchange reserves and international trade, and the weaponisation of the dollar, the long-term bull case for gold remains as strong as ever.

What is going on with gold?

One of the notoriously difficult asset classes to forecast are gold and precious metals. Touted as a safe haven, store of value and inflation hedge, the recent price action in gold has largely defied such classifications. This is particularly so within a risk-off environment that is currently sweeping through markets.

Unfortunately, the short-term outlook for gold remains decidedly unclear despite some of the conditions being in place that gold bugs have dreamed of for decades in inflation and geopolitical tension. What is evident is that precious metals and mining companies have been unable to escape the recent volatility encompassing nearly all financial assets.

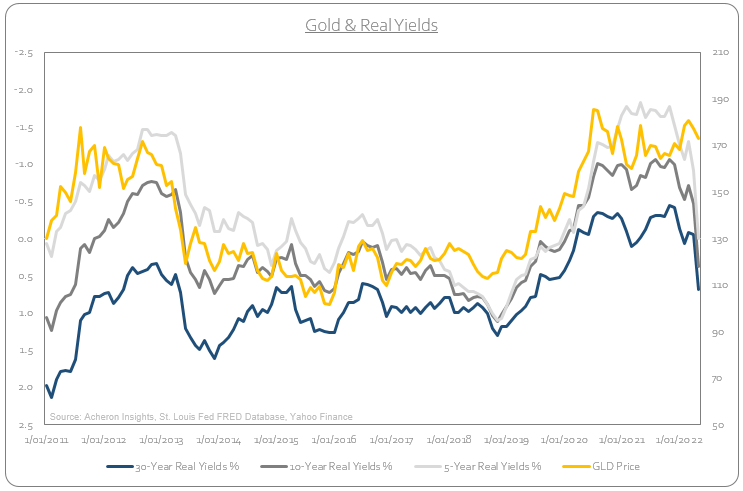

However, given the recent moves higher in real yields, this pull-back is perhaps unsurprising as real yields tend to be the most reliable indicator for the yellow metal.

Negative real yields are of the consequence of financial repression, an environment that clearly favours gold’s store of value attributes. So, with the recent move higher in nominal yields (particular on the long-end of the curve) being of greater magnitude than inflation, real yields are now largely positive across the board and thus have dragged gold lower.

Right now, real yields are signaling further pain may be forthcoming for precious metals.

Indeed, we can see this relationship between gold and real yields by also looking at the rate-of-change in TIPS (via the TIP ETF) compared to the gold price.

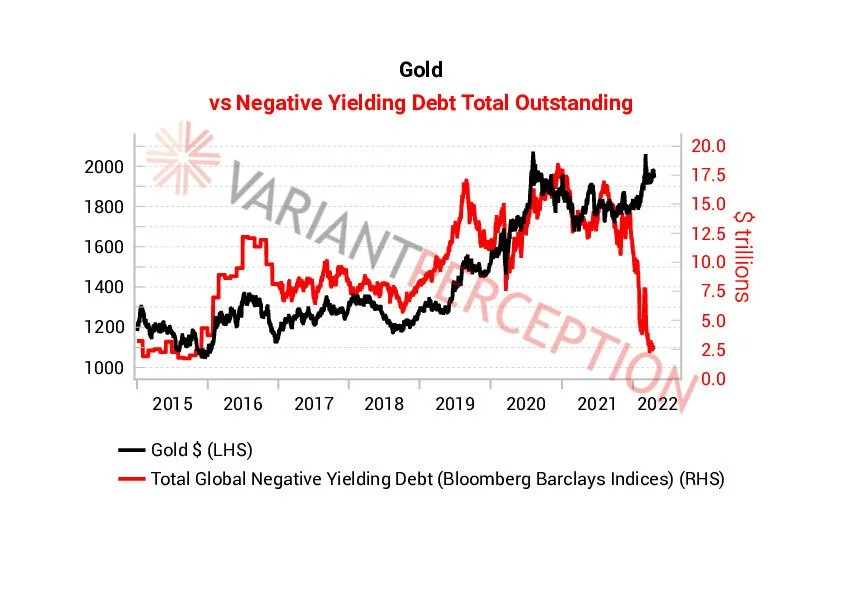

And by the examining the relationship between gold and the total level negative yielding debt outstanding.

Source: Variant Perception

As rates have been rising worldwide, the level of negative debt outstanding has plummeted. Clearly, rising real rates are a significant headwind for precious metals at present.

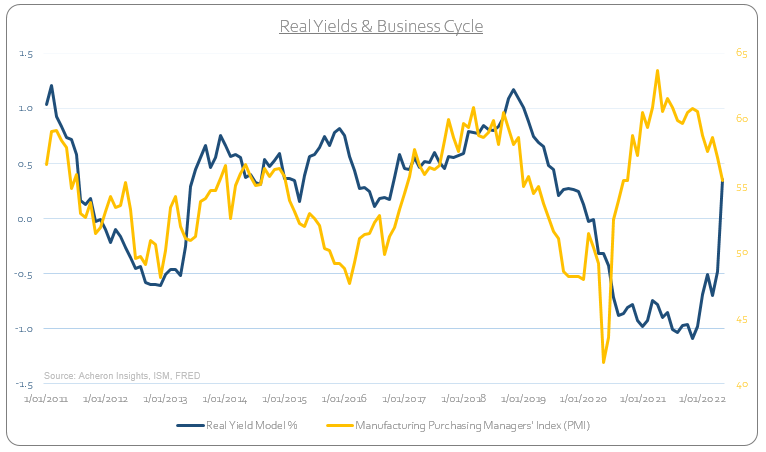

This swift (and historic) move higher in real rates shouldn’t necessarily be surprising to investors however. Historically, one can get a good idea of where real rates are headed simply by looking at the business cycle. We can observe this relationship between real rates and the business cycle below, using the ISM manufacturing PMI as a proxy for the business cycle.

A growing economy should lead real rates higher and a slowing economy lead real rates lower.

An important observation we can ascertain from this relationship is how much the monetary policy actions at the Fed suppressed real rates through their historical levels of QE since early 2020, despite a growing economy. Now, with the Fed tightening monetary policy in response to their underestimation of inflation, we have finally seen the release valve for real rates turned and allowed them to catch up to the business cycle. A move that has happened in short order.

Whilst there is the likelihood real rates will continue to move meaningfully higher over the next few months, given the outlook for economic growth such a move will be short lived. Whilst this would be negative for gold in the short-term, such a scenario would present attractive entry points for those looking to allocate to gold, silver or precious metals miners long-term. Indeed, the long-term case for gold lies in this thesis that an overindebted economy simply cannot handle sustained positive real rates.

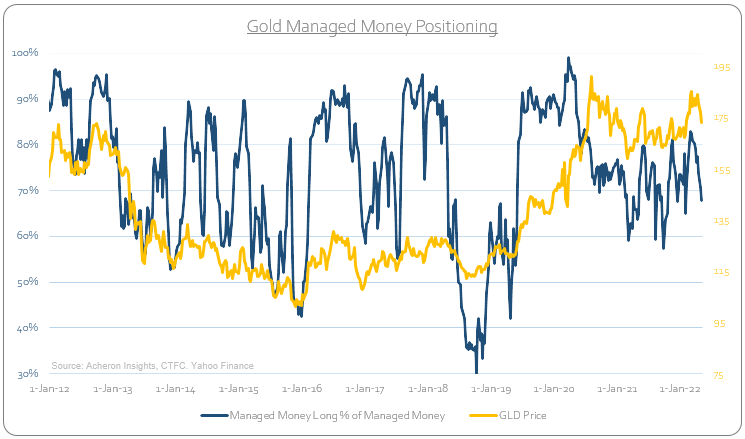

From a positioning perspective, we are beginning to see some constructive movements. Firstly, by looking at money manager positioning in the futures market, we have seen a significantly unwind in long position through this recent move. Remember, money managers consist of hedge funds and CTA’s, both of which are largely trend followers and tend to be long at the tops and short (or less long) at the lows.

A further unwind in managed money longs is something I am keeping a close eye on as a move to the 50-60% level in longs relative to total managed money positioning has been indicative of excellent contrarian buying opportunities in the past. Likewise, an unwind of speculative long positioning will help to put a floor on the gold price.

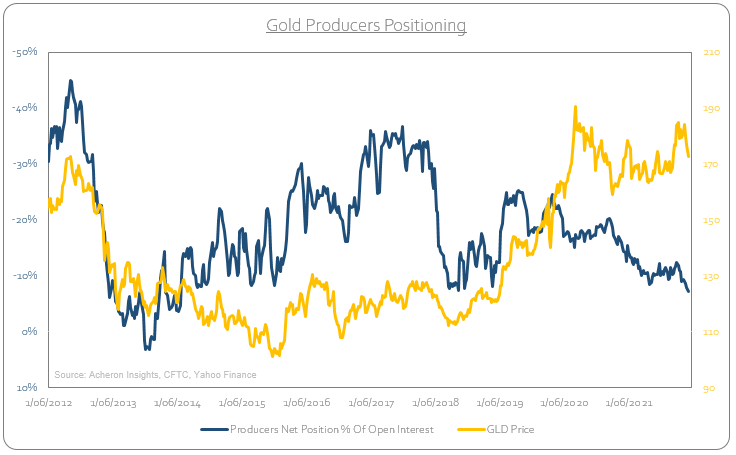

More constructive for the present however is the futures market positioning of gold producers. Producers (i.e. the smart money) tend to be largely short the market as they are selling forward futures contracts as a means to hedge their production. They currently have on their smallest short positions since 2018, which as we know was an excellent time to buy.

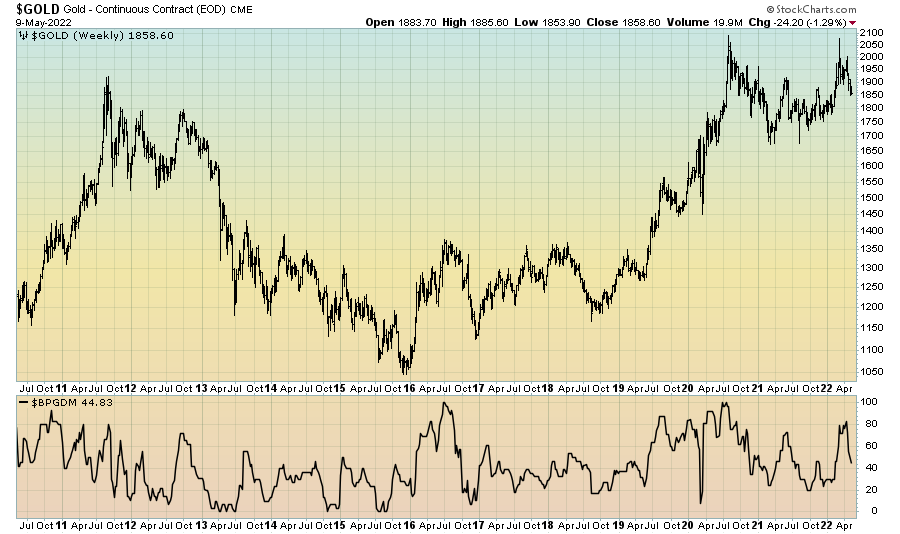

From a sentiment perspective, we have also seen a constructive unwind of bullishness of late, as measured here by the Bullish Percent Gold Miners Index. Again, I would like to see a little more pessimism towards precious metals before I become tactically bullish.

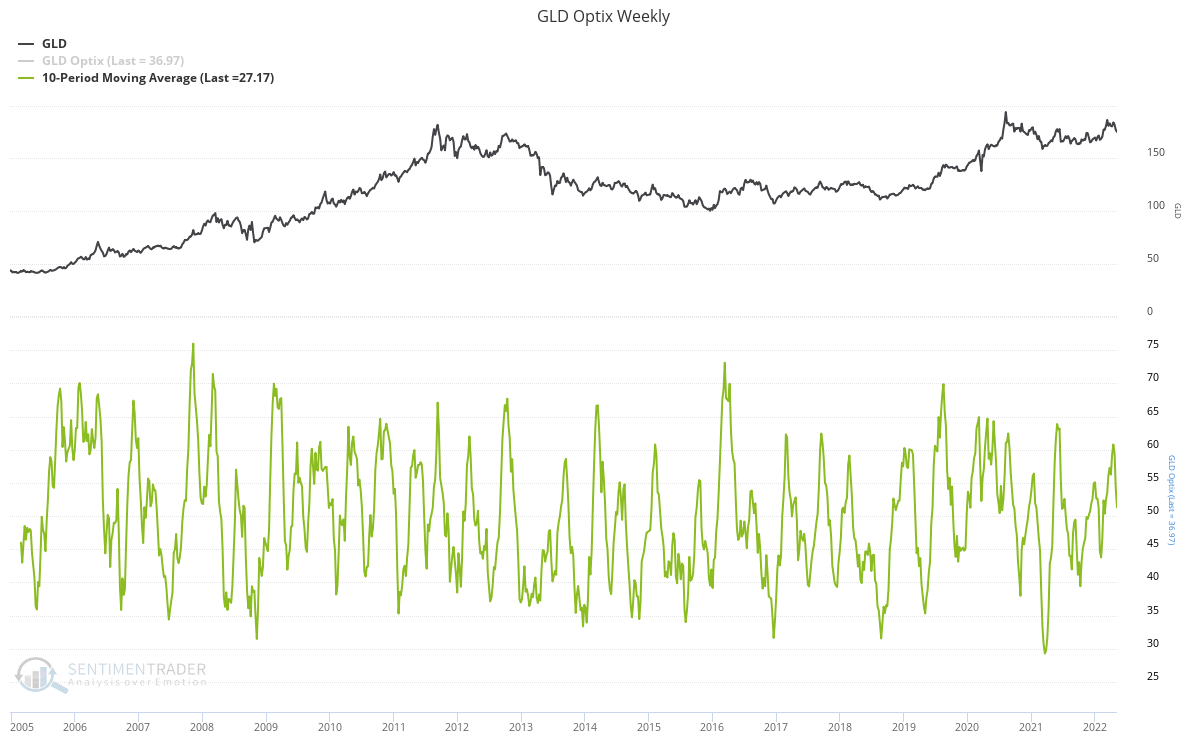

If we look at sentiment through the lens of SentimenTrader’s Optic index, we can see a further washout generally aligns with the better buying opportunities in recent times.

It is important to member too that sentiment is not necessary a great timing tool as it can remain elevated or depressed for long periods.

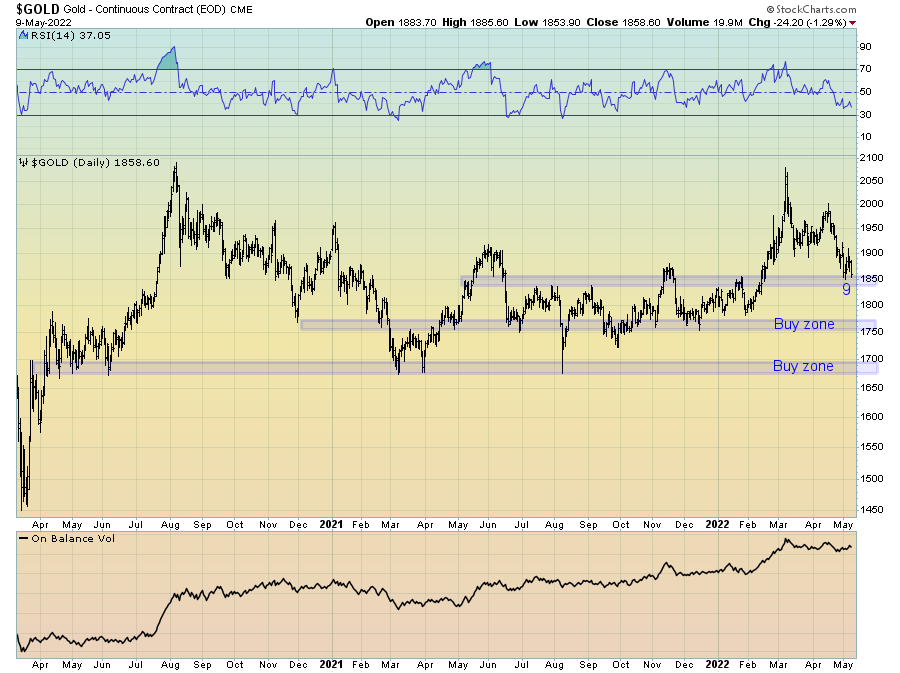

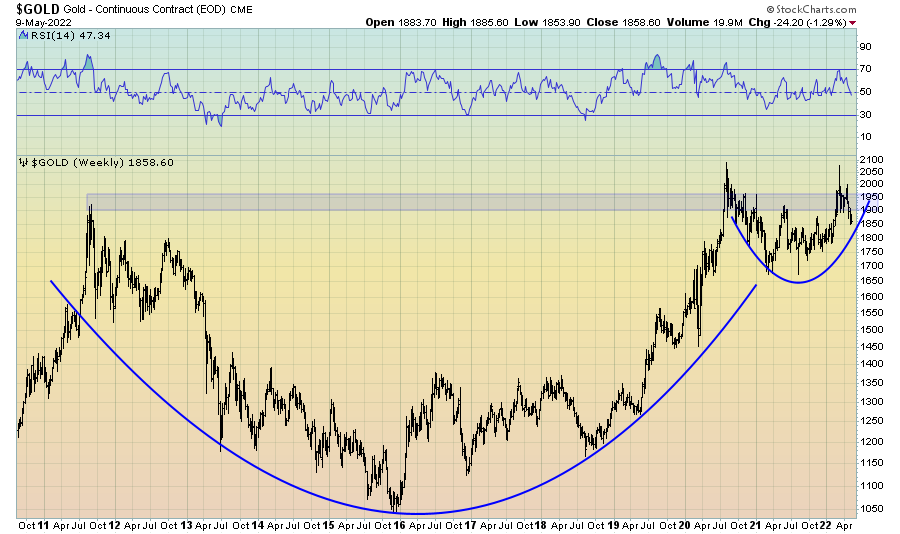

From a technical perspective, the picture is somewhat positive. As real yields have been repriced higher, gold has corrected back down to the $1,850 support area, with this test of support accompanied by a DeMark 9 sequential buy signal.

Depending on your time frame this may be a level worth slowly buying into a precious metal position. However, given my outlook for the economy, I could see a flush down to $1,750 or even $1,700 as a distinct possibility for the yellow metal, both of which would represent excellent points to add.

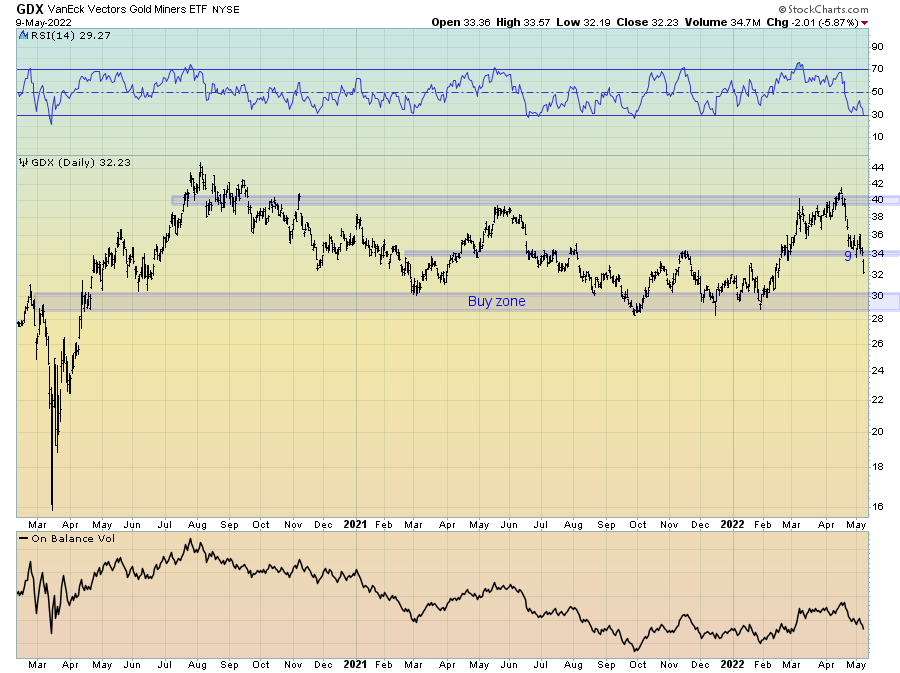

In regards to the gold miners, given the $34 support area of GDX has been lost, I suspect a move down lower to $30 to be likely, an area I would look to slowly accumulate. Should gold correct further however it is important to remember that miners are largely high-beta versions of gold, so the downside risk is more prevalent with gold miners in a market wide risk-off event typically seen during growth cycle downturns.

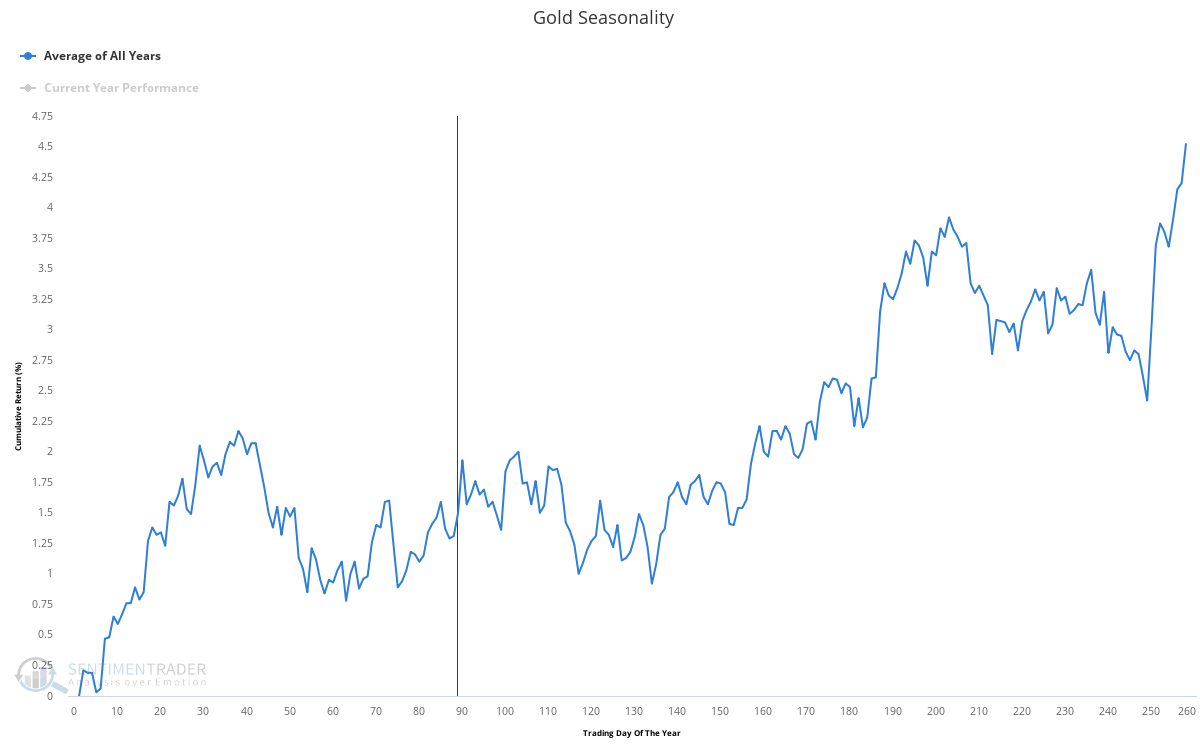

Indeed, given we are entering the worst seasonal period for precious metals in May and June, this ties in nicely to the idea that this correction has yet to run its course.

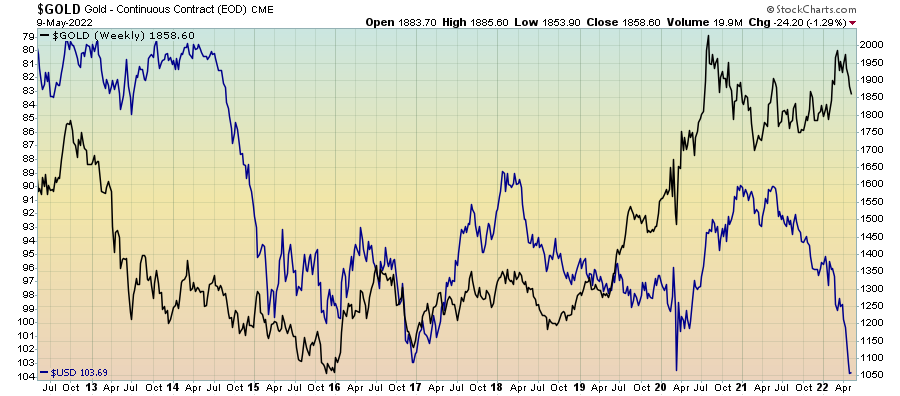

Another significant headwind for precious metals at present is the dollar. Whilst the negative relationship between the dollar and gold has not been evident in recent months (a bullish sign for gold), it is important to remember that in a slowing growth environment the dollar will remain bid and is likely to continue higher. Dollar strength is not an ideal environment for precious metals.

What is the catalyst for the next move higher?

Fortunately, these short-term headwinds for precious metals should provide investors an opportunity to accumulate at lower prices. The question then becomes; what will catalyse the next move higher?

To me, a dovish policy pivot by the Fed will likely be said catalyst. Given Chair Powell and his minions continue to hold steady in their attempts to tighten the economy to stave off inflation, the Fed put is certainly lower than what we have been accustomed to in recent times. However, I am of the belief that maybe it is not as low as some now believe it to be. Given the poor outlook for the economy, one that risk assets look to be beginning to price in, tightening monetary policy into a slowdown was only ever going to be a recipe for disaster. We remain in a financialised economy and risk assets will continue to struggle whilst the Fed pursues this course. It is only a matter of time before something breaks. Should such a pivot occur later this year if equities correct meaningfully lower, injecting liquidity into an environment of higher inflation would be an environment wherein gold would likely thrive.

Furthermore, as I have touched on, slowing growth will eventually become a headwind for real rates themselves. As such, it seems as though this move higher in real rates is only temporary, and is one that will eventually turn from a headwind to a tailwind once more.

For now however, gold will not escape a market crash event, as correlations between all assets will rise to one. This is a distinct possibility.

The bull case for gold remains intact

Longer-term, the bull case for gold remains as strong as ever. All else equal, an environment of ongoing geopolitical tensions, fiscal dominance, coupled with a precedent for sanctions on foreign exchange reserves and international trade, and the weaponisation of the dollar, these dynamics should provide more than enough fuel to warrant investors maintain an allocation to precious metals.

Indeed, the long-term technical picture for gold remains widely bullish, with the decade long cup-and-handle structure pointing to much higher prices in the years ahead, very much confirming the long-term fundamental case for gold.

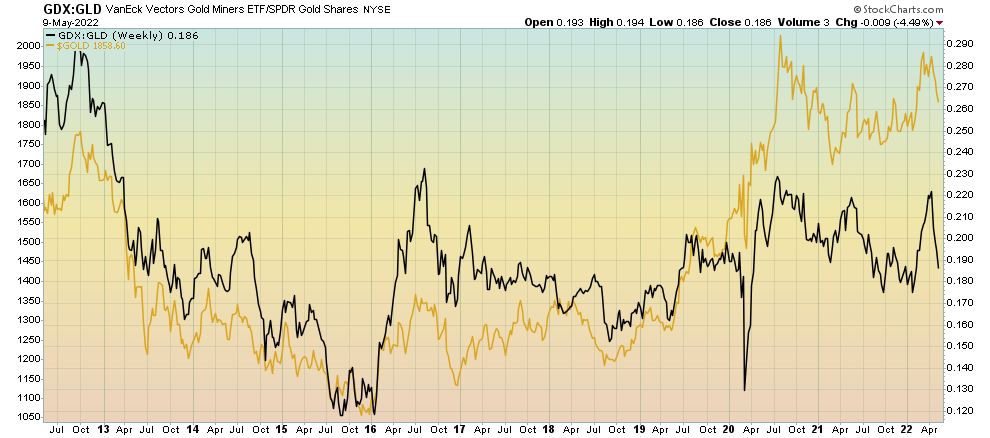

This is particularly true for miners, who have largely lagged gold in recent times.

When the bull market for gold resumes, the miners should finally have their time in the sun.