The Commodity Bull Market Is Fast Approaching

Following a strong rally earlier this year, commodities have been hit hard over the past few months driven by speculative selling and disappointing economic data from China and the US. As it stands, commodities are starting to look particular attractive for contrarian investors.

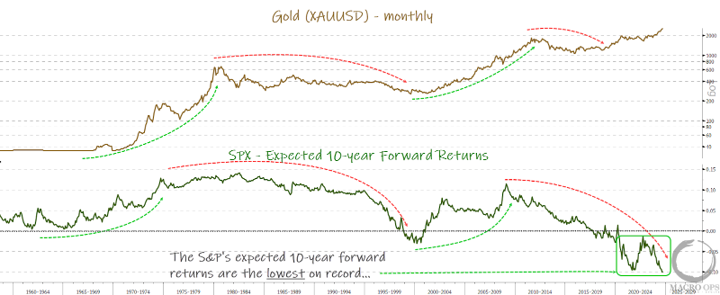

One area of the commodity complex which escaped the recent sell-off was precious metals. In fact, gold recently broke out to a new all-time high on relatively little fanfare. Although gold is prone to false break-outs (as can be observed in the below chart), it’s hard to deny the price action of gold as anything but bullish.

Relative to the S&P 500, the gold price looks to the in the process of developing a decade long basing pattern. We all know the bull case for precious metals by now, and finally, the market seems to be in agreement.

History suggests that unfavourable periods for stocks tend to be favourable periods for gold. Given the decade-plus fundamental outlook for stocks (i.e. record valuations), I see no reason why gold does not outperform moving forward.

Source: MacroOps

Silver too has a fantastic looking chart. The silver price recently broke out of its bullish wedge pattern and is now flirting with the $32 resistance level. It also looks to be forming a potential head and shoulders bottom pattern. As this precious metals bull market gains momentum over the coming years, expect silver to outperform.

One commodity to which I am becoming increasingly bullish is platinum. Platinum exhibits both precious metals qualities and industrial uses (primarily as a autocatalyst in internal combustion engines), and has been in a 15-year bear market. Now, underinvestment in supply coupled with resilient demand could well see sustained deficits moving forward (and hopefully higher prices). If the platinum price can break-out of its long-term downtrend, look out.

Uranium is another commodity who’s chart is looking increasingly bullish. The sector has now been correcting for nine months and has developed a descending wedge pattern coupled with bullish divergences in momentum and RSI. Again, we all know the fundamentals story for uranium, and after a year of frustration for bulls, positive price action appears imminent.

Agriculture stocks appear to be forming a very similar technical pattern following the post-2022 spike in agricultural commodities. This is another area of the commodity complex who’s price action is becoming increasingly constructive and probably worth investigating by investors given the valuations in the sector.

Natural gas is another commodity that has been left for dead over the past couple of years. On an energy equivalent basis, North American natural gas is the cheapest unit of energy in the world. Of course, the sector has been dealing with bloated inventories following back-to-back mild summers in the US along with better than expected production. But now, US oil production (and by extension natural gas production) is finally showing signs of approaching a peak, all the while the US is set to drastically expand its LNG export capacity over the next 24 months with politicians worldwide finally embracing natural gas as a greener alternative to coal (and even diesel) and more reliable option than renewables to meet carbon goals. There is plenty of reason to believe US natural gas prices can move much higher in the coming years.

Commodities as a whole have been wholly out of favour over the past few years and have drastically underperformed tech stocks during this period. It now seems only a matter of time before this seemingly bullish descending wedge pattern breaks out to the upside.

A pattern we can observe also in the relative price action of energy and tech.

Sentiment is now basically as bearish as it gets toward commodities, as is positioning.

Even copper, everyones favourite play on the green energy transition (and one to which I am not particularly bullish) is looking rather constructive.

It has been a difficult year for commodity investors, but fortunately, things appear to be heading in the right direction.

. . .

Thanks for reading!

If you would like to support my work and continue to allow me to do what I love, feel free to buy me a coffee, which you can do here. It would be truly appreciated.

Regardless, feel free to share this with friends and around your network. Any and all exposure goes a long way and is very much appreciated. Thanks again.