The Best Trades For The Green Energy Revolution

The ability to predict secular shifts in the economy has created careers out of many of the worlds greatest traders and inventors. If predicted and traded upon correctly, decades long and career defining opportunities present themselves to those astute enough to have done so. The great bond bull market of the past 40 years has made millionaires out of many, so has the rise of blockchain, cryptocurrencies and the digitalization of the financial system. Another such paradigm shift upon us is the worlds unified move to decarbonize and green the economy.

What we are witnessing is a worldwide push for industries to move away from excessive green house gas (GHG) emissions. Such unification around a common goal is perhaps unlike anything we have witnessed in the entire history of humanity. With governments and companies worldwide fully committing to the green transition and most aiming for net-zero emissions by the middle of this century, many are taking several significant steps to achieve this goal. The move from internal combustion engines to electric vehicles (EVs) is the most obvious and popularized move thus far. For example, the EU has announced a target of 30 million electric vehicles by 2030, Britain plans to ban the sale of new traditionally powered petrol and diesel engines by 2030 and so too are the Japanese. California is also adopting a similar goal. Likewise, the automakers themselves are largely embracing the change as they realistically have no option but to do so. Ford, Jaguar and Volvo are some such examples. What is abundantly clear is the climate change goals of nations are no longer within the realm of speculation; the transition is real and it is coming, whether we are prepared or not.

People are now far more open-minded, educated and aware of the potential damage on both our environment and on our economy that global warming can unleash. Our world leaders and notably the Biden Administration are agreeing there is much to be done to green the economy. This is a huge task and is occurring from a global, country, sovereign and individual level. Whilst the evidence above suggest most of the action thus far has centered around the use of electric vehicles and renewable energies, the process of electrifying everything is enormous in scope. Upstream, midstream and downstream; the way we generate, transport, store and use energy must be revolutionized.

The green energy transition is a once in a lifetime paradigm shift that we can trade and profit from. Much will change during this generational transformation.

Copper

Copper and other metals used in the electrification process are undoubtedly a popular way to trade the green energy transition. Regardless of the rapid price appreciation in such metals over the past 12 months, there are abundant reasons why so many investors are bullish over the long-term. The role these metals will play in the green energy transition is so very important.

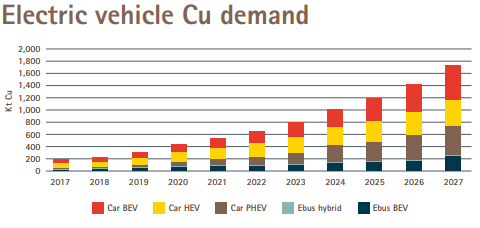

Front and center of the electrification metals sits copper; perhaps the biggest winner of the green transition. It’s role is critical in all aspects of the push to electrify the economy. With the world’s motor vehicles set to become almost completely electrified over the coming decades and coppers use therein being three to fourfold relative to traditional vehicles, we are going to need a lot of copper. According to the International Copper Association (ICA), a battery powered electric vehicle (BEV) uses 83 kg of copper, a hybrid electric vehicle 40kg and an internal combustion engine only 23kg of copper. From just the transition to electric vehicles alone, the demand for copper is set to increase three to four times from its current levels. Indeed, the ICA predicts the number of electric vehicles will rise to 27 million by 2027, a nine-fold increase from the roughly 3 million as of 2017. Such an increase is set to increase copper demand for the production of EVs from 185,000 tons to 1.74 million tons.

Based solely on the adoption of electric vehicles, we can clearly see the demand for copper is set to increase dramatically over coming decades. What’s more, such projections as those of the ICA are modelled only on coppers use within EVs, the green energy transition will require an immense amount of copper for much more than just its use within electric vehicles.

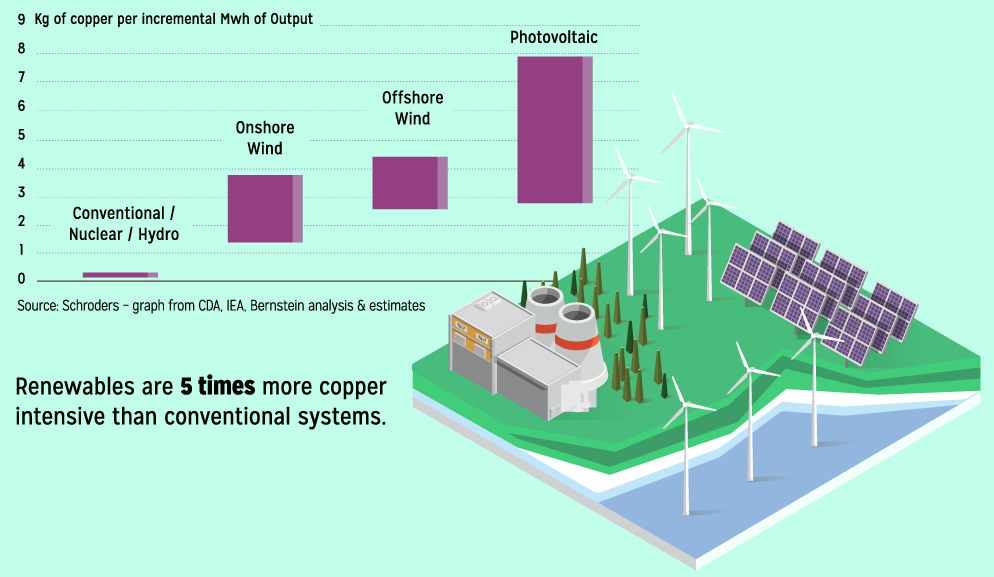

Indeed, according to the ICA, electric vehicle chargers themselves will require from around 0.7 kg up to 8 kg each, equal to an additional 216,000 tons of copper demand by 2027. Additionally, the adoption of renewable energy sources such as wind and solar are heavily dependent on the use of copper n their construction. According to the Breakthrough Institute, a California based environmental research center, “wind energy requires on average 2,000 tons of copper per gigawatt, whilst solar needs 5,000 tons per gigawatt - several times higher than fossil fuels and nuclear energy”.

The graphic below illustrates coppers use in the generation of electricity from conventional methods compared to wind and solar. Copper will be required to a significant degree in all forms of renewable energy generation.

Source: Kutcho Copper

A hugely underappreciated and at this stage seemingly underfunded part of the green transition for many developed countries, notably the US, is the need to rebuild, or at the very least significantly improve their electrical grid. For the most part, the electrical grid does not have the ability to store electrical energy. One of the major issues with wind and solar generated power is their intermittency, that is, their inability to constantly generate power. The sun is not always shining nor is the wind always blowing. Thus, the ability to be able to store the electrical energy created from such sources for future use becomes paramount.

What’s more, the United State’s electric grid as is currently constructed is not able to provide and transmit the necessary electricity to power an entirely electrified economy. If the majority of the population came home from work in the evening and were to plug their EVs in to charge, the grid would simply be unable to support such demand and would shut down. In some parts of the US, the electrical grid is nearly a century old. It was designed and built from a completely different era. Those living in Texas can no doubt attest to the grids limitations.

Rebuilding the electric grid will require astronomical amounts to copper and other important metals. The importance of this enormous task will only become more prevalent in the minds of policy makers as we continue down the road to electrification.

What makes copper so useful is its ability to conduct electricity and transmit heat. It is roughly twice as conductive as aluminum, making it far more efficient in its use. Copper is the primary source of conductors in wires and cabling, electrical equipment and renewable energy infrastructure. Whilst silver is another such metal that can serve a similar purpose, it is simply too expensive and not as abundant. Precious metals aside, pound-for-pound copper is the best conductor of electricity and heat. It is also one of the few commodities that cannot be feasibly replaced by any alternatives in the electrification process in the way that battery technology is susceptible to innovation. Additionally, copper itself is also renewable and is one of only a few materials that is fully recyclable.

Also favoring copper is its long-term supply dynamics. In spite of this huge forthcoming growth in copper demand, copper itself is notoriously difficult to source. As detailed by energy and commodity experts Leigh Goehring and Adam Rozencwajg in their Q4 2020 market commentary; “a structural deficit has crept into global copper markets that will become increasingly obvious to investors as the decade progresses. Confronting this strong demand is copper mine supply that will show little in the way of growth over the next five years. Few large copper mining projects are slated to come online over the next five years”. They also note that “the lack of massive new copper mining projects, coupled with an ever-accelerating copper mine depletion problem, means growth in mine supply should remain minimal over the next five years. Global copper consumption exceeds copper mine supply and recovered copper scrap by about 500,000 tons per year presently and will get worse”. Whilst an increase in the price will of course lead to further capital injected into the sector to source further supply, the process of getting this new supply online to meet demand is not as simple as it may appear. Clearly, there is a structural supply shortage of copper. This presents an incredibly favorable demand and supply dynamic for copper over the comin years, one in which the copper price and the miners themselves will benefit enormously.

Finally, turning to the technicals, lovers of a long-term chart will find it hard not to appreciate the recent bullish breakout from copper’s near two-decade wedge pattern.

Source: StockCharts.com

Whilst much of the rapid price appreciation we have seen over the past 12 months can somewhat be attributed to the COVID-19 lockdown induced supply shortages and rampant speculation, it is important to remember this is a long-term trade. Though the immediate risk-reward may not be as attractive, any significant dips in the price of copper and the copper miners should be bought with earnest for those who believe in the long-term viability of this trade, as I do.

Copper and copper miners are the simplest long-term play on the green energy transition.

Uranium

With so much focus and capital being directed towards renewable sources of energy in wind and solar, there is relatively little thought given to the limitations of these as sources of clear energy. Due to such limitations I will endeavor to detail below, herein lies the inevitability of nuclear power’s role in electricity generation as we progress through this green revolution.

The limitations of renewables

Whilst renewable energies will play a significant and important role in the green energy transition, they are not the panacea for carbon reduction as one might initially believe. There are significant limitations to the sole use of renewables as a means to reach net-zero emissions.

Both solar and wind are inefficient generators of electricity. This is primarily a result of their intermittency and energy density, as I have only briefly touched on. According to Goehring and Rozencwajg, who have also released some excellent research on the limitations of renewables, note that a standard solar panel is likely to only generate between 12-20% of its capacity due to intermittent sunshine, whilst a wind turbine is only marginally better at around 25% due to the intermittency of wind. Goehring and Rozencwajg have developed a metric to track the efficiency of energy generation from its various sources, measured as Energy Return On Energy Invested (EROEI), estimating that between 25-60% of the energy generated by renewable sources is consumed internally by the process of actually generating that electricity, meaning the EROEI for renewables is roughly 3 to 1. Compare this to a traditional gas plant, whose EROEI is around 30 to 1, meaning that it internally consumes only 3% of its generated energy. Traditional and less carbon friendly sources of energy are roughly 30 times more efficient in their energy generation compared to renewables.

What’s more, due to the inefficiency of renewables and their need of servicing and maintenance, which in itself is quite impactful on carbon emissions, in addition to the need to overbuild solar and wind farms as well as the ability to store the energy to counter their intermittency, has largely resulted in those countries who have adopted renewables to a significant degree not seeing the reduction in carbon emissions they would have hoped for.

As we can see above, much of the gains toward a green economy made by the adoption of renewables will be offset by their inefficiencies and the additional energy requirements to maintain the infrastructure and store their sourced energy. Few people understand how energy intensive the green transition will be.

Whilst they will play an important role in the green energy transition, renewables will not solve problem of global warming to the degree that is desired. This leads to nuclear power, one of the few solutions able to provide the carbon-free, base load power required.

Why uranium?

Uranium is the fuel that powers nuclear reactors which then generates power. Nuclear power is generally misunderstood. On the whole, it is a clean, safe and reliable source of of base-load energy.

If we return to Goehring and Rozencwajg’s Energy Return On Energy Invested (EROEI), "a modern nuclear reactor generates electricity with an EROEI of nearly 100 compared with 30 for gas and 1-4 for renewables. As a result, only 1% of the generated electricity is consumed internally compared with 3% for gas and 25-60% for renewable energy”. Compared with renewables, nuclear energy is anywhere from 40-100 times more efficient. What’s more, nuclear energy is far more scalable than renewables and completely avoids their intermittency shortcomings. The green energy transition simply must have an increased reliance on nuclear energy, it is one of the few sources of clear energy that has the ability to drive the green energy transition in an efficient way.

Not only is nuclear energy the most efficient source of electricity generation, but it is also less carbon intensive than renewables.

Source: Sachem Cove Partners

Perhaps the biggest reason behind the lack of reliance on nuclear as a source of energy is the negative sentiment towards it. Nuclear energy certainly gets a bad wrap. There have been three significant nuclear incidents responsible for this; Three Mile Island, Chernobyl and Fukushima. Despite the actual loss of life being surprisingly less than one might have thought, these incidents have largely left the industry bereft of capital and acceptance as a source of energy over the past 40 or so years. However, what will likely surprise many is that nuclear energy is actually the safest form of electricity.

Source: Sachem Cove Partners

The use of uranium within nuclear energy does have somewhat of a dark history. The uranium cycle of nuclear energy creation, as opposed to using the thorium cycle, was chosen as the by-product of creating electrical energy using uranium is plutonium, which was used to make nuclear weapons. The reasoning behind this choice was because the heyday of nuclear energy occurred during the Cold War, and it was the agenda’s of the worlds governments to create nuclear weapons. However, the Cold War has long since past. It is now time for policy makers to revisit the use of nuclear energy within their climate goals. Indeed, this negative view towards nuclear energy has created a huge mispricing for the sector. The math no longer is equal to the narrative.

Convincing environmentalists that the positive impacts of nuclear energy do indeed significantly outweigh the negative impacts will likely be a game-changer for how the world produces energy. Likewise, an education of the general public is needed in regards to nuclear energy. We cannot meet our climate objectives without nuclear energy in the mix.

Indeed, we now are seeing sentiment towards nuclear slowly begin to change. The pressure of governments to meet their green energy objectives will ultimately lead to nuclear power having an ever increasing role as a source of carbon free base-load energy. On the whole, nuclear energy is actually very clean, safe and reliable. Nuclear energy simply must be a part of policy makers plans should they wish to achieve their green objectives.

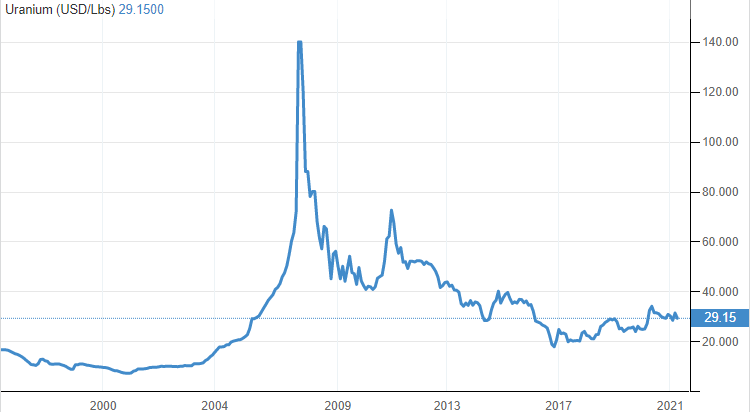

The industry fundamentals for nuclear energy and uranium is quite different to most other commodity and energy markets. As the sector has been in a bear market since the Great Financial Crisis, it has largely been bereft of capital. This seemingly paints a positive picture for the price going forward. Due to the lack of capital and investment, there is very little in the way of new production set to come online in the next few years in order to meet the increasing demand for uranium. This lack of new capital has been beneficial for the sector, as only the strongest, most profitable and best-run producers have survived.

Likewise, the production of uranium is a highly concentrated industry, with the two largest miners, Kazatomprom in Kazakhstan and Cameco in Canada, accounting for roughly 60% the the worlds uranium production. With both producers significantly reducing their production over the past 12 months due to COVID-19, a structural supply shortfall could well be with us for years to come so long as nuclear energy becomes a significant part of the green energy transition. Furthermore, what could result from such supply shortfalls is the producers themselves entering the spot market in order to fulfill their supply obligations to the various reactors; a bullish outcome to be sure.

From a technical perspective, the spot uranium price appears to be finally bottoming after its prolonged bear market.

Source: TradingEconomics.com

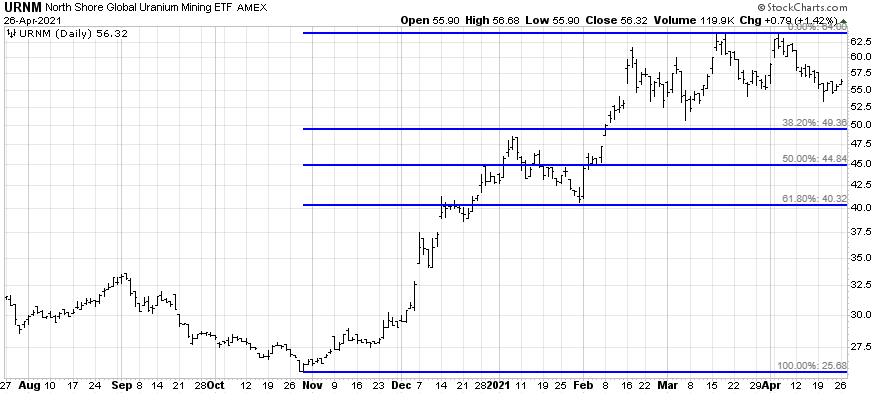

Due to how the industry contracts uranium supply between producers and users, the spot price is perhaps not the most relevant and is a very thinly traded market. For me, I am happy to invest via the URNM ETF, which is superior to the older URA ETF. URA is more of a nuclear energy ETF than a play on uranium, and as a result there are many constituents of the fund which makes little sense as they are not related to the production of uranium. URNM is a better vehicle for those looking for a purer exposure to the uranium miners.

However, similar to copper, it is important to keep in mind the uranium trade is for those with a long-term time horizon. Given the near doubling of the price of both URA and URNM since the reflation trade took off in November of last year, the risk-reward for the immediate-term is perhaps skewed to the downside. Of course any significant pullbacks should be bought in earnest for all those who buy into the long-term bull case for uranium, as I do. The 38.2% Fibonacci retracement of the Novembers lows looms as one such attractive entry point.

Source: StockCharts.com

The case for uranium is simple; nuclear energy will ultimately be required in order for governments to meet their carbon goals.

European Carbon Credits

What are European Carbon Credits?

European carbon credits, or perhaps what are more accurately defined as carbon allowances, are part of the European Union’s Emissions Trading Scheme, or EU ETS. The EU ETS is at its core, a market-based approach to controlling carbon emissions introduced by the EU as the cornerstone of their efforts to control emissions and meet their carbon goals. The Emissions Trading Scheme is what’s referred to as a ‘cap and trade’ system, which attempts to set a maximum limit of emissions certain companies and industries involved in the scheme are allowed to emit during a certain period of time. The EU ETS is the worlds first and largest ‘cap and trade’ system aiming to reduce GHG emissions.

The system works by setting an emissions cap and issuing a certain number allowances, which are referred to as EU Emissions Allowances (EUAs). The cap is set by the EU, and all the companies within the scheme are required to accumulate a certain amount of allowances (EUAs) for every ton of CO2 they emit each year. These allowances are issued via auction each year (or issued for free to various industries where there is considered to be a potential risk if they were required to pay the full cost of the allowances they need to cover their emissions), and are tradable between companies. At the end of each year, the participants are required to return an allowance for every ton of CO2 they emitted during that year. Those companies who were unable to accumulate a sufficient number of allowances to cover their emissions (i.e. the more carbon intensive industries), are required to reduce their emissions or buy surplus allowances from companies whose allowances exceed their carbon emissions during the period. These surplus companies are also allowed to accumulate their unused allowances for use in later years.

The following graphic provides a helpful illustration of how the system works.

Source: EU ETS Handbook

For those companies who fail to accumulate sufficient allowances or reduce their emissions accordingly, they face a fine of approximately 100 euros per excess ton of carbon emitted, as well as being required to accumulate allowances in future years to cover those not covered in past years. The system is structured such that there are significant penalties for the participants who do not meet the emissions goals.

The benefits of using a ‘cap and trade’ system as a means to meet carbon emissions goals is it allows the market to determine how the emissions can be reduced at the lowest cost to consumers and to the economy. What this means is the price of carbon is effectively set through the market via the supply and demand for allowances. Relative to more traditional methods of simply taxing carbon emitters, a ‘cap and ‘trade’ system offers far more flexibility and efficiency, resulting in carbon emissions being cut by companies and industries who will incur the smallest cost for doing so.

First launched in 2005 as a pilot program, the Emissions Trading Scheme is now in its fourth stage, and has undergone several changes throughout its history. Phase 1 (2005-2007), was the testing phase where too many allowances were issued, resulting in the price effectively falling to zero. This oversupply was partly driven by the companies themselves overestimating their carbon emissions on purpose, allowing them access to a greater number of allowances. Phase 2 (2008-2012), was similarly driven by an oversupply of allowances from Phase 1, and coincided with the Great Financial Crisis, both working to keep prices down. Phase 3 (2012-2020) on the other hand worked to reduce the supply and increase the amount or participants. Phase 3 has been very successful and has established the EU ETS as one of the worlds most effective measures to combat carbon emissions. The system is set to further reduce supply and increase participants throughout Phase 4 (2021 and beyond). What is important to note in regards to Phases 3 and 4 is the number of allowances available has been declining, along with the number of participants who were previously entitled to free credits is declining, and finally, the number of industries and countries included as part of the scheme is increasing. As it stands, 27 countries within the European Union are part of the scheme, along with non-EU countries Norway, Liechtenstein and Iceland. As I will touch on the in following section, the supply and demand dynamics for the scheme indicates the prices of these allowances is heavily skewed to the upside.

Demand and supply dynamics

The current supply of allowances is what’s referred to as the Total Number of Allowances in Circulation, or TNAC. This is currently set at around 1.4 billion tons of carbon emissions annually. The emissions targets of the scheme is a reduction of emissions by 43% relative to the 2005 levels when the system was initiated. This implies a linear reduction in emissions of 2.2% annually from 2020 to 2030. The TNAC will reduce accordingly in line with the targeted reduction in emissions. Simply put, the supply of allowances will reduce each year.

This creates a simple dynamic within the scheme; a reduction of supply coupled with an increase in demand. The system is skewed towards higher prices. The brilliance of the scheme is it creates incentives for higher prices of the allowances for almost everyone involved. The higher the price (i.e. the higher cost of emitting carbon), the greater the incentive for companies to own credits and thus fewer greenhouses gases are emitted. What’s more, the governments not only have an environmental incentive for higher prices, but as a result of the sovereign governments of the many nations involved in the scheme being the ones who actually distribute the allowances to the participating companies, they directly receive revenue via the auctions for doing so. Again, higher prices equals higher revenue.

To a certain extent, the allowances themselves are being viewed by the participants as a store of value. They are aware the prices are going to rise, they are aware the supply of allowances is going to continue to fall, and they are required to all hold enough allowances to conduct their business as it stands. There is little incentive to sell. Analyzing this supply and demand dynamic from a stock-to-flow perspective as one would gold, bitcoin or other scarce assets again presents a favourable outlook for the price. What’s more, unlike gold or bitcoin, it is in the governments best interests to see the prices rise. The system is being championed by government policy as opposed to an alternative to government policy.

To give some idea of how the supply and demand dynamics of the scheme are set to work within the coming years, Lawson Steele of Berenberg Bank, one of the worlds leading experts on the EU ETS, projects a cumulative supply shortfall of around 99% by 2024! If such projections were to modestly prove true, there is huge upside of the price of allowances in the coming years.

However, it must be noted the EU is somewhat cautious of a too-rapid increase in price, and do have measures in place to combat such a rapid price rise if it were to be too damaging for the companies involved in the ETS. Should it be deemed necessary, the policy makers will (attempt) to intervene via what is known as the Market Stability Reserve (MSR), as well as there ability to alter the supply of allowances as defined by Article 29a of the ETS.

The MSR is basically a feature of the system that helps to control over an oversupply or undersupply of allowances. Introduced in 2019, the MSR works to reduce the supply (i.e. the TNAC) when there is an abundance of allowances, and increase the TNAC when there is a potentially harmful allowances deficit. The idea behind the MSR is to allow prices to rise in a smooth fashion with minimal volatility. Likewise, Article 29a of the scheme’s directive obliges the policy makers to monitor the supply and demand dynamics and intervene by reducing or increasing supply should this be deemed necessary. Whilst the purpose of Article 29a is again to try to ensure prices rise in an orderly manner, the actual rules therein are cloudy in nature and very much open to interpretation. What’s more, the many different sovereign’s involved will want different prices depending on their industries included in the ETS, thus creating somewhat of a potential conflict of interest between participants and thereby increasing the difficulty of intervention via Article 29a.

Whilst the biggest risk is an excessive rise in prices to the point whereby policy makers deem it appropriate to intervene, such a risk could be considered immaterial given that prices must rise in the first place to warrant such intervention. To be clear, the policy makers most certainly want higher prices. These measures are more so designed to achieve those higher prices in an orderly manner. At the end of the day, the priority of the scheme is to reduce GHG emissions, and if the price must rise to achieve this then so be it.

Technicals and ways to trade

Capping off the bull case for the EU carbon allowances are the technicals. The allowances themselves can be traded in the futures market. This futures market of EUA’s has a near $300 billion market cap with a significant level of liquidity.

From a long-term technical perspective, the recent breakout of the decade plus basing pattern remains immensely bullish.

The allowances can also be traded via the KRBN and GRN exchanges traded funds. The KRBN ETF is made up of roughly 70-80% of EU allowances, with the remaining constituents being that of other, smaller Emission Trading Schemes over the world. The GRN ETF, which is smaller than KRBN, trades nearly exclusively off the EUA futures. I have positions in both ETF’s and intend on adding more as attractive opportunities present themselves. Though the price action over the past 12 months has been near parabolic and I would be more inclined to wait for a pullback of some sort before buying more, the supply and demand dynamics suggest further upside is ahead.

The EU ETS is Europe’s flagship way to meet its carbon goals over the coming years. There remains a vast amount of institutional money yet to make its way into this trade as the ESG incentives for pension funds and institutions to buys allowances will only grow. Remember, a higher price equal fewer emissions.

Final thoughts

What I have discussed here are my favourite trades for the green energy transition. I do not doubt there will be other investments who will benefit significantly over the coming years as the world moves to decarbonize. Whilst EV’s has certainly been the winners to date, the risk-reward for such a trade is not necessarily skewed to the upside as much as one would like.

Geothermal, battery technology and nickel are all themes in which I am sure will receive much investment and whose investors will likely benefit, along with many others.