Economic Growth Outlook For 2023

Summary & Key Takeaways

On a coincident basis, driven by a historically tight labour market and robust industrial production growth, the US economy remains deceptively strong despite negative real incomes and tight financial conditions.

However, the leading indicators of the business cycle continue to unanimously suggest the cyclical slowdown will accelerate throughout 2023.

A China reopening coupled with strong consumer and household balance sheets may help weather the severity of a slowdown, and may even help avoid recession altogether.

The stock market has done a solid job pricing in the poor outlook for growth, while credit markets and interest rate markets appear mispriced relative to economic reality.

Regardless, the outlook for the growth and liquidity cycles suggest it is too soon for investors to overweight pro-cyclical and high-beta risk assets.

Economic activity is faltering, but coincident growth remains robust

When assessing the business cycle, the coincident measures of economic growth is an excellent place to start. It is these measures of economic growth that allow us to define the current trend. Rather than predicting the future direction of the cycle, coincident growth metrics allow us to assess where we currently stand within the business cycle; be that a recovery, expansion, slowdown or contraction.

There are a number of ways to assess coincident growth, with the broadest measures being those used by the NBER in their recession determination methodology. These metrics include the growth of industrial production, employment, real personal consumption, real manufacturing and trade sales, and real personal income ex-government transfer payments, among others. At present, the US economy remains robust and relatively strong across the board.

As we can see below, outside of real personal income growth, the trend in the business cycle is yet to materially inflect lower, with industrial production and employment being the standout areas of the economy. For now, broad economic growth remains on solid footing and is far from recessionary levels.

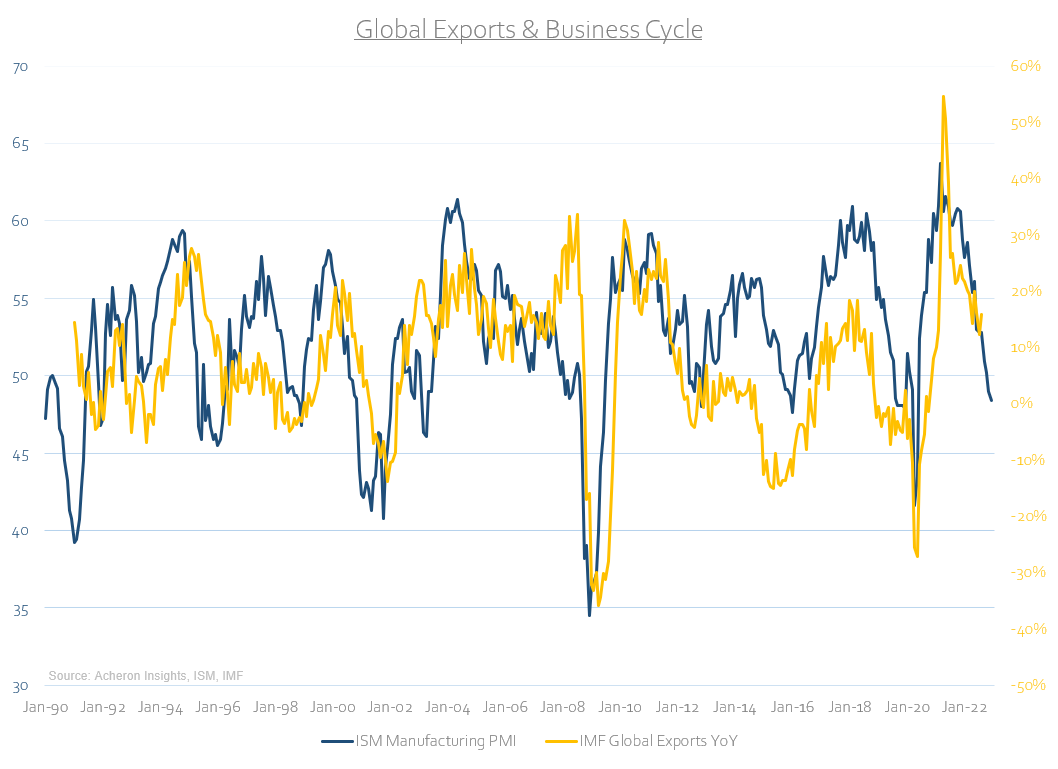

Other measures of the business cycle are less optimistic, however. For one, the ISM Manufacturing PMI - often cited as proxy for the business cycle itself - has recently fallen below 50, meaning the majority of survey participants within the manufacturing sector are suggesting conditions continue to deteriorate. Though manufacturing only contributes to around 20% of GDP in today’s economy, like housing it is both a cyclical driver and leader of the business cycle.

Likewise, the Economic Research Instructure’s (ECRI) Coincident Index too continues to decelerate. However, we are yet to enter negative growth territory that has historically preceded a recession, again indicating coincident growth is solid for now.

Delving deeper into the measures of current economic activity and coincident growth, we can see that rail carloadings and freight shipments have both slowed significantly and are both at or near negative growth territory. Similar to what the Manufacturing PMI is signaling, these measures of activity seem to confirm the notion that the goods and manufacturing side of the economy have been hit hardest to date, while the services side (such as employment) remain on solid footing.

Global exports also seem to be holding up nicely considering where the Manufacturing PMI stands, though the trend is clearly down.

Meanwhile, real income growth remains firmly negative, with this trend being responsible for much of the demand destruction seen thus far. However, should inflation roll over faster than wage growth, real income growth could in fact inflect higher into positive growth territory in the near future. Such an outcome would undoubtably be positive for the business cycle and help reduce the severity of a cyclical slowdown.

For now however, real income growth does remain negative, and with it, consumer sentiment remains depressed to nearly the greatest extent seen in decades.

As does small business optimism, who along with consumers are clearly taking the brunt of the contraction in demand. Small businesses play a significant role in the economy given they account for approximately 66% of all new jobs and roughly 44% of total US economic activity according to the US Small Business Administration. The trends in small businesses are a big part of the growth cycle.

Meanwhile, almost all measures of the yield curve are now inverted and have been for several months. I pay particularly close attention to the 10-year less 3-month spread, which historically has the most reliable recession predictability, as I detailed here. Both suggest a recession is on the cards in 2023.

For the most part, the trend in economic growth remains on solid footing and is far from contractionary levels. While this is all well and good, coincident measures of economic growth are by definition, coincident (and even lagging in the case of employment). As a result, they provide little information as to the future outlook for the business cycle, which is what matters most to us as investors. In order to ascertain where the economy is headed, both the long and short-leading indicators of the growth cycle must be assessed.

Leading Indicators of the business cycle

Using a leading indicator approach to forecasting the business cycle requires the use of a broad number of metrics and indicators of economic activity, whose forecasting abilities range anywhere from three to 18 months. The long-leading indicators are useful because they provide us with a directional outlook for growth and help shift our bias to which general direction the business cycle is headed and thus filter through the noise, while short-leading indicators are more useful from an asset allocation perspective, particularly when they align with the longer-leading indicators.

Some of the most reliable long-leading indicators of growth are those that capture the liquidity cycle, particularly that of the US, Europe, Japan and China. As we can see below, developed market liquidity continues to remain depressed and trend lower, here proxied by US excess liquidity and developed market M2 growth. Liquidity growth tends to lead economic activity by around 12-18 months, as greater liquidity is generally a function of increased balance sheet capacity, easier financial conditions, increased credit creation and higher asset prices, all of which generally lead to positive economic activity and are favourable to a risk-taking environment.

Outside of China (which I will discuss in greater detail later), the liquidity cycle is yet to inflect higher and until it does, this likely does not bode well for both growth and asset prices over the coming quarters.

With most central banks worldwide continuing to raise their policy rates and contract their balance sheets, financial and monetary conditions continue to tighten as a result. Unfortunately, due to the long lags of monetary policy we are still yet to fully feel the negative associated effects, one reason why many are opining that the Fed’s continued tightening will culminate in a policy error. The percentage of central banks raising interest rates tends to lead growth by around 12 months, and suggests growth will begin to be heavily impacted during 2023.

Claiming responsibility for such central bank actions is of course inflation. This is why inflation itself tends to provide a solid 12-18 month lead on the business cycle.

Borrowing costs have thus risen in dramatic fashion to reflect this new reality, seeing their largest and swiftest rise in decades. Both interest rates and mortgage rates tend to lead growth as tighter financial conditions beget slowing growth.

Unfortunately, it is not just rising interest rates causing stress, but changes in the dollar and energy costs are also highly impactful on economic activity. Higher energy costs (and higher commodities overall) constrain economic activity for both the corporate and household sector for obvious reasons, while a stronger dollar reduces corporate profits for companies conducting business overseas and heavily impacts foreigners’ ability to finance their dollar debts and settle transactions, constraining growth.

Higher rates, a higher dollar and higher energy prices are a recipe for demand destruction. When we combine the three into a growth tax composite, we tend to get a fairly solid read on where growth is headed over the next nine months or so.

Worse still, we have also seen banks tighten lending standards in recent months to the greatest degree since the COVID-19 pandemic, another dynamic which has still yet to be felt by those in need of credit. Higher lending standards for commercial and industrial loans tend to lead industrial production by around six months, while higher lending standards for credit card loans should see retail sales inflect lower over the next six months as well. Higher lending standards for credit cards is likely to be of particular importance given how many households are increasingly relying on credit card debt to fund consumption in light of negative real income growth.

The inventory cycle is another long-term leading indicator of growth pointing to continued contraction over the next six months. As a result of the significant inventory build-up that drove growth higher during 2020 and 2021, higher manufacturing inventories have been a cyclical headwind for some time now and continue to suggest growth will contract as the bull-whip effect plays out.

Perhaps most important for cyclical growth is what is unfolding in the housing market. From an economic and business cycle perspective, the housing market has forever been one of the most important drivers. Housing impacts economic growth through construction and residential investment, housing related consumption (i.e. furniture and household goods) as well as through the wealth effect of our financialised economy. Housing contributes to around 15-20% of GDP and thus should be taken very seriously.

Unfortunately, the outlook for housing remains far from rosy (as I detailed recently in depth here) and will continue to be a headwind for growth throughout 2023. An oversupplied market coupled with high mortgage rates and falling demand have seen building permit growth reach its lowest level since the GFC. This is significantly influencing residential investment, which itself tends to lead the business cycle by around 12 months.

With so many of the medium to long-leading indicators of economic growth pointing to a continued contraction throughout 2023, it is no wonder why such composite leading indicators such as the Conference Board LEI have rolled over in such extreme fashion.

On a shorter-term basis, the negative wealth effect is likely to continue to drag down growth over the next few months. This negative wealth effect will be ever more pronounced should the housing market (and the stock market) fall further throughout 2023.

The spread between the ISM New Orders and Inventory subcomponents are suggesting the same thing, suggesting a sub-45 Manufacturing PMI reading is imminent.

As we can see, the array of leading indicators of the economy still suggest growth will continue to slow throughout 2023, and is likely to become more pronounced during this period. Until we begin to see these indicators inflect higher, it appears we are amid a cyclical slowdown that is yet to resolve itself, particularly with services sector data beginning to show cracks.

Is China the bullish catalyst?

While developed market leading indicators remain lackluster across the board, we cannot ignore the China reopening and its implications on global growth.

Given China’s status as the largest manufacturer in the world, they drive much of the business cycle. Chinese credit impulse growth and M1 money supply growth are thus two excellent indicators of liquidity and growth conditions for the worlds entire business cycle. As we can see below, the credit impulse in particular has been accelerating over recent months.

While this acceleration in Chinese credit creation and money supply is positive and does generally lead US and global growth, as we can see below, the growth in credit impulse thus far has been relatively tame compared to what has occurred during previous cycles. As such, China’s impact on global growth for now may be relatively smaller than what we have seen in the past.

This is particularly so when we assess the actual leading indicators of Chinese credit and money creation. What tends to lead these dynamics is the direction of Chinese yields, especially the SHIBOR rate. SHIBOR is the Shanghai interbank offer rate, which measures the rate charged by banks to one another for unsecured loans in the Shanghai money market. The three-month SHIBOR can be viewed as a proxy for Chinese monetary policy given that roughly 80% of all credit creation in China is done so via bank balance sheets, rather than that of the shadow banking system in the US. Lower yields and a lower SHIBOR tend to lead credit creation in China by around six to 12 months, and both have been rising in recent months. This suggests that the growth in Chinese credit impulse may only be temporary.

As such, although the China growth story appears real and their reopening will be positive for global growth and commodities, it appears to be too early at present to suggest the growth impulse will be as significant as to what we have seen in previous cycles. A pick-up in the China Manufacturing PMI would certainly help.

Household sector balance sheets remain strong

While China will at least be somewhat positive for the business cycle during 2023, the dynamic likely to go a long way to help avoid recession is the current status of the household sector. Outside of real income growth, households and consumers remain on solid footing.

From a debt serviceability perspective, the rise in mortgage rates have had an immaterial impact on debt costs for the majority of households, given the fixed nature of most outstanding mortgages. The area where households are beginning to feel the pinch is in consumer and credit card debt serviceability, as households turn to credit cards to fund the shortfall arising from negative real income growth. However, consumer and credit card debt serviceability is only around its average levels of the past decade while mortgage debt serviceability and overall household debt serviceability are both at multi-decade lows.

Meanwhile, despite the swift contraction in household net worth over the past year, households are still significantly well-off with total household net worth relative to GDP still well above its trend and household checkable deposits and currency too at extremely high levels.

As a result, the downside risks to the economy may not be as severe as the leading indicators suggest they may be. Households may be able to weather the storm better than in the past and may help reduce the severity of this economic slowdown.

What is the market pricing in?

While having an outlook for the business cycle is imperative to one’s investment approach, what matters is how asset markets are pricing in the any potential slowdown. Looking for divergences between the leading indicators and market pricing can lead to very profitable investment opportunities, along with helping investors tactically adjust their allocations to various asset classes in an informed manner.

Starting with the most growth sensitive assets in oil and industrial commodities, both have fallen in-line with the PMI over the past year. Given the leading indicators suggest we could see a PMI reading of anywhere from 40-45 in the months ahead, this does suggest the potential for further downside in energy and commodities as a whole is possible. However, a China reopening will help to put a floor under both, as will the structural supply constraints within the energy sector.

The same can be said of the dollar, which is roughly pricing the PMI at around 45-50. Should growth continue to slow, expect the dollar to remain bid over the next few quarters. I recently discussed my cyclical and secular outlook for the dollar here, along with its significant implications on various assets.

The broad stock indices on the other hand have done a better job at pricing in the growth slowdown thus far. This is particularly the case for the Nasdaq. Stocks are pricing in a PMI of around 40-45, which is closer to where the leading indicators suggest the PMI may bottom in 2023. Does this mean equities cannot go lower? Absolutely not. But it does suggest that perhaps the best macro trade is not shorting equities, at least for now.

Especially given how well the cyclical versus defensive ratio has re-priced during 2022.

However, the high-beta areas of the stock market are still not the place to be. The high-beta/low-beta ratio (which is highly correlated to speculative and liquidity driven assets such as crypto) clearly has further re-pricing to do to the downside. Now is not the time to be overweight high-beta risk assets.

Meanwhile, as I have detailed several times in recent months (here and here), from a business cycle perspective it is the bond market which is the most mispriced. Although there are significant risks for the bond market at present, there may also be significant opportunity, particularly if inflation rolls over as swiftly as many believe it will.

Likewise, the credit market is another area that does not appear to have truly re-priced to reflect economic reality. Credit spreads in particular appear to be overly optimistic relative to what the leading indicators of economic growth and corporate earnings suggest is coming. The credit cycle downturn appears to only be just getting started. This does not bode well for volatility.

Conclusion & Implications

In summary, the outlook for growth and liquidity remains poor and are not indicative of a risk-seeking environment. Whether we do enter recession in 2023 remains to be seen as the coincident measures of economy growth suggest the economic is robust for now and households remain on solid footing. Any potential recession is thus likely a story for the second half of 2023. Meanwhile, China appears to the right-tail risk for growth, depending on how much further monetary easing we see from the PBOC in the months ahead.

Best of luck for 2023.

. . .

Thanks for reading!

If you enjoyed this article, feel free to share this with friends and around your network. Any and all exposure goes a long way and is very much appreciated. Thanks again.